Dear Chuck,

Our homeowners insurance continues to rise. My husband asked me to find a new insurer or negotiate better rates. What is the best approach?

Stressed About Home Insurance

Dear Stressed About Home Insurance,

A friend of mine recently requested prayer after many of the buildings that housed their commercial agricultural business were burned to the ground by a massive fire. It turns out that the insurance company has a very different evaluation of the present value of the insured buildings, and it is much lower than the company needs to be able to rebuild! It was a reminder to me to be diligent about understanding and managing our insurance coverages!

We did some research that I hope will be helpful to you and many others who may be out of date with coverage and costs.

Why Home Insurance Rates Increase

All companies evaluate the risk of insuring a home and try to price it so they can make money. Besides the threat of severe weather, insurers consider crime rates, fire protection services, and proximity to high-risk areas. Many homeowners and potential homebuyers cannot afford the expense of insurance on top of mortgage payments, taxes, HOA fees, and routine maintenance. In addition, there is a correlation between credit history and claim likelihood. That is an incentive to stay current on bills, pay taxes on time, and not accumulate a lot of debt!

Resale is especially difficult in areas where coverage is limited or denied. Few buyers want to own a home/business that they cannot insure. When insurers have higher-than-expected payouts for a region, they raise rates in order to remain financially stable. Renovations and additions, especially custom or luxury finishes, energy-efficient features, and smart technology, add to the cost.

Comparison Shop Every Year

I was a loyal insurance customer, having only used one company for car and home coverage since 1979! Then they raised our rates. It no longer mattered how long I’d been faithful to them. So a friend, an independent broker, found us a policy in 24 hours at nearly half the cost of the quote from our current provider! I was shocked and delighted.

Over time, insurers raise premiums. Unless comparison shopping is conducted annually, you may end up paying more than necessary. The key is comparing apples to apples. A lower premium might cover less, and a great discount might start with a higher premium.

How to Get the Best Deal

Homebuyers should request all costs of insurance before making an offer on a house, condo, or commercial building. Get a thorough inspection to verify conditions that may impact coverage.

NerdWallet says that multi-policy discounts average 18%. If your insurance costs $5000, an 18% reduction qualifies for $900 in savings. Plus, bundling makes it convenient to deal with just one insurer. Here are some other tips they offer to save on home coverage.

Experts Identify Causes and Cautions

Rainy Hake Austin, president of The Agency:

Rates have steadily risen due to increased natural disasters, rising construction costs, and higher claim payouts. “In markets like Los Angeles and Aspen, home insurance rates are seeing premium spikes influenced by several factors unique to the area, including the risk of earthquakes, wildfires, and other natural disasters, as well as the cost of living and property values.” Since 2009, a 335% surge in buildings lost to California wildfires resulted in a 270% rise in associated costs. “In markets throughout Florida and Louisiana, home insurance costs rose due to destructive hurricanes. We are seeing insurance costs in high-risk locations, specifically in Florida and California, cost hundreds of thousands of dollars per year, and have seen it triple in price in many of these high-risk locations since 2020.”

Jennifer White, RE/MAX specialist in Florida:

“Insurance companies are requiring new shingle/asphalt roofs as early as 10–12 years into existing roof lifespans, or as early as 20–25 years for concrete or clay tile roofs.” She notes they are requiring inspections for water heaters, HVACs, ice makers, plumbing fixtures, and connections/pipings to verify that they are newer, in order to bind coverage. Aging may require replacement or coverage denial. Customers with previous claims may also be denied.

David Harris, Coldwell Banker agent:

“In a state like Florida, other insurance challenges include the soaring prices of reinsurance, and the state’s litigation-friendly environment, which makes it easier for customers to sue their insurers, further increasing the insurance challenge.”

With so many complex factors, be sure you keep current on the amount of coverage you have and that you are paying a competitive price for the insurance. Shopping around for home insurance is good stewardship! Hopefully, you and your husband will get a nice surprise with a much lower quote for the cost to insure your home.

Do you want more tools and tips on financial stewardship? Are you interested in receiving ministry updates from around the world? Sign up to receive the Crown Newsletter emails by using the form on the homepage at Crown.org.

This article was originally published on The Christian Post on June 27, 2025.

Dear Chuck,

My father was recently diagnosed with a terminal illness and may not live another year. I’ve encouraged him (and my mom) to prepare financially for the future, but they refuse to think about it. My siblings and I want to intervene, but we need a plan. How should we go about this?

Help for Loved Ones

Dear Help for Loved Ones,

I am sorry to hear about your father. My mom died six years ago, and my dad is 92. My brother and I talk to him multiple times each week. We know that his desire is to avoid being a burden to any of us, so he has everything planned for his eventual transition from this life to the next. More importantly, we are at peace on a financial, emotional, and spiritual level. We can talk openly about anything with him, which is a blessing.

It is likely that your parents may be in shock, unable to process the diagnosis, or unsure how to move forward. Hopefully, they are more prepared than you think. I will offer my advice and some Scripture to support a plan to help them.

Biblical Advice for Setting Your House in Order

2 Kings 20 begins, “In those days Hezekiah became sick and was at the point of death. And Isaiah the prophet the son of Amoz came to him and said to him, ‘Thus says the Lord, “Set your house in order, for you shall die; you shall not recover.”’” If you know the rest of the story, God gave Hezekiah more years, and then he died.

So teach us to number our days that we may get a heart of wisdom.

Psalm 90:12 ESV

The fact is, each one of us will die, no matter how good our genes are, how devoted we are to exercise and healthy eating, or how advanced medical care becomes. We will all face physical death until the Lord returns. It is wise to live in light of our temporalness here.

God has an exit plan for each of us. We just don’t know when or how. That’s why we must prepare.

Make a Plan

First, you and/or your siblings need to request a meeting with them in an attitude of humility and service. Let them know you are ready and willing to lovingly help them both. Address any fears that they may have to ensure they will not be embarrassed or pushed into making unwanted disclosures or hasty decisions. Ask them if you can assist them with making a plan for present and future needs.

One of my brothers-in-law did everything he could to prepare his future widow. He had time to make sure everything in the house was in tip-top shape and showed her how to do as much on her own as possible—from changing HVAC filters to replacing sprinkler heads. He secured all accesses to the house, bought her a new car, and had new garage door openers installed. They had lived frugally and were prepared financially, but the little things he did gave her a peace that allowed her to grieve without fear when he passed.

God’s people should not die expecting someone else to pay their bills, take care of their family, or handle after-life decisions. It’s important to have a will and life insurance that will at least cover death and funeral costs. Providing passwords, bank access, lockbox details, and safe codes or keys is essential. This blesses those left behind. Careful planning can help us weather any storm that may come our way.

Record-Keeping

One of the most important steps one can take to prepare survivors for the future is to show them how to pay bills and provide important information for banking, insurance, debts, investments, and more. In the midst of medical distractions, it is important to stay up-to-date with finances. It may be beneficial to recruit a family member or hire a trusted advisor to help through a difficult period.

Financial Literacy

Men, women, young adults, and teens all need to attain a certain level of financial literacy. Knowledge is a powerful way to gain wisdom and alleviate stress or fear when having to make decisions. We have pulled together some helpful tools to guide you as needed.

If they are managing significant assets or complex investments or expect a windfall from insurance proceeds, we suggest you consider working with a Christian professional advisor. You can learn more at BlueTrust.com and KingdomAdvisors.com.

Finding Joy in Your Sorrow

I applaud you for wanting to help your parents be ready financially for the future. This is a good time to open up about their spiritual condition as well. Consider letting them know that as believers, we have nothing to fear because our future is secured by the promises of God. Consider using Scripture to comfort your mom and dad and point them to the victory secured over the sting of sin and death. While there is sorrow for those remaining behind, there is joy ahead for those joining the Lord in their heavenly home.

In my Father’s house are many rooms. If it were not so, would I have told you that I go to prepare a place for you? And if I go and prepare a place for you, I will come again and will take you to myself, that where I am you may be also.

John 14:2–3 ESV

I’d like to invite you and your parents to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that can provide encouragement by bringing God’s Word into your daily life.

This article was originally published on The Christian Post on June 20, 2025.

Dear Chuck,

My young adult children and their spouses all use these Afterpay plans as if it’s no big deal. I try to warn them, but they think I am old-fashioned and need to catch up with modern conveniences. What do you think about this new form of borrowing?

Concerned About “Buy Now, Pay Later” Plans

Dear Concerned About “Buy Now, Pay Later” Plans,

Times have changed. When I grew up, we had an option called “Layaway.” The retail store would allow you to set aside an item for purchase to be kept in the warehouse until you made three or four equal payments, usually without interest! Notice that the store kept the merchandise until payment was made in full.

Now we have PayPal, Klarna, Affirm, and Afterpay, the most common “Buy Now Pay Later” (BNPL) lenders, which allow the consumer to take the goods home before they are paid for. The plans are popular, even though users report the following problems:

The Appeal Is Broad

Bankrate conducted a BNPL survey and found that the appeal for this type of financing was far-reaching. Usage is nearly consistent across all income levels. Almost one-third of Americans have used it for at least one purchase. The appeal includes:

Eat Now, Pay Later

In March, Klarna and DoorDash announced a partnership. Now customers can “eat now, pay later.” Customers can choose to pay in full, in four equal interest-free installments, or at a time that aligns with their paycheck. David Sykes, chief commercial officer of Klarna, said: “Our partnership with DoorDash marks an important milestone in Klarna’s expansion into everyday spending categories. By offering smart, more flexible payment solutions for groceries, takeout, and retail essentials, we’re making convenience even more accessible for millions of Americans.”

That “convenience” comes at a price! Imagine how much more “convenient” it is to pay cash, avoid interest charges, and be done with it.

Enjoy Now, Suffer Later

Despite the benefits when used responsibly, some people are struggling to repay their loans. As a result, lenders are experiencing a growing number of late payers. Terms have changed since inception. Four interest-free payments have stretched into plans as long as 48 months with interest as high as 36%, depending on the provider, merchant, credit score, and other factors. Reading and understanding the details before use is crucial, but most never do.

A February article at Bankrate noted three troublesome trends among BNPL borrowers:

NBC News reports: “The debt strain among BNPL customers coincides with broader signs of stretched household finances.” Klarna, a Swedish company, saw net losses double in the first quarter despite a growing revenue and user base. It paused plans to go public due to economic uncertainty.

According to a recent report by Lending Tree:

Why I Recommend Avoiding BNPL Plans

Job loss, medical bills, the high cost of homes and mortgages, student loans, and the cost of living in general have impacted many. Too often, the vulnerable or uninformed about the real risks fall into BNPL traps. It starts off easy, but reliance can create growing debt loads and be difficult to repay, especially when several things hit at once. My advice is to lovingly suggest they learn how to live frugally and be content with what they have to avoid the need to use these programs. Paying cash is very convenient! Regardless of the amount or terms borrowed, this proverb stands as a dire warning:

“The rich rule over the poor, and the borrower is slave to the lender.”

Proverbs 22:7 (ESV)

Contentment Outweighs Debt

Here are some solutions to debt dependence:

BNPL can be a helpful way to finance a large, needed item in a pinch, when the borrower is very disciplined and little or no interest is charged. However, credit cards are a better option for those who can pay in full because they offer rewards and are a quick way to improve one’s credit score. Here is some additional recommended reading: The BNPL Phenomenon.

Consider connecting your young adult children with a Crown budget coach to help them avoid the desire to use BNPL. A budget coach can work with them to develop a customized spending plan and debt-elimination strategy.

This article was originally published on The Christian Post on June 13, 2025.

Dear Chuck,

Our house, cars, and credit card debt prevent us from giving to the church. We argue about this, but my husband wants to get out of debt first before we start giving. I think we are robbing God. Can you help unite us?

Divided Over Giving

Dear Divided Over Giving,

Thank you for your very sincere question. I believe there is hope for unity despite your different views. Like your husband, I held the same view for many years. I had good intentions and a plan to give generously—but only when we were not struggling financially.

Everyone Is Generous

For years, I was a very content charitable giver of 2.6% of our gross annual income. I believe this is close to the national average for American Christians. My wife wanted to give a minimum of 10% of our gross annual income, but I always told her that there was no way we could afford to do that. We were divided and stuck for many years.

A significant shift occurred in my thinking when a friend shared with me that everyone is generous. The challenge is what we prioritize. You see, I was giving generously to myself and my family. I was spending everything God entrusted to me on us.

Through the conviction of Scripture, a Crown Bible Study, and the encouragement of my wife, God changed my heart in 1999. We had been married for 21 years before we became united in our belief that giving to the Lord should become a priority. When my wife and I agreed to follow what God says we should do with money, He united us in our hearts and minds.

I remember telling my wife that if we increased our giving from 2.6% to 10%, that dramatic increase would require us to change our lifestyle. I said, “You realize this will change how much home we can buy, what we can afford to drive, and how we live, don’t you?” She replied, “Now you finally get it.”

We united around God’s truth that it truly is “more blessed to give than to receive” (Acts 20:35) and made giving to the Lord our top financial priority from one month to the next—before we got out of debt!

Giving is not a legal requirement to please God. It’s a tangible way for us to express our love to Him. It is our acknowledgement that He is first in our hearts, making it an act of worship. Giving is a privilege that we miss until we actually engage in it. But don’t try to convince your husband of this; pray and ask the Lord to do the conviction and bring you together.

What About Debt?

Since I don’t have a clear picture of your financial situation, I don’t want to assume that you can begin immediately giving to your church without careful planning. However, discuss with your husband what you might miss by waiting to get out of debt. Consider the missed opportunity of trusting God and seeing how He provides. By delaying the habit of giving regularly, you are missing out on the joy it brings. Plus, I have seen many times that when couples prioritize giving, it actually serves to help them reduce their debt more quickly.

When you have obligations to pay, giving can be extraordinarily challenging. Remember how Jesus pointed out the widow who gave her two small copper coins in Mark 12? She gave all she had, believing God would meet her needs. Those two coins—small to the world but large to her—demonstrated her complete dependence on the One who loved her.

Many find it easy to skip giving to God first. They choose to give what is left over after their own needs and desires have been met. I know I did. Even though debt must be paid, consider how you can cut spending elsewhere in order to give something to the Lord. Don’t do it reluctantly or under compulsion, but unite with your spouse and follow God. “God loves a cheerful giver” (2 Corinthians 9:7).

Consider giving an amount you know you can handle at first. It is ok to start small. The repeated action will establish the habit. By setting it aside ($1, $5, $10…), you will not spend it. Acknowledge the Lord while you are paying off your debts.

Trust Him to Unite Your Hearts

God sees and knows our struggles. He promises to meet our needs, but we have the responsibility of following His principles. I often hear from people who began taking steps of faith and giving first. God honored them, and somehow, someway, their debt was reduced in record time. Ask Him to help you live as a steward of all He provides. Ask Him to unite you and your spouse, so together you can find joy in managing things His way. Here are some great resources to help you:

If you’re burdened with credit card debt, consider reaching out to Christian Credit Counselors, a trusted partner of Crown. They are a valuable resource to help consolidate debt and get on the road to financial freedom so that you can become a more generous giver.

Dear Chuck,

We promised our children a theme park vacation this year, before I checked the prices. I am in shock. Should I back out or do it even though we can’t really afford it?

Frugal Family

Dear Frugal Family,

When I was a boy, my parents allowed me to take a trip to Disneyland with a family of six who were driving from Texas to California in a station wagon! It was one of those classic station wagons with a rear-facing seat that popped up in the storage area. To save money, we stayed in a tent in KOA campgrounds at each stop along the way. Even though it was a very low-budget trip in a crowded car that seemed to take forever to get there and back, it is a memory I will always cherish—not just the theme park but the entire experience.

We preferred other forms of family vacations with our children, so it’s been a long time since I’ve visited a theme park. However, since you made a promise, I suggest you do your best to keep it, unless your children change their minds. From what I’ve read, with some dedicated planning, you may be able to enjoy a budget-friendly trip.

Become Proactive Early

Disney raised ticket prices this year and went to dynamic pricing. This means prices will vary according to the date. So try to schedule the trip when prices dip, like during the hottest months. Another option is to go during school when rates are cheaper and there are fewer crowds. My wife, who helps me with these questions, found this article, which says Disney prices its parks based on the income of the top 20% of American households. It provides great information and charts for lodging, meals, and other fees.

Don’t get burned by buying discount tickets off eBay or Craigslist. They could be counterfeit. Deal with secure websites. The time you put into early planning could save you hundreds of dollars.

Stay Within Your Budget

Determine how much you can realistically afford for a vacation. Then resolve to stay within that amount or a little under, so you are prepared for any unexpected charges.

If you need some extra funds, work together as a family to exercise some cost-cutting and income-producing measures. Months before you make the trip, stop eating out, cut some streaming services, have a garage sale, or sell items on Facebook Marketplace. “Eat the pantry,” and prep frugal meals to save money. Working on it ahead of time will help you find deals, save money to pay cash, and ultimately find more pleasure in the trip! Bring your children into the effort to help them appreciate the commitment you have made to provide them with this special trip. Think about exploring our State and National Parks in the future. Taking your family into God’s creation can be a worshipful experience and far more affordable.

Money Saving Tips

Suggested websites for planning and more cost-saving suggestions:

Consider discussing alternatives with your children before you absolutely commit to a theme park vacation. Instead of theme parks, we joined a fishing club, and our now-adult boys look back on the time we spent out there as a favorite memory of their childhood. Trips to visit family were also a part of our vacations. These are important to help your children create more offline connections in an online world.

We were made to work and rest, so keep your own needs in mind as well. A lot of people I know return sunburned and exhausted after a theme park trip. So allow some time to recover when you get home. Be careful not to promise the children a trip that creates financial stress in the future!

Additional Reading:

Vacation Clubs, Timeshares, or None of the Above

Do you want more tools and tips on financial stewardship? Are you interested in receiving ministry updates from around the world? Sign up to receive the Crown Newsletter emails by using the form on the homepage at Crown.org.

This article was originally published on The Christian Post on May 23, 2025.

Dear Chuck,

I like buying luxury brands, but my husband couldn’t care less about the brand. He says he just wants quality. I argue we are getting both. Who is right?

Luxury Brands Are Quality

Dear Luxury Brands Are Quality,

This is a hard argument to mediate since I don’t have all of the information about your financial circumstances. I decided to research the “luxury brand” market and give you some perspective before I reply to who I think is right.

Who Is Buying Luxury Brands?

A 2020 article at Forbes describes luxury brands as exquisite, expensive, and exclusive. Marketers aim at the middle class and use celebrities to sell a lifestyle. To retain the scarcity of their products, some companies destroy their unsold items. This 2018 article reports how Burberry destroyed items to prevent them from being stolen or sold cheaply.

The market for luxury goods was estimated to be $254 billion in 2023 and is expected to reach $370 billion by 2030. An expanding global middle class is emerging across the world and is expected to tap into this market. Luxury items are now more accessible due to the adoption of digital channels.

One unidentified online source claims that two income-earning groups account for 75% of the purchase of luxury goods: those that earn less than $56,000 per year, with a net worth of less than $6,000, and those that earn $56,000–$168,000, with an average net worth of $104,000. The point of his post is that the majority of luxury brands are not purchased by the wealthy.

Most studies agree that the wealthy are not keeping luxury brands in business. They buy assets that grow in value or increase their cash flow—or both. They buy freedom, not status. They use money to create options, not to impress strangers.

The wealthy know that money should be working for them, not the other way around. Assets generate income while liabilities generate expenses. Assets pay; liabilities cost.

It’s been said that the poor buy stuff, the middle class buy liabilities, and the wealthy buy assets.

Rather than using common sense, waiting, and trusting God, some people are caught up in the need for luxury. It boils down to what you believe about money—how you use or steward God’s money.

The Appeal of Buying Luxury

Luxury marketing is aimed at aspirational shoppers: those who want to feel wealthier, cooler, or more successful than they can truly afford. A 2023 survey found that nearly 40% of Gen Z shoppers went into debt to purchase a luxury item. According to Bain and Company, about 75% of global luxury spending is from middle-income households. As previously mentioned, those with a high net worth account for a fraction of the sales.

The most common luxury purchases include designer clothing, handbags, jewelry, watches, and cars. Experts project that a third of the overall luxury brand market will be for apparel. However, there is a growing demand for “luxury experiences” over possessions. That, coupled with an awareness of sustainability and ethical practices, is impacting the purchase of certain items.

Luxury items are associated with strong emotions:

In the God Is Faithful Devotional, Larry Burkett wrote, “Greed has become such an accepted attitude that most major advertisements for luxury products are built around it. Many committed believers are convinced (often by other believers) that it is God’s absolute responsibility to make them wealthy and successful.”

What people will do to get luxury items:

We need to live our lives in such a way that we can meet our obligations as well as stand before God and give an account for our choices. To fully consider the costs of daily decisions, we must remember that eternity stretches before us and that our choices have long-lasting implications. We need to make sure our priorities for spending are greater than our desires.

Count the Cost before Spending Money

Freedom from the Grip

“Do not lay up for yourselves treasures on earth, where moth and rust destroy and

where thieves break in and steal, but lay up for yourselves treasures in heaven,

where neither moth nor rust destroys and where thieves do not break in and steal.

For where your treasure is, there your heart will be also.”

Matthew 6:19–21 ESV

Those who struggle with the desire for luxury items can be released from the emotional grip.

They need to recognize the stronghold, confess it, repent, and be grateful for all they have. They can ask God to help them be satisfied in Him and all that He provides. Meditating upon or memorizing a passage of Scripture helps bring things into focus.

My position is that you both have a valid point. It is possible to buy a luxury brand and also get quality. However, it is also possible to buy quality and get “luxury,” without overpaying for the brand name. I am, therefore, in support of your husband’s position. A friend of mine purchases the cheapest luggage at Walmart. He says he can replace it once every year for 20 years (if it breaks) and still spend less than a luxury brand piece of luggage. We need to remind ourselves that this is all temporal. Treasures in Heaven will be far more meaningful than a Louis Vuitton handbag.

Further Reading

Rationalizing a Luxury or Indulgence

Fake It Till You Make It” Lifestyle

Why Financing Is the New Layaway

Buying luxury goods can quickly lead to credit card debt. If you’re burdened with credit card debt, consider reaching out to Christian Credit Counselors, a trusted partner of Crown. They are a valuable resource to help consolidate debt and get on the road to financial freedom.

This article was originally published on The Christian Post on May 16, 2025.

Dear Chuck,

We need to purchase a car on a tight budget. We’d like to buy a dependable used one, but we hear that parts are going up due to tariffs. I know you like to purchase used, but is that still our best option?

Buying a Car on a Budget

Dear Buying a Car on a Budget,

A car purchase has become a major life decision and can lead to a cascade of financial problems if the car is unreliable or it puts stress on your budget. Like you, many are concerned about used (and new) car prices and how to afford the best options.

The key is finding balanced information that doesn’t exaggerate the potential impact of tariffs. Deals are out there if you have the discipline to exercise patience, do your homework, and stay within your budget.

A Personal Experience

Even with the best of plans, it does not always go well. I recently did the research for one of our sons who needed a pickup for his work. Despite all of my best efforts at finding the perfect used model for him and his wife, it has consistently given them mechanical problems. Sometimes buying new is the best option, so don’t rule it out, depending on your budget.

Car Market in 2025

CarEdge.com reports that the average price of a used car this month is $25,128. The spring car buying season, combined with market uncertainty, may push prices higher for a while. Tariffs, supply chain disruptions, inventory, and interest rates are all factors. If new car prices go up, expect used ones to do the same. As for now, it’s a used car seller’s market.

Value in Timing

I do a lot of research before making a purchase, comparing sales at dealerships, Cargurus.com, and Facebook Marketplace. Timing, as reported by U.S. News, is important:

Sometimes, the best time to buy a used vehicle is after big sales events. Wait a few days for trade-ins to move onto the dealers’ used car lots. Those who sell privately may wait until after they have purchased a new one. Be careful buying after a flood or natural disaster. I search for one-owner or certified pre-owned cars that have maintenance records and low mileage. I always use CarFax to check the history and never buy a car that has been to auction or has a rebuilt title. A rebuilt title means it was declared totaled by an insurance company at some point in its history.

Value not Vanity

Buy cars for value, not vanity. Mark Zuckerberg (Meta), Larry Page (Google), and Jeff Bezos (Amazon) drove unassuming cars for years: Honda Fit, Toyota Prius, and Honda Accord. Warren Buffett drives a 2017 Cadillac sedan. The wealthy realize that most cars depreciate in value and prefer to put their money in appreciating assets. Understated vehicles don’t attract attention. Reliability, good gas mileage, and one that does not attract a lot of attention is preferred. Plus, insurance can be less expensive.

A study from Experian Automotive showed that 61% of households earning more than $250,000 annually don’t own luxury brand cars. They choose to drive mainstream brands or modestly priced luxury vehicles that coincide with their values and needs.

Value in Prayer

Ask God to provide. He knows exactly what you need and when you need it. One friend of mine was in need of a vehicle, and during his time of waiting on the Lord, he was invited to a charity golf tournament. For the first time in his life, he hit a hole-in-one while playing golf that day. The prize was a brand new car. He knew in his heart that the Lord provided in the most unexpected way!

Be patient while keeping a lookout. Let others know you are in the market. They may know someone who wants to replace a vehicle.

If any of you lacks wisdom, let him ask God,

who gives generously to all without reproach, and it will be given him.

But let him ask in faith, with no doubting…

(James 1:5–6a ESV)

Articles to check out for more information:

Do you want more tools and tips on financial stewardship? Are you interested in receiving ministry updates from around the world? Sign up to receive the Crown Newsletter emails by using the form on the homepage at Crown.org.

This article was originally published on The Christian Post on May 9, 2025.

Dear Chuck,

My fiancé and I hope to marry in November. Our parents are not in a position to help financially. I’ve felt anger and sorrow about that, but I want to have a great wedding without spending lots of money. Haven’t you written about ways to save money on weddings?

Wedding Without Financial Stress

Dear Wedding Without Financial Stress,

No need to be worried or upset about your family’s inability to help you pay for a wedding. In fact, you can view it as a blessing.

My wife and I were married long before cell phones, Instagram, and Pinterest. We had a simple wedding and honeymoon, and our first apartment was furnished with used furniture. We didn’t care! We weren’t comparing ourselves to others. We were happy with what we had and stayed busy working and going to school.

Weddings Can Get Expensive

It’s a different world today! According to The Knot Real Weddings Study, 53% of couples spent more on getting married than they planned, by an average of $7,347. Since the average cost is around $33,000, going over-budget would bump that figure to $40,000!

Weddings have become a big business. Social media has created desires and expectations for everything—from engagement rings to the wedding cake and everything in between. Brides are influenced by Pinterest and Instagram, magazines, blogs, apps, and Google searches. Young girls imagine, dream, and plan their weddings. They carry those dreams into adulthood without asking God for wisdom or seeking the advice of those older and wiser.

Suppose the wedding and reception last four hours. That means the average couple spends $10,000 an hour for the event. Granted, that’s not a worry for some people, but for others, it’s a LOT of money! Some (usually parents) recognize that money could be used for the down payment on a house, a newer car, career/skill training, or starting a business.

Keep It in Perspective

Your wedding is a significant moment in time, but it is just one day in your life. Once married, you will share many days together, Lord willing. While barns, beaches, and destination weddings make great social media posts, there is beauty in church weddings, where couples are celebrated by the congregation in a setting conducive to worship. Some churches have fellowship halls for a reception, an outdoor pavilion, or space to set up a tent. I’ve officiated a home wedding and one in a park. Both were beautiful, and the couples were spared great expense. Receptions held in venues not typically used for weddings can also be less expensive. Just make sure you understand the rules for catering, and read the contract in its entirety before signing.

Focus on the Marriage, Not Just the Wedding

My advice is to renew your heart and mind with an eternal perspective of your wedding day. Choose simplicity over stress and financial margin over debt. It’s a matter of stepping back in order to think realistically. Spend focused time in prayer, make peace with what you can afford, give thanks for your future husband, and ask the Lord to be at the center of all your plans. Aim to make your ceremony a time to worship Him as you dedicate your lives to one another.

Do

Don’t

Money Saving Tips

Begin your marriage using money wisely. It is crucial for your future financial success. I highly recommend that couples go through our Money Dates or Money Life Personal Finance Study. These will help you set your course, enabling you to align goals and have a plan to achieve them from day one.

I hope more churches will encourage ceremonies to be held on their property. Forming a committee to encourage and support church weddings at lower costs would be a blessing. If you have not asked your church about this, possibly send them this article.

More Information

If you’re entering marriage with credit card debt, consider reaching out to Christian Credit Counselors, a trusted partner of Crown. They are a valuable resource to help consolidate debt and get on the road to financial freedom.

This article was originally published on The Christian Post on May 2, 2025

Dear Chuck,

My parents are extremely fearful about the future of Social Security benefits. How can I help them with their concerns?

Fearful About Social Security

Dear Fearful About Social Security,

A recent Gallup report reveals that 52% of Americans worry about the Social Security (SS) system. It has been at the top of the minds of millions who are approaching or in their retirement years. Although this is not a new fear, it has been making headlines of late.

The Department of Governmental Efficiency (DOGE), in an effort to eradicate mistakes and fraud at the agency, has caused quite a stir among SS recipients. Political opponents are seizing the opportunity to create fear and unrest through the airwaves. As a result, many people are being misled by presumptions.

Some fear that cost-cutting measures will impact their benefits. The reality of it is that those who are receiving payments fraudulently should be afraid. Those who received overpayments and never reported them should expect repercussions. But what about the unrealistic fears that people are feeling?

Stirring the Pot

Former SSA commissioner Martin O’Malley, interviewed on CNBC, made comments which would indeed be unsettling if one didn’t recognize that his presumptions were opinions, not facts. He stated:

CNBC also referenced comments made by Jill Hornick, a union official at the American Federation of Government Employees Local 1395, representing SS offices in Illinois. She noted that “it will take a while for the effects to be felt, but they’re coming,” predicting that changes in SS will be “far worse” than the Medicaid planned cuts. In addition, she thinks processing new claims could be delayed due to an understaffed workforce.

Both people based their negative response to SS changes on presumptions. According to James 4:14, these types of statements are misleading, for no one knows “what tomorrow will bring.”

Facts Can Reduce Fear

What Now?

I believe it was Milton Friedman who said we can always expect the government to pay people their benefits, but the purchasing power of the benefits when received cannot be guaranteed. This is a very good point, since inflation can lower the purchasing power of future retirement income.

As Christians, we should assume the responsibility ourselves for saving and investing by living and planning as if Social Security will not be there. Prior to 1940, Americans did not receive Social Security benefits. President Roosevelt (FDR) signed the Social Security Act in 1935. The collection of taxes began in January 1937, and monthly payments started three years later.

It is better to rely on the Lord and follow His precepts.

“Wisdom is good with an inheritance, an advantage to those who see the sun. For the protection of wisdom is like the protection of money, and the advantage of knowledge is that wisdom preserves the life of him who has it.”

(Ecclesiastes 7:11–12 ESV)

“Moreover, it is required of stewards that they be found faithful.”

(1 Corinthians 4:2 ESV)

Live Contrary to the Way the Government Does

Our government has low or no savings and excessive debts, but so do many Americans. This should increase our motivation to do the opposite. Do not run up unnecessary debt. This requires sacrifice and self-control.

“Owe no one anything, except to love each other, for the one who loves another has fulfilled the law.”

(Romans 13:8 ESV)

“The rich rules over the poor, and the borrower is the slave of the lender.”

(Proverbs 22:7 ESV, emphasis mine)

Many people carry excessive credit card debt and find themselves trapped in a cycle of borrowing. Anyone experiencing this burden should get in touch with our friends at Christian Credit Counselors. They have helped hundreds of thousands of families experience freedom from debt.

Do Not Fear

Assure your parents that no one knows what tomorrow holds. So why waste time and emotions concerned about changes in Social Security? Instead, live frugally, give generously, save regularly, and invest wisely. Put your hope in the Lord, not man or government programs.

“Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.”

(Matthew 6:34 ESV)

“Trust in the Lord with all your heart, and do not lean on your own understanding.

In all your ways acknowledge him, and he will make straight your paths.”

(Proverbs 3:5–6 ESV)

I’d like to invite you and your parents to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will provide encouragement by bringing God’s Word into your daily life.

This article was originally published on The Christian Post on April 18, 2025.

Dear Chuck,

With the new Trump tariff wars, I fear the stock market will tank, and my retirement savings will be gone. Are you advising people to get out of the market during this downturn?

Terrified of the Tariffs

Dear Terrified of the Tariffs,

I can’t give you investment advice; however, I can address some issues that are expressed or implied in your question. My intent is to offer you some Biblical principles to avoid the most common mistake any investor makes, which is to buy high and sell low.

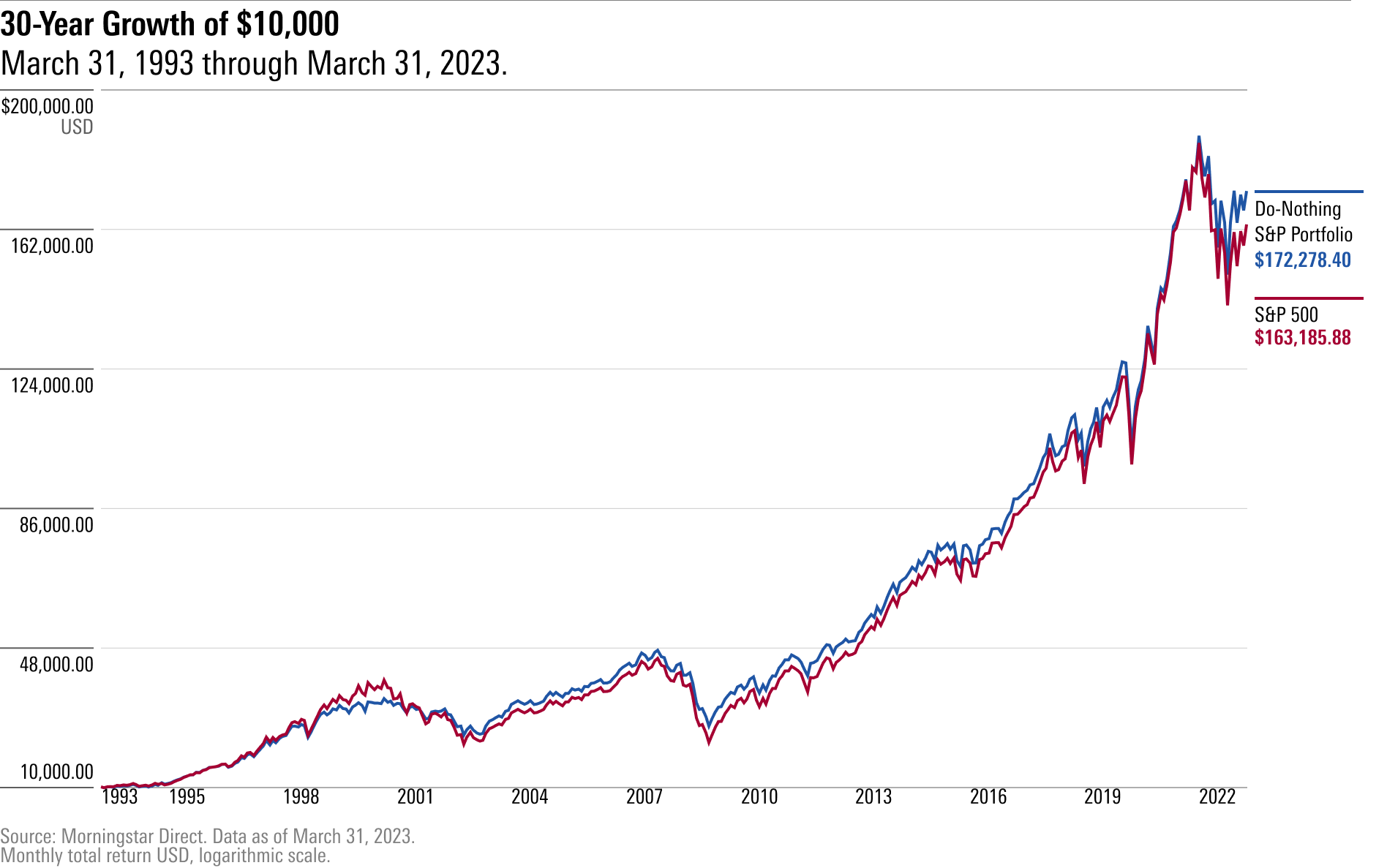

Perspective on the Market

The year 2025 is shaping up to be one of the most volatile in recent history. We have seen declines in the markets year-to-date, with more declines possible. But remember, the S&P is still up more than 100% over the last five years, a historical bull run. While some panic, for many, it is an opportunity. It helps to think of it like a roller coaster that has ups and downs but consistently grows over time, increasing in value.

In a recent interview, Warren Buffett said something to the effect that if the value of your house went down, would you immediately decide to sell it? Surely not! Wouldn’t you continue to live there and wait to sell until the value increased? Owning stock in a company is very similar. Forget about the ups and downs of the stock market price.

“Some people should not own stocks at all because they get too upset with price fluctuations. If you’re going to do dumb things because a stock goes down, you shouldn’t own a stock at all.” –Warren Buffett

Historically, recessions typically last an average of 13–18 months, and then growth returns. The key is to be able to endure the fluctuations in your stock portfolio without making a reactionary decision to liquidate when the prices are at their worst. Obviously, the stocks you own should be evaluated consistently to factor in market changes, poor management, and other forces that could impact long-term value.

Age-Adjusted Risk

Investments should be analyzed by risk as you age. If they have historically weathered the storms, adjustments may be unnecessary. Most professional advisors stress the importance of reducing risk prior to and after retirement. In addition, the Bible stresses the importance of diversification, which is another way to reduce risk.

“Give a portion to seven, or even to eight, for you do not know what disaster may happen on earth.” (Ecclesiastes 11:2, ESV)

Seek many counselors. Think of investing like planting a tree. It needs decades to grow. Digging it up and moving it every time there is a storm will interrupt its opportunity to grow.

Buy Low, Sell High

Markets move on sentiment or emotion. People take action when they are fearful or greedy. The goal is to avoid following the crowd in the wrong direction. Like someone yelling fire in a theater, many may be crushed by the panic to escape instead of waiting to see if there really is a fire.

John Templeton famously said the best time to buy stocks is at the point of peak pessimism and fear, and the best time to sell stocks is at the point of peak optimism.

Buffet says that the poem If by Rudyard Kipling is good to ponder during market turmoil. It is a reminder to avoid panic in the midst of market fluctuations, to ignore the fears created by the “what-ifs,” and to patiently wait things out.

Dealing with Fear

We are called to live one day at a time. Only our heavenly Father knows the future. When we try to enter His realm, we can be overcome with fear and anxiety. That’s why Jesus’ instruction in Matthew 6:33–34 is so important:

“But seek first the kingdom of God and his righteousness, and all these things will be added to you. Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.” (ESV)

“He will give them to you if you give him first place in your life and live as he wants you to. So don’t be anxious about tomorrow. God will take care of your tomorrow too. Live one day at a time.” (TLB)

I’d like to invite you to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will provide encouragement by bringing God’s Word into your daily life.

This article was originally published on The Christian Post on April 11, 2025