Dear Chuck,

My husband and I have good intentions when it comes to using money wisely, but we just don’t follow through. We need help!

Stuck Without a Budget

Dear Stuck Without a Budget,

In my years of counseling couples about their finances, I have met many just like you who want to have a structured approach but can’t seem to get there or stay there. I have three tips: put in the time to plan, write out your plan, and then, faithfully implement it.

Time to Plan

One of the primary obstacles is that most couples don’t take the time necessary to work on their finances. You probably spent plenty of time together when you were dating/courting. Now, you need to invest time in your financial future.

Planning takes time, but it is an essential element for any financial program. God is an orderly provider and expects us, His stewards, to be the same. Set aside a weekend for you and your spouse to begin the process of discussing your goals and putting a plan together to get there. If that is not possible, start with just an hour per week at a time and place where you are relaxed and able to focus.

Sound financial management is an aspect of the Christian life that requires God’s wisdom. We must rely on His Word to make financial decisions for the short term (for the duration of our lives) and for the long term (beyond our lives into eternity).

A Written Plan

A written plan provides goals to work toward and helps you measure progress. It will help you stay on track by referring to your original objective. You will analyze priorities and develop effective habits. Working as a team, you can encourage and motivate one another to stay focused. Your mindset and behavior will change as you strive to manage money by Biblical principles. As Ron Blue said in his book, Never Enough, “Goals tie our habits to our hearts.”

A budget is a tool that shows how much you can spend based on what you allocate to giving, saving, and investing, or vice versa. Certainly, a budget is an important aspect of getting your finances under control, but it should be viewed as a means to achieve your larger goals, not the end goal. For instance, a wise financial plan will accelerate you towards achieving your life purpose, not simply paying the bills and having money for retirement. Friends of mine planned for years to be able to self-fund their full-time global mission work after age 55. They have done it and are having the time of their lives! A budget helped them accomplish their purpose.

Adjust your budget as you gain new insight and as your financial picture changes. Remember that choosing frugality is less painful than it being forced on you due to lack of planning. For help getting started, go here.

A record number of American adults say that their primary financial regret since the beginning of Covid-19 is “not saving enough for emergencies.” A financial plan could have prepared them for the unexpected. See saving tips.

Your plan should include:

Implement Your Plan

Track your giving, saving, spending, and investing. Then, put financial “dates” in your calendar. Make them a time you look forward to. Monthly budget analysis, quarterly progress reports, and yearly goal resets will help you stay the course. Crown has a great program called, “Money Dates” that you can find here.

Pick a night of the week to dedicate to your financial education. You may know a lot about money but perhaps not what God says about it. Feeding on truth, you will renew your mind and gain a Biblical perspective on money. This will help you make smart decisions and find contentment in all situations. This is also a time to review your progress.

Some Guidelines

(Wisdom of Larry Burkett from The Complete Guide to Managing Your Money)

Expect a battle. You will have to arm yourselves offensively and defensively to live out what you believe. However, the two of you, working towards defined goals, will find joy in the journey.

Paul wrote in Philippians 4:12-13, “I know what it is to be in need, and I know what it is to have plenty. I have learned the secret of being content in any and every situation, whether well fed or hungry, whether living in plenty or in want. I can do all this through him who gives me strength.” This perspective will help you find contentment as well as strength to press through the times you may become stuck.

My wife, Ann, and I wrote a book that you may enjoy called Money Problems, Marriage Solutions: 7 Keys to Aligning Your Finances and Uniting Your Hearts. In it, we provide real-life stories, a solid foundation from Scripture, and practical steps for application, giving you a plan to unite and conquer financial issues together.

This article was originally published on The Christian Post on June 4, 2021.

Dear Chuck,

I’m getting concerned about rising prices and the possibility of high inflation. What can I do to keep up with these increased costs for gas, groceries, home improvement materials, etc?

Worried About Inflation

Dear Worried About Inflation,

Inflation is on everyone’s mind right now because it is a threat to our well being, not only individually but also nationally. It will help if I start with a true story to set up my answer.

Years ago, my wife and I lived in a region of Texas located in “tornado alley.” One afternoon, we were under a tornado watch. Suddenly, alarms sounded as the once clear skies turned to near darkness and winds began to howl, and a rush of fear came over us. Serious danger threatening our lives and property was fast approaching!

This fear prompted very swift action without panic or wasting precious time. Ann hauled important papers, valuables, and photo albums to a more secure location. We followed safety protocol to protect our lives as best we could as we waited out the storm in the most secure part of our home. Thankfully, that tornado passed over without causing damage. The point is, we were prepared in advance of the storm. We had a plan.

Plan for Economic Storms

When you have a plan, you avoid panic and the accompanying risk of making poor decisions. “The plans of the diligent lead to profit as surely as haste leads to poverty.” (Proverbs 21:5 NIV)

The key to any threat is to stay ahead of the problem.

Crisis management involves anticipation, planning, and implementation. Being proactive can diminish potential damage. Procrastination invites it.

Anticipate

Plan

Implement

“Light dawns in the darkness for the upright; he is gracious, merciful, and righteous. It is well with the man who deals generously and lends; who conducts his affairs with justice. For the righteous will never be moved; he will be remembered forever. He is not afraid of bad news; his heart is firm, trusting in the Lord.” (Psalm 112:4- 7 ESV)

Inflation May Not Last Long

Greg McBride, chief financial analyst at Bankrate.com, says, “Price rebounds coming out of a recession is normal.” We are certainly seeing that! Prices for gasoline, used cars and trucks, housing, raw materials, groceries, etc. have all increased. Stimulus spending coupled with supply chain issues is driving prices up and decreasing purchasing power. Inflation accelerated at its fastest pace in more than 12 years with consumer prices up 4.2%. See the Consumer Price Index (CPI) at the Bureau of Labor Statistics.

The Federal Reserve says that the nation’s current state of inflation is transitory. That could mean two months or eighteen. Regardless, it is eating away at income, savings, and retirement plans. If high inflation is on the horizon, the Federal Reserve will have to increase interest rates. That could hurt those who carry a lot of debt.

In my recent book, Seven Gray Swans: Trends that Threaten Our Financial Future, I consider other economic threats that we should keep in full view as we navigate a volatile economic environment. I think you will benefit from reading it.

This article was originally published on The Christian Post on May 28, 2021

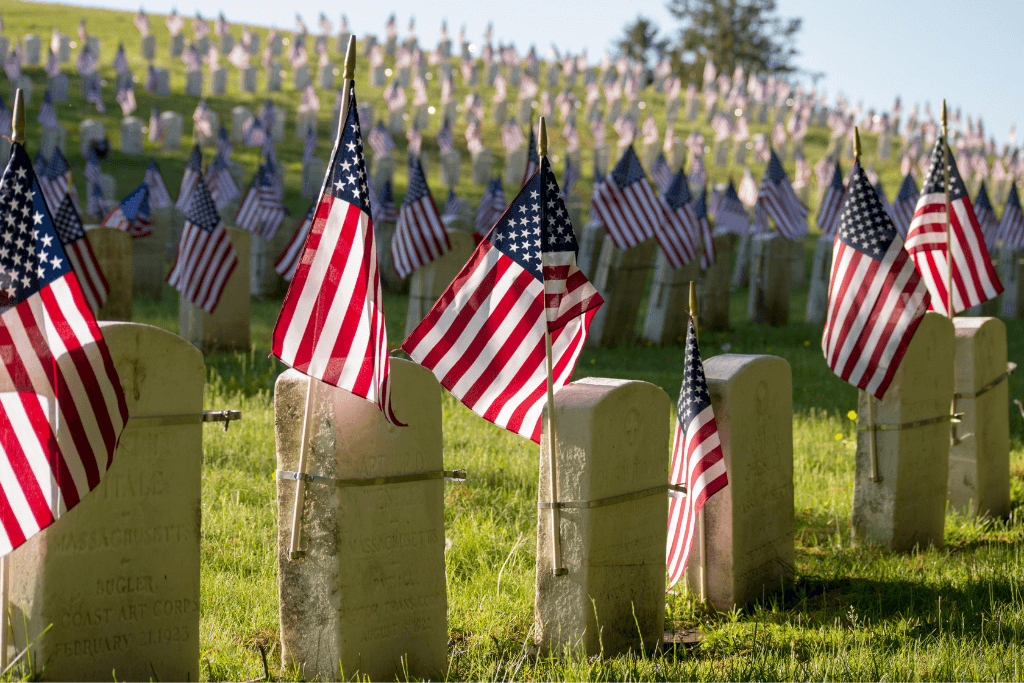

Dear Chuck,

We can’t travel this year. How can I make Memorial Day special for my family while staying on a budget?

Honoring Our Fallen Heroes

Dear Honoring Our Fallen Heroes,

First, thank you for remembering that this national holiday is far more than a time to shop and play.

Memorial Day was founded to commemorate those who died to preserve the Union during the Civil War. It was originally called Decoration Day because people would decorate the graves of the fallen. After we entered World War I, it became a day to remember all who gave their lives in America’s wars. The last Monday of May is dedicated to the holiday. On this day, the American flag should be flown at half-staff from sunrise until noon then raised to the top of the pole until sunset. Officially, a pause for one minute of silence should be observed at 3 p.m.

The extended weekend has become the event that ushers in summer for Americans. People celebrate coast to coast with barbecues, picnics, and parades. The impact of Covid on last year’s celebration may increase the nation’s desire to celebrate this year.

Through the years, for some, Memorial Day has morphed into a weekend of entertainment. Some escape to a beach, lake, or holiday destination. Others look forward to the annual sales. Clothing, home furnishings, grills, and appliances usually top the list.

Make it Special

In addition to flying your American flag and attending a local parade, to make the celebration special while also saving money, I recommend that you host a cookout at your home and invite the family of a fallen soldier to be your guest. Ask them if they would be willing to share their story with your guests. Show them the respect and honor that is due them for their sacrifice and loss. Here is a possible guide for your event:

Budgeting Ideas

Traditionally, menus involve hot dogs, hamburgers, chicken, or steak. Expect to spend more money this year on grocery items and gasoline. Examine your finances, and leave yourself margin. Don’t spend more than you should because the entire summer lies before you.

Make Money

After observing the reason for the national holiday, this can be a time to actually earn money. If you are home alone or have the time, these ideas by Rachel Slifka may work for you.

Remembering and Honoring Those Who Gave Their All

“War is sweet to those who have not experienced it.” (Quoted by Erasmus in his Adages) It is traumatic for those who experience the horror. We thank God for our soldiers and those who gave their all to protect and defend our freedoms.

Crown is privileged to have Christian Credit Counselors (CCC) as a trusted source of assistance. For more household budgeting tips or for guidance with debt, let CCC help.

This article was originally published on The Christian Post on May 21, 2021

Dear Chuck,

Do you have any advice for someone married to an impulsive spender?

Cautious Budgeter

Dear Cautious Budgeter,

Sounds like you may be married to an opposite financial personality; my wife and I can relate!

Most of us have made an impulsive purchase at some point in time. Others struggle with it more frequently. Or they are married to one who does. I was the impulse spender in our marriage for many years. To be clear, impulse spenders buy what they want without considering the consequences. Their behavior negatively impacts others, and the financial stress can be terrible.

It can be difficult to determine if someone is impulsive, compulsive, or materialistic. Some definitions will help here:

Materialistic describes one who is excessively concerned with physical comforts or the acquisition of wealth and material possessions. This is an issue of the heart that drives the behavior. Often, people live ignorant of or in denial of this spiritual deception.

Impulse buying is often related to anxiety or depression. Those who struggle with their self-image desire acceptance, respect, or attention. They shop whether they can afford to or not, in an attempt to meet those needs or boost their mood. Some call this “retail therapy.”

Compulsive spending, on the other hand, is an uncontrollable desire to shop. It results in spending large amounts of time and money and tends to escalate over time. Mental Health America gives 4 stages of compulsive spending: anticipation, preparation, shopping, then spending. If impulse buying impacts budgets, compulsive spending can destroy them!

Symptoms of Compulsive Spending:

A Change of Heart

To help your spouse identify if he/she is struggling with materialism, consider doing an online Crown study together. Typically, the behavior will not change until the heart is transformed. In my own experience, I had to repent of the control money had over my life. I surrendered my life to the Lord’s control in order to escape my double mindedness.

Practical Tips

Ask your spouse to consider some of the steps that will bring the impulsive buying or compulsive spending under control.

Pick a stress-free time and environment to set goals. Write them down, and post them in a visible place. Then, create a budget. Honor God and one another by staying within the spending limits for each expense category. Learn to give first, and then, pay your bills; use automatic transfers to specific savings accounts. Discover what the Bible says about money, and ask the Lord to work in your situation.

Track shopping sprees. Discover the triggers, and note what is purchased.

Avoid shopping—period. Find a healthier activity to substitute for the rush. If you must make a purchase, determine your needs, make a list, use cash, then exit immediately. Take a spouse or trustworthy friend with you.

Stop using credit cards. Put them in a very, very inconvenient location. Unsubscribe from store emails, and avoid online shopping. Professional counseling may be necessary. Just remember, “No temptation has overtaken you that is not common to man. God is faithful, and he will not let you be tempted beyond your ability, but with the temptation he will also provide the way of escape, that you may be able to endure it.” (1 Corinthians 10: 13 ESV)

Aim to be humble and transparent, committing to honesty in all transactions. This removes distrust in relationships. Seek accountability with your spouse and the wisdom of an older couple. Learn good communication skills. (Check out the numerous resources available at RightNowMedia.org.)

Learn to appreciate things money can’t buy—like nature, health, and relationships. Ask God to remove the impulses so that you can fulfill His purposes in your life. He is “able to do immeasurably more than all we ask or imagine, according to his power that is at work within us….” (Ephesians 3:20 ESV)

Pray for an eternal perspective—that the things of this world would lose their luster. “Do not lay up for yourselves treasures on earth, where moths and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also.” (Matthew 6:19-20 ESV)

Christian Credit Counselors may be able to provide more guidance, as they are a trusted source of help to free individuals and families from the burden of credit card debt.

This article was originally published on The Christian Post on May 14, 2021

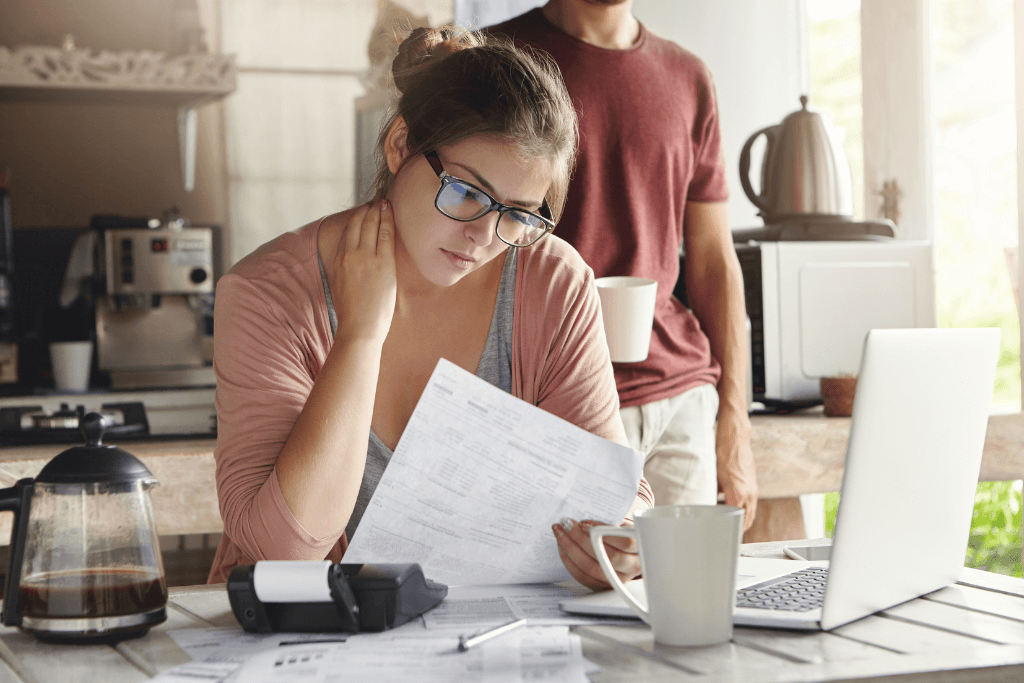

Dear Chuck,

Our best friends are on the brink of a divorce. A financial mistake occurred several years ago, and they’re slowly working their way out. But the wife is struggling to forgive. Any advice?

Financial Bitterness

Dear Financial Bitterness,

This is a far bigger problem than simply fixing their finances. A divorce usually leads to a financial and emotional disaster. My hope is that this advice will help you give them guidance to save their marriage.

The Big Picture

Financial stress is a leading cause in marriage conflicts. Breaking up may not solve the issues. The average cost of divorce in 2019 was $12,900. This varies depending on location, child support or custody, alimony, and if it was settled outside of court or in a trial.

I know of several marriages that are in serious danger of failing because apologies and forgiveness were not implemented early on. When this happens over a period of time, a woman feels unloved and loses respect for her husband, or a husband does not get the respect he needs and is unable to show her love. It is what Dr. Emerson Eggerich calls The Crazy Cycle.

Marriage requires time and commitment. Men and women need to learn how to voice their emotions and listen well. It prevents bitterness from taking root. Some basic communication skills are important, and Drs. Lee and Leslie Parrot are great guides in this area.

Learning to Forgive

My wife, Ann, and I try to live by this simple little saying:

The first to apologize is the bravest. The first to forgive is the strongest. The first to forget is the happiest. But make no mistake, the first step is usually the hardest.

Ford Taylor has a tool he calls the Six-Step Apology. He says that it saves marriages and relationships—even those that appear beyond repair. Saying the words in each step is key. The process can lead to a change in behavior that can save or grow relationships. Learn the steps. Use them. Model and teach them to children. See what happens.

Believers know that we are to forgive one another. Many of us grew up memorizing some of the verses. In fact, shortly after Ann and I were married, we attended a newlywed Bible study and were encouraged to memorize Ephesians 4:32: “Be kind to one another, tenderhearted, forgiving one another, as God in Christ forgave you.”

But, forgiveness is step 4 in Ford’s method. It comes after stating the offense, admitting the error, and apologizing. That may seem insignificant unless you are the one who’s been hurt. If you are in that position, those steps prepare you to forgive, forget, and move on. It takes humility to begin the process.

You can have a financially healthy marriage, but unless you learn to apologize and forgive, you will fall short of what God intends. We are to forgive as He forgives. Or think of it this way: We forgive because He forgives. When we choose to do so, we are able to experience peace and wholeness in our relationships. We obey Him and trust that He will work it all together for good.

Paul told the Colossians: “Put on then, as God’s chosen ones, holy and beloved, compassionate hearts, kindness, humility, meekness, and patience, bearing with one another and, if one has a complaint against another, forgiving each other; as the Lord has forgiven you, so you also must forgive. And above all these put on love, which binds everything together in perfect harmony.” (Colossians 3:12-14 ESV)

I am glad to know your friends are working out of a financial mistake. Christian Credit Counselors may be able to provide more help. If needed, refer them here.

My wife, Ann, and I wrote a book, Money Problems, Marriage Solutions, that I would encourage your friends and you to read. In the book, we present seven keys to peace in marriage and help couples unite and conquer to resolve financial issues together.

Dear Chuck,

I read your new book on economic threats. What do you think of China’s new digital currency? Isn’t it a threat that should be on your list of Gray Swans?

Economic Observer

Dear Economic Observer,

I wrote a book about Seven Gray Swans—trends that threaten our financial future which are low probability occurrences that we tend to ignore. As I mentioned in the book, my list is not exhaustive. Thank you for reading the book; unfortunately, many of the events I described are rapidly developing. While I did not mention a specific threat of China, I did reference their social scoring system, and my book was released before they introduced their new digital currency. I will address your specific concerns and the advancements in their social scoring technology.

China’s Dream of Ruling the World

I am pleased that you are paying attention to China. In a recent speech, President Xi Jinping openly expressed his disdain for the United States and his desire to work cooperatively with Russia and the UN to establish themselves as major influences in shaping the future of the world. Here is an excerpt from recent remarks:

“The combined forces of changes and a pandemic both unseen in a century have brought the world into a phase of fluidity and transformation.”

Xi called on China and Russia, as major powers of global influence, “to deepen comprehensive strategic coordination in the new era, and to play an underpinning role in safeguarding international fairness and justice, maintaining world peace and stability, and promoting common development and prosperity.”

You can read the full reference to these remarks here.

China’s Digital Currency

In recent weeks, according to the Wall Street Journal, China introduced the world’s first digital currency to be backed by a Central Bank, the cyber yuan. The article states:

“China’s version of a digital currency is controlled by its central bank, which will issue the new electronic money. It is expected to give China’s government vast new tools to monitor both its economy and its people. By design, the digital yuan will negate one of bitcoin’s major draws: anonymity for the user.”

“Beijing is also positioning the digital yuan for international use and designing it to be untethered to the global financial system, where the U.S. dollar has been king since World War II. China is embracing digitization in many forms, including money, in a bid to gain more centralized control while getting a head start on technologies of the future that it regards as up for grabs.”

This useful convenience comes with a price—the loss of privacy. Unlike cryptocurrencies such as Bitcoin, use of the digital yuan makes no pretense of financial privacy. China will be able to track and ultimately control the use of the cyber yuan. Some are calling it a massive trojan horse to introduce financial surveillance into the flow of funds around the world and not just among its own citizens.

I, for one, will not use the cyber yuan should I be given the opportunity. The only thing that gives it value is trust in the integrity of the issuer. China remains fraught with corruption within the government, education, and commercial sectors.

Social Scoring Expands

One of the gray swans in my book is biometric identification and social scoring. Social scoring is rapidly invading the lives of Chinese citizens. The social credit ranking system collects data about peoples’ financial situation, spending habits, careers, and social media behavior. They are rewarded for good behavior like buying water instead of alcohol or obeying traffic rules. However, they are punished for jaywalking, disorderly behavior on trains, bad driving, buying too much junk food, or not paying bills. Poor scores ban them from public transportation or basic benefits of society.

Recently, the government launched a new app to encourage the reporting of those who criticize the Communist Party’s ruling. It is their latest effort to identify “malicious people distorting facts and confusing” others. There are an estimated 400 million surveillance cameras, signifying an eventual tracking system of the Chinese citizens. In addition, the internet provides opportunities to enhance “efficiency of state policies.”

Nearly a century ago, the Reichstag passed a law known as the Malicious Practices Act. It became “a crime to speak out against the new government or criticize its leaders….Those who were accused of ‘gossiping’ or ‘making fun’ of government officials could be arrested and set to prison or a concentration camp.” They were able to control the population through fear and intimidation.

Ultimately, Big Tech could be used like Big Brother, just as is happening in China. We need to pray that this system is not universally adopted by governments to assert control over free speech which is essential for the freedom that enhances economic growth.

Our Confidence

Centuries ago, Daniel was “watched” by jealous government administrators. He was “trustworthy and neither corrupt nor negligent.” However, the men knew they could convict him by introducing a new law. They framed him as being malicious: “Daniel…pays no attention to you, Your Majesty, or to the decree you put in writing…” You know the account. Daniel was thrown into a lion’s den.

When King Darius learned that he was protected by the angel of God, he declared that all should fear and revere Daniel’s God: “For he is the living God and he endures forever; his kingdom will not be destroyed, his dominion will never end. He rescues and he saves; he performs signs and wonders in the heavens and on the earth. He has rescued Daniel from the power of the lions.” (Daniel 6:26b-27 ESV)

We must pray and trust God and continue to be vigilant in understanding the times, just as you and I are both seeking to do.

Crown is privileged to have Christian Credit Counselors (CCC) as a trusted source of help to free individuals and families from the burden of credit card debt. You can check out more of their services here.

This article was originally published on The Christian Post on April 30, 2021

Dear Chuck,

My wife and I want to escape the high taxes in California. She thinks we should look into a place offering moving incentives. We have two young children; so now may be the best time to move. What advice can you offer on these moving incentives?

Leaving LA

Dear Leaving LA,

This is a very significant decision and one you should pray about and think through. I will offer a few tips to help guide you.

Not long ago, I was in Nashville, TN, and happened to meet a couple that had only recently moved (seven months ago) their family of four from Los Angeles. I asked, “Why Nashville?” She was quick to reply, “No state income taxes, much lower property taxes, and we get much more home for our money.” Clearly, they had made their move based on the financial benefits. I pressed in further by asking about any changes to their jobs or careers. She explained that she and her husband both worked from home so it was no change to their income. She also said she liked the schools for their two children, found the people very friendly, and really enjoyed the area, but she missed her family badly.

Moving Incentives

There is a massive amount of relocation happening right now driven by a number of converging factors: COVID 19, state governments’ management of the pandemic, the ability to work from home, and historic low interest rates. A number of moving incentives are in place in an attempt to attract new residents. I will provide some cursory research on the topic.

As you noted, there are several cities or states attempting to attract new residents. Tulsa, Oklahoma; The Ozarks; Savannah, Georgia; Topeka, Kansas; Newton, Iowa; Hamilton, Ohio; and Alaska are all offering cash incentives for new residents. The newest is Morgantown, West Virginia, which I will expand on below as an example of what you can and need to look for.

West Virginia Wants More People

AscendWV.com is a talent attraction program for remote workers who are seeking a high-quality lifestyle in the mountains of West Virginia. The package, worth $20,000, is an effort to draw remote workers to the state. The program received a major boost with a $25-million grant from native Brad D. Smith and his wife Alys in partnership with West Virginia University’s Outdoor Economic Development collaborative. The program is simple: “We want you to experience work-life balance in a brand-new way through community, purpose and the outdoors. You can bring your remote work to the mountains of West Virginia.”

Ascend accepts applicants who commit to living in Morgantown. Next year, Shepardstown and Lewisburg will be added. The package includes $12,000 plus a year of free outdoor recreation on public lands, access to free co-working space, free outdoor gear rentals, the ability to earn remote work certifications through West Virginia University, and networking opportunities and events. $10,000 is paid over the first 12 months, and $2,000 is paid at the completion of the second year. It is all taxable income. The state is looking for full-time remote workers who currently reside outside of West Virginia or who are currently in positions based outside of the state. Interested applicants should apply by May and are expected to move within 6 months of being accepted.

Benefits and Attractions

West Virginia has 2,032 miles of whitewater, 1,500 miles of public trails, and 1.5 million acres of public lands. It is also home to the country’s newest national park: New River Gorge Park and Preserve. In addition, there is the Green Bank Observatory, the National Radio Quiet Zone, and the famous Greenbrier resort in White Sulphur Springs.

Housing costs are 16% below the national average. First time home buyers should check out the West Virginia Housing Development Fund. The Ascend website claims that the cost of living is 22% lower, and median home costs are $134,800 lower than national averages. Check out some pros and cons of life in West Virginia.

Not So Fast….

There are downsides to leaving your home for greener pastures or lower taxes. I took a job that moved us away from siblings and parents. We still miss family, college friends, and relationships that were established prior to moving here. Though we have settled in, there are things to examine for anyone who is considering a major move.

Seek the Lord and Wise Counselors

Moving for the financial benefit can be wise, but much more needs to be considered before you call the real estate agent and the moving company.

Proverbs 16:3: “Commit your work to the Lord, and your plans will be established.”

Proverbs 15:22: “Plans fail for lack of counsel, but with many advisers they succeed.”

Seek the Lord, pray together, and be patient. Consider fasting while seeking direction. Get the advice of your parents or a wise, older person. Talk about it with your extended family. We are seeing some cases where families are making the move with their children and grandchildren. Make sure you and your wife are unified in your decision before proceeding.

As you seek the Bible for wisdom, consider joining one of Crown’s study plans available on the popular YouVersion Bible app to help guide your decision.

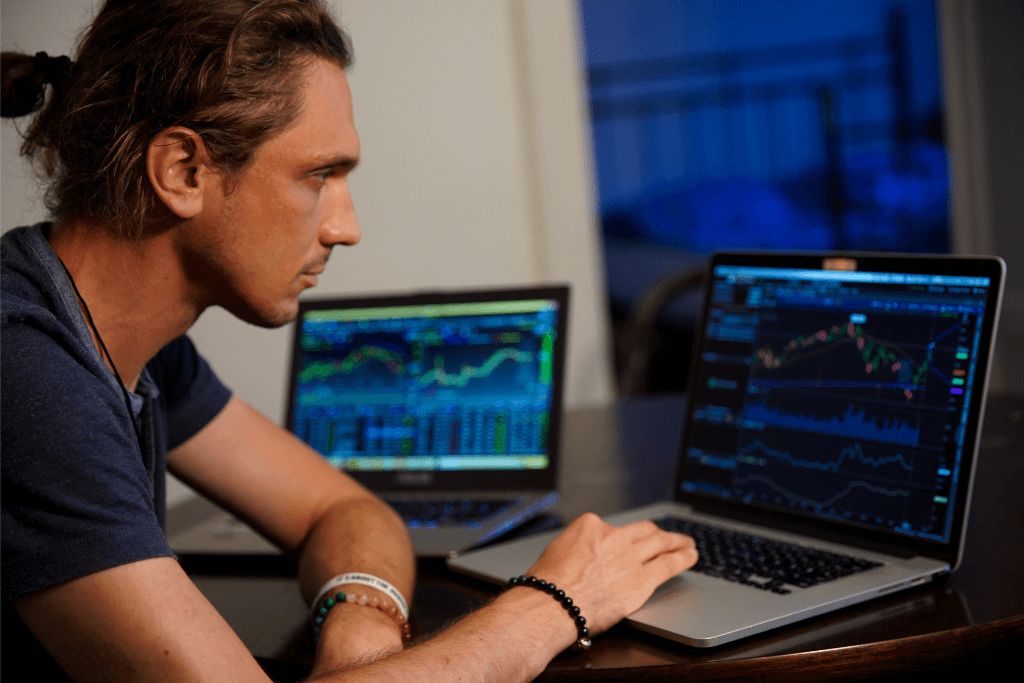

Dear Chuck,

My son’s college roommate made some money in day trading. Now my son wants in on the action. I’m not sure what to tell him, except to avoid it!

Day Trading Fears

Dear Day Trading Fears,

The Bible talks a lot about investing, so I will be able to give you some of those principles to help direct your son. He is jumping on to a very hot trend among young people right now.

Here is a simple framework of my core beliefs about this topic:

Investing is not gambling.

Day trading is not investing.

Investing should be done according to God’s principles.

Day Trading on the Rise

Day traders are traders who execute intraday strategies to hopefully profit off of relatively short-lived price changes for a given asset. On the contrary, investors look to maintain ownership of a given asset indefinitely to give it the opportunity to increase in value.

Last week, Felix Salmon at Axios.com wrote: “Never mind saving for retirement. Gen Z has embraced the stock market as a place to make short-term gains.” Technology, social media, and overconfident young people are causing the resurgence of day trading. Barriers to entry are low, numerous apps make trading easy, and they do not fear risk or failure. They only see potential wins.

According to Investopedia, active traders desire to profit quickly from price fluctuations and only hold trades for a brief period of time. They generally focus on stocks, foreign currency, futures, and options. Volume is necessary because price changes may only be in the pennies. Day traders make tens or hundreds of trades per day. Swing traders open or close positions every few days. Active investing is slightly different. It involves ongoing buying and selling activity to beat the market. Portfolios are rearranged to adjust to the market. Passive investing is a buy-and-hold strategy for those interested in long-term investments with minimal trading. It is cheaper, less complex, and for those who desire to build wealth gradually. Each has pros and cons. But beware, some of these methods violate God’s principles.

Investing is Not Gambling

The only thing investing and gambling have in common is they both involve a financial risk. However, they radically differ in one key aspect—how you create a financial gain. Gambling requires that other participants lose in order for you to gain. Investing requires that everyone must win in order for you to gain.

Gamblers do not care if others lose, only that they win. The Bible warns against this attitude.

“But those who desire to be rich fall into temptation, into a snare, into many senseless and harmful desires that plunge people into ruin and destruction. For the love of money is a root of all kinds of evils. It is through this craving that some have wandered away from the faith and pierced themselves with many pangs. (1 Timothy 6:9-10 ESV)

Day Trading is Not Investing

While not actually gambling in the strict sense, day trading is certainly more akin to it than investing.

The Bible warns: “Steady plodding brings prosperity; hasty speculation brings poverty.” Proverbs 21:5 (TLB)

My friend, Tim Macready, former Chief Investment Officer at Christian Super, a pension fund located in Australia, says: “At a personal level, investing represents an opportunity to provide for our future needs by setting aside money today and growing it for the future. At a societal level, the assets we invest can be used for productive purposes—to support the creation of goods, services, and jobs that support human flourishing.”

People fail to recognize that investing is ownership in a company. Robin John, CEO of Eventide Investing, says, “The real issue that we face today is that investors are divorced from their investing.”

Investing is willingly placing your funds into a business, commodity, or other asset to allow it time to grow and increase in value. This takes patience, knowledge, and wisdom.

Proverbs 24:3-4 (NIV) says, “By wisdom a house is built, and through understanding it is established; through knowledge its rooms are filled with rare and beautiful treasures.”

To apply this proverb to investing, we must read, learn, research, study, and understand what we are investing in to create lasting wealth. While many may claim the same approach to day trading, it is difficult to defend rapid trading as a wise approach.

Jonny Wills at FaithDrivenInvestor.org says, “An influx of novice investors is blurring the line between investing and gambling….How should I view the resources God has put in my hands? Is money a toy or is it a tool?”

Invest According to God’s Principles

Vince Burley, CEO of Vident Financial, says, “Christians should see financial markets as a great test to ensure that their love and security stays with God and are not misplaced with money.”

Unfortunately, day trading is often driven by greed. Combine that with overconfidence, and you’ve got a dangerous situation. In Luke 12:15-21, Jesus told the parable of the rich fool. He said, “Take care, and be on your guard against all covetousness, for one’s life does not consist in the abundance of his possessions.”

Encourage your son to be a good steward of what God provides. Suggest that he takes a Crown course to learn more of God’s economic principles, as a foundation for how he approaches his finances. At Crown, we have many resources on learning God’s principles of investing.

I also recommend that he begins to read and learn from some of the great investors before making any trades or investments. Many resources are available, starting with works by Benjamin Graham, Peter Lynch, Sir John Templeton, or Warren Buffet. They offer experienced insights into becoming a serious investor. Young people desire to make a difference in society. Perhaps he would also be interested in learning about impact investing.

If you’re interested in this topic, I encourage you to join us on April 22nd for a brief economic update from Vince Burley during Crown’s Spring update, Renewed Faith. This virtual event is free, but registration is required. Sign up today.

Dear Chuck,

A friend suggested we get a home equity loan to cover our daughter’s wedding this summer. This makes me very uncomfortable, but I want my daughter to have her big day.

Money for Matrimony

Dear Money for Matrimony,

I have a very wise friend that always responds to my questions with the same reply: “This is a question that demands some education!” What he is somewhat jokingly telling me is that he will explain the why behind his answer before he actually answers. Well, I sense the same opportunity with your question. I need to talk about home equity loans before I talk about financing your daughter’s wedding.

Understanding a Home Equity Loan

A home equity loan is a type of second mortgage. Funds are taken from the equity—the difference between the home’s value and the mortgage balance—and repaid over a certain period of time. For some, it is an easy and practical way to access cash. Equity is typically used for big expenses and can be more cost-effective than credit cards or personal loans with high interest rates. These loans average 6.36% compared to 15.96% for credit cards and 11.79% for personal loans (March 29, 2021).

Home equity fluctuates based on the market. Currently, home prices are climbing in much of the United States, but property values could plunge should we experience some catastrophic event. In 2007, home prices hit a high, then they steadily fell 35% by 2012.

A Motley Fool article at fool.com, “The Only 4 Reasons to Use Home Equity Loans,” approves these uses:

Not So Fast or Easy

I understand the first three as possible justifiable reasons; however, I do not recommend borrowing money to make any investment.

Michele Hammond, of Chase Private Client Home Lending, notes that applicants’ debt-to-income ratio, loan-to-value ratio, credit score, and annual income are checked. “Additionally, to determine the amount of equity in a home, a lender will employ an appraiser to determine the current market value of the home, which is based on its conditions and comparable properties in the area.”

If the money is used for home improvements, make sure they actually increase the home’s value and marketability. This website provides job cost and resale data for different regions of the country.

My Straight Answer

I don’t like the idea of using a home equity loan to pay for your daughter’s wedding. While you could pay for a nice experience for her, borrowing money puts your entire family at unnecessary risk.

Although a repayment plan must be in place for the loan, the same need for cash could arise in the future. Using the cash to cover debt or luxury lifestyle choices can compound a spending problem. Late payments could impact your credit score. Defaulting could mean losing your home.

Some Options

Do your homework to avoid the possible pain and stress of two mortgage payments. The pandemic has impacted the employment of many Americans. Analyze your income and employment situation, and put your pencil to the numbers to determine how much wedding you can afford without debt. Talk this over with your daughter.

When Jesus told a crowd (Luke 14:25-33) to consider the cost of discipleship, He gave an illustration: “For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it?” This diligence and analysis is necessary for every big decision we face in life.

It is possible to do a cash out refinance. Rates are beginning to rise, but they may be lower than your current mortgage. Talk to several lenders, know all the costs involved, and pray for wisdom to determine if you should proceed. Seek counsel from those who understand the pros and cons.

Look at alternative ways to host the wedding that reduce the typical costs. Here are a few ideas: ask friends to help you crowdsource flowers, look for venues that are less expensive to rent, and seek volunteers for music, pictures, and even meals for the rehearsal and/or reception. Frugal weddings are nothing to be ashamed of. Years ago, I read a survey that weddings featuring low costs but a high number of guests produced longer lasting marriages than high cost weddings with fewer guests.

Be encouraged and patient. I am not sure how long you have before the big day, but disciplined spending and saving now can help you avoid borrowing. My hope is that this information will help you show the maximum amount of love and support to your daughter and future son-in-law, with the minimal amount of financial stress.

Want to Stay Connected with Crown?

I spoke about finding Renewed Hope in Crown’s Winter update; you can view the 15 minute video here. Join me for more encouragement during our Spring update on Renewed Faith on April 22nd. The virtual event is free, but registration is required, so sign up today.

Dear Chuck,

I am working hard to be better with money. What’s your best tip for getting out of debt?

Debt Free in Three

Dear Debt Free in Three,

I am excited that you have a goal to be debt free. I am hoping that your phrase “debt free in three” is a three year goal—or maybe even less—to pay off your debt. What I want to address is your first comment about wanting to become better with money.

Stewarding involves the heart and what we believe about God.

If all we ever do at Crown is get people on a budget, out of debt, or to have more savings in the bank, then we’ve failed because fixing our money problems is not the goal—our hearts need to be changed.

People can retire as millionaires and die as billionaires. But, unless they turn to God for the forgiveness of sins and the gift of new life, they will remain paupers—eternally separated from Jesus Christ.

How To Know the Lord

Man’s relationship with God was broken when Adam disobeyed the Lord. The guilt had to be punished; the debt had to be paid. In the Old Testament, Passover and sacrifices foreshadowed a future event in which God provided the perfect sacrifice, a Lamb without blemish—His only Son.

Jesus is God’s gift to us. We can’t earn salvation. We don’t deserve it. We can only receive it by humbly trusting the Lord and His grace.

“If we confess our sins, he is faithful and just and will forgive us our sins and cleanse us from all unrighteousness.” (1 John 1:9 ESV)

“If you declare with your mouth, “Jesus is Lord,” and believe in your heart that God raised him from the dead, you will be saved.” (Romans 10:9 ESV)

Our goal is not simply to help you get out of debt and on a budget. Our goal is to lead you to God so that you can know Him as Lord and Savior. Stewardship is born out of this relationship. When you know Him, you then want to obey what He teaches about finances.

A Long-Term Plan

True stewardship flows out of love and gratitude for what He gave. Faithful stewards don’t see their lives, money, and possessions as their own. They acknowledge that everything they have belongs to God, and they manage it accordingly. They desire to handle money wisely, to care for the earth and others, and to further God’s Kingdom. They don’t order their lives so that they can spend whatever they want. They order their lives so that God can spend them however He wants. They are thinking not just about how to get to the end of this life comfortably but also about how to prepare for the life to come.

Larry Burkett said, “Most Christians are more than content to live out their lives surrounded by the trappings of our world, rather than to risk losing them in becoming a radical Christian—one who will put God first in all decisions, even when putting God first is costly.”

In a few years, everything you have will either be thrown away or will belong to someone else—your house, your car, your clothing, your books, and all of your most prized possessions…everything.

Guard yourself from the material distractions of this temporary life, and focus your time and money on the eternal. You’ll only spend a few years here on earth. Our deepest needs can never be met with more things; they can only be satisfied with more of Jesus.

Debt Free in Three

I encourage you to continue your quest to become debt free. God wants us free from all earthly masters. He identifies financial debt as a form of slavery. More importantly, recognize that Jesus paid a debt that He did not owe so that you could be free of the debt you could not pay. That is the debt you owe for your sin. When you confess that Jesus Christ is Lord and surrender your will to obey His, you will be set free of your sin and shame and the penalty of eternal separation from God. You will be set free by the Father, Son, and Holy Spirit. This is the beginning point of your stewardship journey. It is the best advice I could ever give you.