Understand Inflation & Make a Plan to Thrive

Prices rising everywhere can cause anxiety, especially when your budget is being pressed to the max. The Inflation Survival Guide will help you understand:

- What inflation is and why it happens

- How to recognize inflation

- Where the Bible addresses inflation

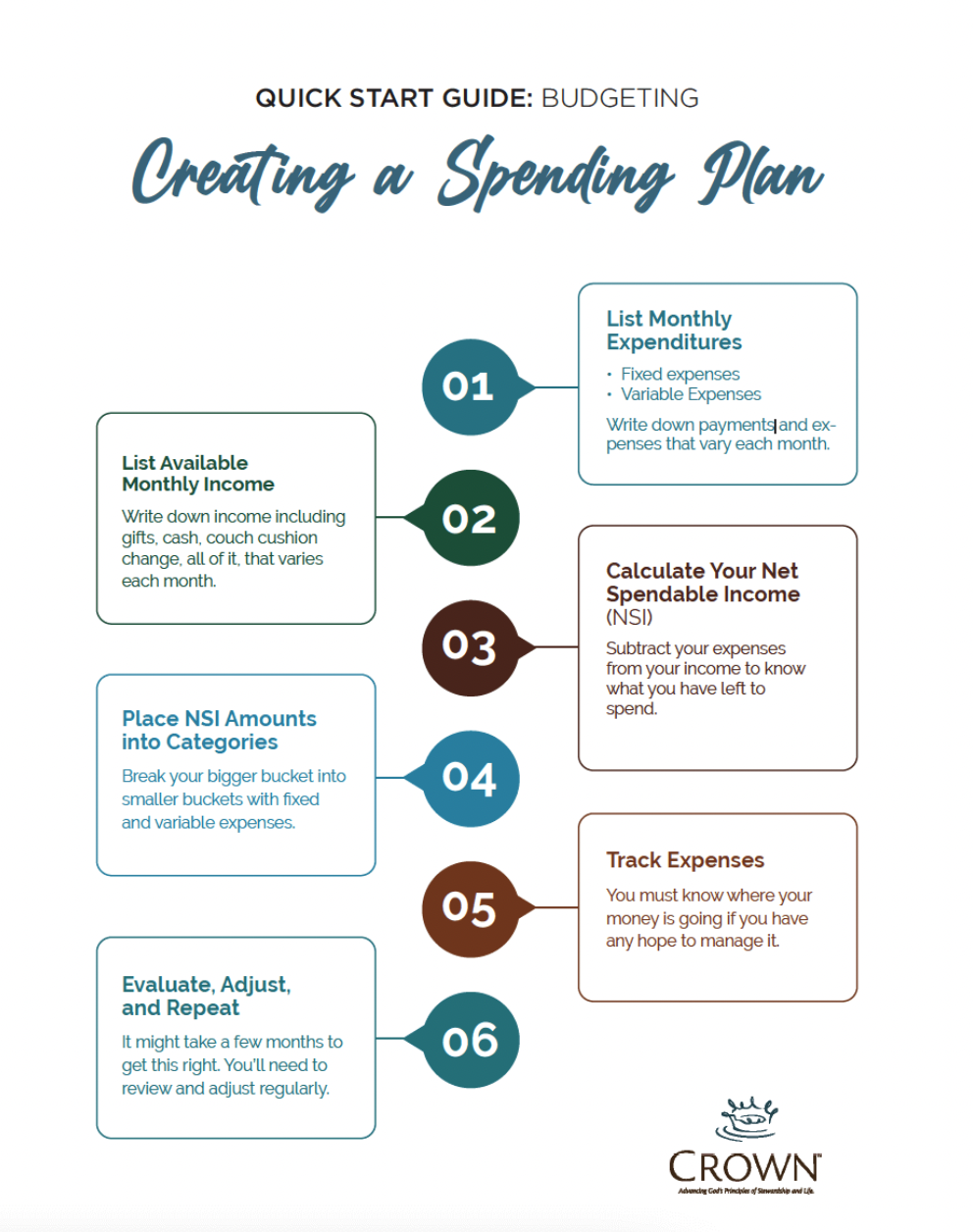

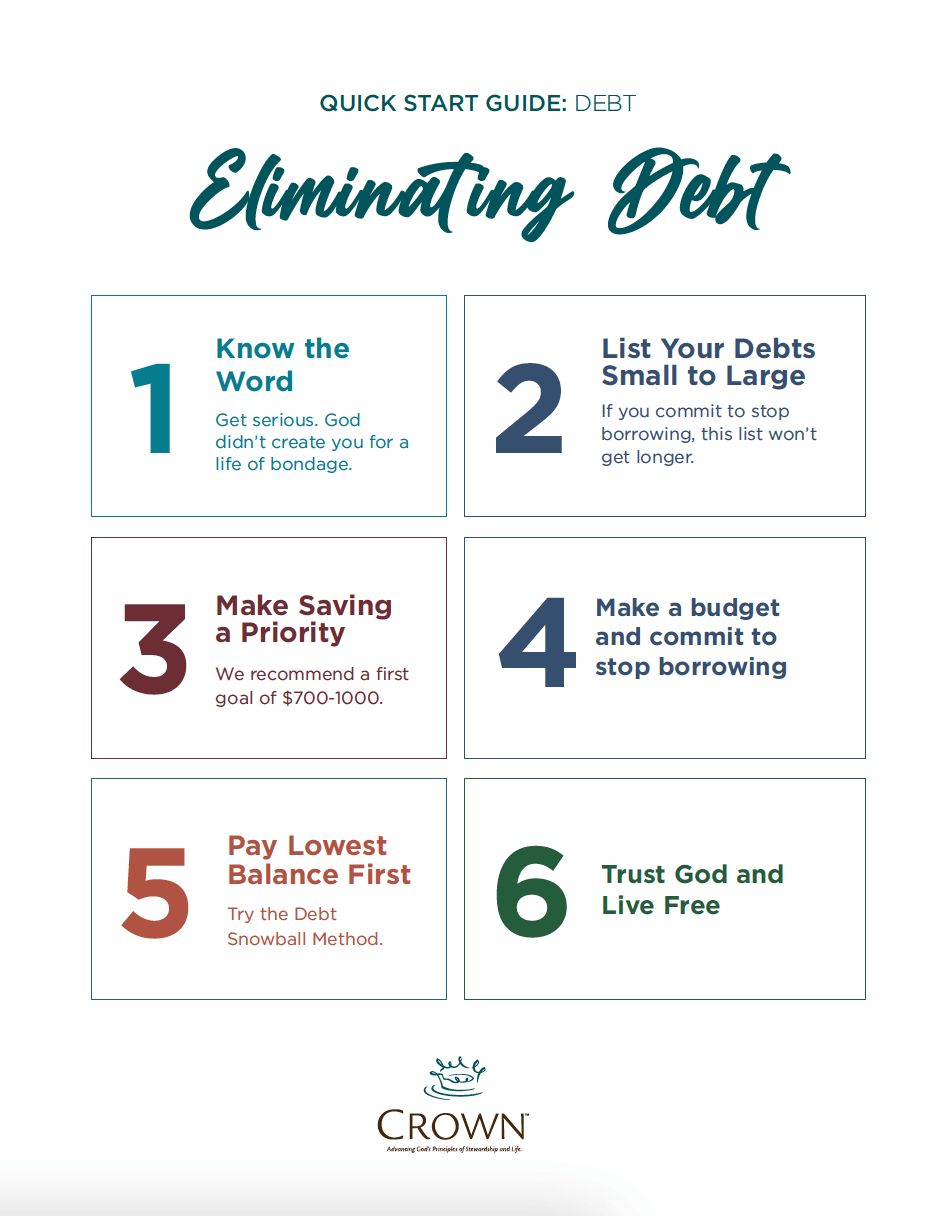

- Practical ways to adjust your habits to combat inflation

Watch

Crown CEO, Chuck Bentley, discusses inflation, why it happens, how to recognize it, and what the Bible has to say.