Dear Chuck,

I’m getting nervous about the rising cost of gasoline because of my long commute each day. How can I avoid having my budget whacked?

Bring Back Cheap Gas!

Dear Bring Back Cheap Gas,

You have good reason to be concerned, but it is not all bad news. There are plenty of reasons not to panic. You have a number of good options that I will recommend.

Gasoline is Moving Higher… and Maybe Lower

Prices at the pump follow fluctuations in crude oil prices. California’s known for the highest prices in the nation. On March 16, the Orange County Register reported that the average price per gallon was $3.73, the highest in 67 weeks. One week later, it rose to $3.76, with premium at $4.108. Price comparisons by state can be found here.

On the 22nd, GasBuddy released a report entitled “Upward Gas Prices Broken as Oil Sags.” Although the national average gas price was 22.2 cents higher than a month ago, prices dropped slightly for the first time in 11 weeks. Patrick De Hann, head of petroleum analysis for GasBuddy, addressed the decrease.

“While gas prices still rose in a majority of states last week, we may see some price decreases in the week or weeks ahead, even as U.S. gasoline demand continues to rally to the highest level since the pandemic started nearly a year ago. It’ll be a bumpy road the next few weeks as markets sort out the bearish and bullish factors, but I still believe prices will likely experience more upward momentum ahead of Memorial Day.”

According to Trilby Lundberg, an industry analyst, prices are up due to higher crude oil costs, the February snow storm that shut down Texas refineries and reduced operations, and surging prices on credits for a renewable fuel.

In an NBC News article, De Hann said we have a supply and demand problem. “Covid decimated demand. It caused a lot of contraction and production cuts. 2020 set things back for U.S. oil production by several years.” Now that people are moving about, demand has increased, but production is short of where it was a year ago.

Sergio Avila, of AAA Nevada, says, “This increase isn’t something that is just isolated to the west. It’s something happening across the country. Every state average has climbed by double-digits since February resulting in 1 in 10 gas stations with pump prices that are $3 per gallon or more.”

Gasoline Prices Impact Us All

Jean Folger, at Investopedia, shares how gas prices impact the economy. Increased cost of transportation will be felt in:

Food prices go up as a result of more than just transportation. Farmers require diesel fuel to run machinery, and many fertilizers contain oil byproducts.

Gasoline prices impact spending and consumer confidence. A U.S. Gallup poll in August 2020 revealed that one’s view of the economy appears to be inversely correlated to the price of gasoline. Increases in state gas prices create pessimism about the economy.

How to Reduce Your Gasoline Spending

Many companies are now offering remote work since adapting to the challenges of COVID. Since you have a long commute, ask your employer to reduce the number of days that you need to drive into the office. Two of our employees with long commutes now only come into the office once per week. This has not only saved them gas money but also has improved the quality of their lives.

In addition, I recommend you plan your outings to reduce drive time and mileage. Remove any unnecessary weight in the vehicle, and make sure your gas cap seals properly. Skip premium gas, and use grocery store loyalty cards for discounts. Budget for increased gasoline prices when making vacation plans.

MoneyCrashers.com gives several tips to prepare for rising prices.

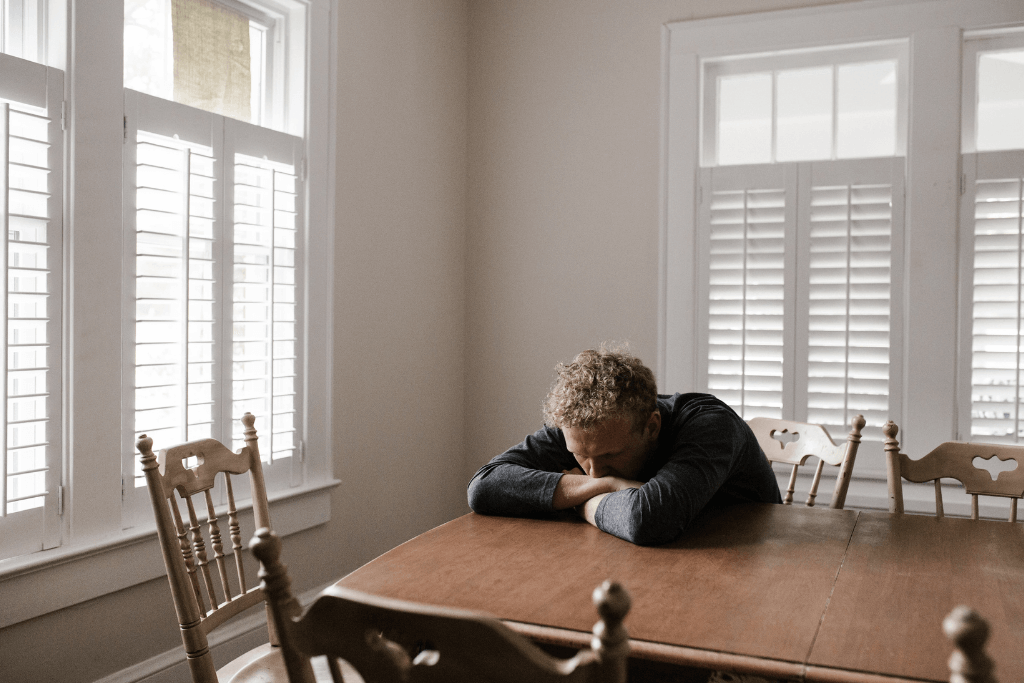

How to Reduce Your Stress

I often say that 90% of what we are worried about will never happen. The Lord reminds us not to use our time and energy to try and project the future.

“Therefore I tell you, do not be anxious for your life … But seek first the kingdom of God and His righteousness, and all these things shall be added to you. Therefore do not be anxious for tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.” (Matthew 6:25-34 ESV)

Taking one day at a time means keeping your thoughts confined to the present. Yes, we should all do scenario analysis to prepare for and avoid danger, but we should also trust the Lord for right now.

One practice that I recommend is to verbalize all that you are certain about today. Make as long of a list as you can think of, and say it out loud. For example, I might say, “ I am alive. I am able to walk, see, hear, smell, taste, touch, and talk. I am free. Our nation is not under the threat of an invasion. I have friends and family who love me. I can afford gasoline today. I have a job! The Lord knows me. The Lord cares for me. The Lord promises to provide for me…” This will reduce your anxiety and bring your thoughts captive to enjoy what you do have and to praise the Lord for His goodness.

You are not alone in your feelings of concern about the future, which is why I recently spoke about finding Renewed Hope in Crown’s Winter update; you can view the 15 minute video here. Finally, I invite you to join me for more encouragement during our Spring update on Renewed Faith coming up soon on April 22nd. The virtual event is free, but registration is required, so sign up today.

Dear Chuck,

Do you think we are heading towards runaway inflation? If so, how should I prepare financially?

Inflation Fears

Dear Inflation Fears,

Any commentary on the state of the economy is like commenting on the water level in a river—it is an ever-changing dynamic. So, whatever is said is likely to be wrong within minutes, hours, or, certainly, days. In spite of this, general trends and specific directional observations may prove helpful.

Since inflation is on everyone’s mind, allow me to paraphrase Shakespeare’s character, Hamlet: “Inflation or No Inflation? That is the question.”

While economists and central bankers prefer a low level of controlled inflation, it is a very difficult scenario to achieve. Needed to create economic growth, inflation can negatively impact other areas, like the federal debt. Managing inflation requires the precision of a brain surgeon operating aboard a ship that is rocking back and forth in a stormy sea.

One thing I have learned about investing in public securities (stocks and bonds) is how emotion drives value from one day to another. Stocks drop with fear and danger, rise with optimism, and rotate with foreseeable trends. Investors shift in anticipation of economic winds. As Wayne Gretzky famously said, they are attempting to “skate to where the puck will be.”

The best way to answer your question is to give you the three prevailing viewpoints from very capable, professional investors. Here is the general spectrum on the topic of inflation: Yes, it is coming and fast; No, it is under control by the Fed; and It could go either way.

Dr. Michael J. Burry – Investor, Hedge Fund Manager, Physician; featured in The Big Short

A recent article explains that Dr. Michael Burry, in his recent tweets, spoke of current modern monetary theory policies with a quickly growing debt-to-GDP ratio along with more stimulus and the re-opening of the economy. He said, “…employee and supply chain costs (will) skyrocket.” He expects a market crash within months.

Warren Buffet – CEO of Berkshire Hathaway; considered one of the most successful investors in the world

In a current YouTube video, Buffet says, “The best businesses that will perform the best are the ones that require little capital investment to facilitate inflationary growth and that have strong positions that allow them to increase prices with inflation.”

Ray Dalio – Founder and Co-CIO of Bridgewater Associates; one of the top investment managers in the world

Dalio spoke at the opening panel of the Future Investment Initiative, saying, “We will see a rebound in growth and a rebound in inflation.”

Larry Fink – Chairman and CEO of BlackRock, the largest investment fund in the world

“I think we are going to have a huge amount of job creation, but all these elements are highly potentially inflationary,” Fink predicted. “It is fair to assume we are going back into an era of growing inflation.”

While businesses are already raising prices and seeing inflationary headwinds, the Fed disagrees. A recent Washington Post article says, “The Fed’s view is that the long-term forces keeping inflation low for the past decade and more are still at work, while the economy still has a way to go before completing its pandemic recovery.”

John Mauldin – Widely Recognized Financial Writer, Publisher, and Best-Selling Author

Mauldin says that the current bull market is a perfect cash-flow storm because of the following:

In a different, not-so-bullish article, Mauldin explains that he thinks we will see both inflation and deflation. He adds, “If we get even a modest recovery in the COVID numbers, we clearly could see some short-term ‘inflation’ in annual data… It won’t last… The debt burden will cap growth enough to keep the inflation mild.”

While difficult to predict, due to a number of factors, the majority of high-profile investors seem to think that inflation is imminent. As one article summarizes: “Increasing inflation can be caused by increases in the supply of money, increased access to credit, or demand that outstrips supply. In reality, inflation is usually caused by all or a combination of these factors.” Only time will tell.

To be prepared, be sure you are following these timeless investment principles:

Diversify – This means having investments in asset classes that can benefit from inflation, such as commodities and hard assets like real estate and precious metals, etc.

Get Debt Free –Your flexibility to adapt to a changing economy is improved when you are no longer shackled with debt, especially consumer debt like credit cards, automobile loans, and student loans.

Increase Financial Margin – If you spend less than you earn each month and increase your savings, you will reduce your stress, be in a position to navigate rising costs, and be able to take advantage of new opportunities.

Don’t Try to Predict the Future – The Bible makes it clear that no one knows the future. Many investors try to convince us that they do. Follow God’s financial principles, and stay the course.

“ Steady plodding brings prosperity; hasty speculation brings poverty.” (Proverbs 21:5 TLB)

This article was originally published on The Christian Post on March 19, 2021

Dear Chuck,

We just bought an older home and intend to remodel it. We hope to flip it within two years. We want to be prepared for the inevitable challenges. Do you have any tips besides building our emergency fund?

First-Time Remodelers

Dear First-Time Remodelers,

I hope this ambitious undertaking to remodel and flip your house for a profit is not driven by watching too much Fixer Upper or other home remodeling programs on HGTV. It is risky and more difficult than it looks on TV.

I have lots of advice from experience; in fact, I have more advice than I can write on this topic in this article! Hopefully, these crucial tips will help you achieve your goal.

Tip #1 – Prepare for the Unknown

Taking on a remodel, especially of an older home, is a venture into many unknown problems lurking behind the walls, under the carpets, or beneath the foundations! Plan on the likelihood of cost increases, time delays, and material shortages.

Tip #2 – Consult Experts

It sounds like this is a do-it-yourself project. All DIY projects are improved by learning as much as you can before you start. Read manuals and handyman books, and watch YouTube explainers. Recruit friends to share their expertise. If they already own the tools, you may save even more if they are willing to help. Trade your skills for theirs, or provide meals or yard work to pay them back for the help they bring to your project.

Get word-of-mouth referrals to find trustworthy contractors. Check their references and insurance coverages, and ask to speak with their most recent clients before you hire them.

Tip #3 – Conduct a Market Analysis

One of the biggest mistakes is to spend more money than you will ever get out of the house by over building in your market or making improvements that do not improve the value of your home. I have made both of these mistakes! It is painful. Once you know what you can market your house for, you can work backwards on your remodeling budget.

Tip #4 – Count All the Costs

“Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it?” (Luke 14:28 NIV)

Knowing you have the money to complete the job is step one. But, the cost of remodeling and flipping a house goes far beyond the financial. It takes a toll on your marriage, your ability to conduct your normal job, and your emotional health. Be sure you have counted all the costs before you start to demo anything.

Tip #5 – Maintenance and Repairs

Once the remodel is complete, an older home will need continual maintenance. According to one financial advisor, nearly 70% of his clients reject the idea of budgeting for repairs and maintenance. That’s a mistake that will eventually have consequences. The age and condition of your home, your climate, and the previous owner’s care will impact the amount of money you should budget for costs while living in your home. The Balance recommends the following calculations. Allow for more depending on your particular home.

Track your home maintenance and repair costs, and file your receipts. The total cost of owning an older home can be shocking. Any upgrades to energy efficiency of the home may qualify for tax benefits.

Tip #6 – Think Like the Future Buyer

Far too often, we remodel a home according to what we like or the styles that we prefer. That is fine if you plan to live in the home for years to come. Since you intend to sell your home in a short period of time, I recommend that you research the home styles preferred by today’s buyers. It may not be your style, but it will help you when it is time to put the home on the market.

As of the writing of this article, mortgage interest rates have begun to rise from historic lows. Don’t assume the market for selling your home will be the same two years from now. Be prepared to live in your home if you are unable to sell it.

This can be an exciting opportunity for your family to make some money on this project. But, it will be hard work. I know a couple who has done this on their first two homes where they have lived. It was very successful for them financially; however, by the third home they purchased, they did not want to think about fixing it up and flipping it again. They wanted home to be a place of rest, not stress. Thanks for writing.

This article was originally published on The Christian Post on March 12, 2021.

Dear Chuck,

I have several friends who are in deep financial trouble in the early years of their marriage. I want to avoid the stress they’re experiencing. Do you have any helpful tips so that I can guard my home and marriage?

Avoiding Disaster

Dear Avoiding Disaster,

Being under constant financial stress is terrible at any age, but it is especially dangerous in the “early years.” This is a time when most couples are vulnerable to separation and divorce.

I assume your friends are struggling with debt due to being unprepared for their lifestyle.

It usually occurs in a series of small mistakes, as a result of one huge accident, or because of the assumption that “this is just the way it’s done.” Since I don’t really know what happened to your friends, I will give you some financial advice and also some general principles so that you can avoid the five most common causes of debt.

Plan on financial disaster if you fail to plan for unexpected expenses. These are often things that have yet to come due or the unexpected costs of maintenance, repairs, or health issues. Anyone with a car, home, children, or pets understands this. Ignoring the inevitable or not working expenses into a budget creates credit card dependency. Adjust the budget to include setting aside money into an Emergency Account. Though temporarily uncomfortable, it is very wise long-term. It is best to have 3-6 months of your monthly expenses in an Emergency Fund.

If you are struggling with credit card debt now, contact our friends at Christian Credit Counselors. This should be done before you dig a deep hole.

Purchasing a home too early in marriage or paying too much for one creates problems. A house payment for the average family’s budget should not exceed 40% of net spendable income after giving and taxes. Include the mortgage, utilities, HOA fees, property tax, maintenance, and repairs. Destroying the budget to get into a home is not logical. It restricts the ability to give, save, and invest. Only purchase if the numbers work, preferably based on one income only.

If you cannot put 20% down before you take on a mortgage, it is best to rent and save until you can.

Most people look at the monthly payments for a car instead of the overall price. Interest translates into paying significantly more than the asking price and being burdened by the debt for years. Unlike a house, a car depreciates in value the moment you drive it off the lot. So, do not finance something that will lose money. Save, and buy reliable used cars with cash.

Disaster Proofing the Marriage

There is no silver bullet to protect “your home and marriage” from a disaster. Satan prowls around seeking to cause havoc in all relationships including the best marriages. Having your finances under God’s control is a sign of wisdom, and I highly recommend it. At the same time, let me give you a few tips that have helped us through the hard days.

Pray together, often. This took us years to get comfortable with, but it is now a way of life. Often, we take long walks and pray aloud together the entire time.

Seek to grow as Christ’s disciples. When you are both pursuing this goal, you will experience the fruit of the Spirit which is a glue to make any marriage even better.

Invite your spouse to be your most intimate, trusted advisor on all decisions. This trusting submission builds confidence and leads to better outcomes in all things as you work in unity.

Be humble, gentle, and quick to apologize. Nobody escapes hurting their spouse in a marriage. We can escape becoming indifferent about it through showing mercy, kindness, and grace when we are offended.

A good marriage is a financial benefit. A divorce is emotionally and financially devastating. My wife and I wrote an entire book on the topic of money and marriage, called Money Problems, Marriage Solutions. It is a step-by-step guide to growing in unity. You can get your copy here.

I made many of the mistakes that you are hoping to avoid. By God’s grace, He kept our marriage together, and we worked through the mistakes. Today, we are in a much better place and stronger because of our ability to work together. There is always hope when you fully trust Him and apply the principles of God’s economy.

This article was originally published on The Christian Post on March 5, 2021.

Dear Chuck,

I need to replace my car this year. I’m trying to decide if I should buy an electric vehicle or not. What would you do?

Car Choice

Dear Car Choice,

This is a timely question as a great deal of policy is attempting to move us towards electric vehicles with the assumption that it is “clean energy” and good for the environment. Let’s get some context first; then, I will give you my recommendation.

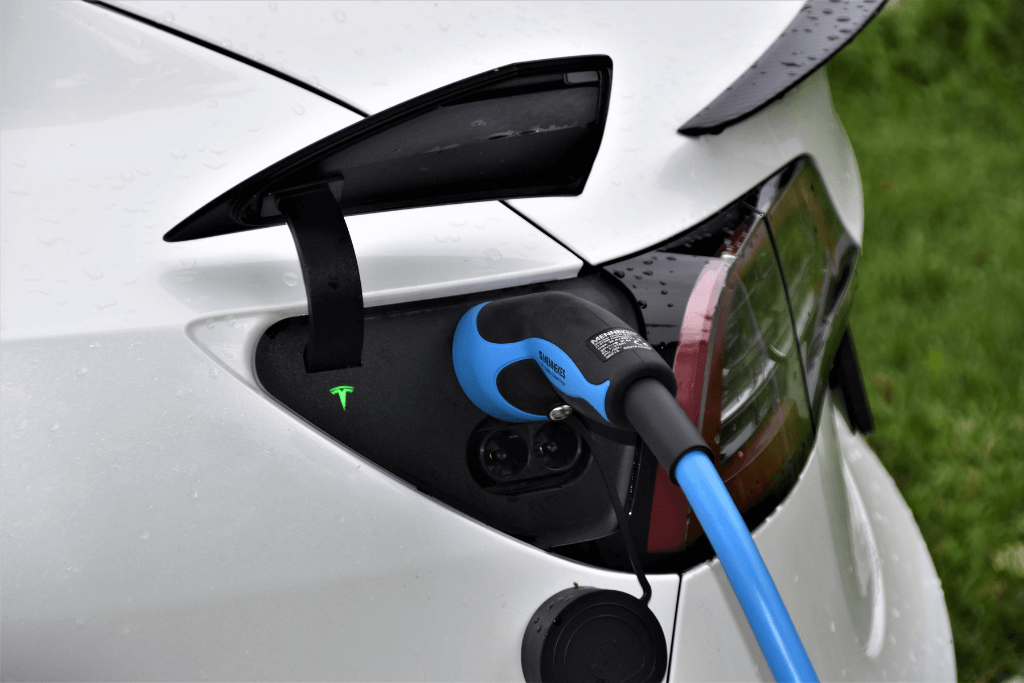

The Push for Electric-Powered Cars

Governor Newsom of California wants to ban cars with gasoline engines by 2035, and President Biden hopes to replace the government’s fleet with electric vehicles.

Tesla, the leading manufacturer of electric vehicles, is now worth about as much as that of the nine largest car companies in the world, combined! Obviously, investors believe this is the wave of the future. This is not an endorsement of the stock, by the way.

Electric vs. Gasoline-Powered Cars

It is important to research and understand the costs of time and money before making any purchase. “For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it?” (Luke 14:28 ESV)

One of my friends bought a new, high-end Tesla and loves it. He calls it the “iPhone of cars” because of its ease of functionality and its superior performance compared to all other electric vehicles. Of course, he spent $75,000 for it, which is far more than I would ever want to pay for transportation. By the way, Apple is looking to enter the market if they can find a willing partner to create “autonomous (self-driving) cars.”

Nerdwallet proposes several questions to think about before purchasing an electric vehicle.

Can you afford one? How far do you need to drive on a single charge? Where will you charge it? What will you use it for? Do you enjoy performance?

In addition, I’ve gathered some pros and cons to consider.

Pros

Cons

Some Facts To Consider

Most electric cars are able to go more than 200 miles when fully charged, but that is still much less than gasoline powered cars. Tesla’s Long-Range models can go over 300 miles, but the cost is significant for the longer-lasting power supply. Plug-in hybrids have a combined gasoline and electric range of 400 to 550 miles. However, air conditioning, heat, and hills can reduce that number.

Charge times vary. Currently, the cheapest and most convenient option is to do it overnight at home. Fast chargers are spreading throughout the country, but they still take longer than refueling at a gas station. Plus, the cost will fluctuate with the cost of electricity. To drive across the country, you have to map out your stops in advance by locating the charging stations and including downtime for charging, which is much longer than refueling gasoline.

Hybrid vehicles have experienced significant depreciation. Be sure to research depreciation of an electric vehicle. Some early models have not done well in the after market.

At What Cost?

Base prices range from $30,000 for the Hyundai Ioniq and Nissan Leaf to six figures for some Tesla and Porsche models. Home charging units cost under $1,000, with rebates available in some states. Some question whether or not our power grid has the capacity to keep millions of cars charged each night.

In addition, there is another cost to consider. Battery manufacturing is water-intensive and pollutes air, soil, and water. Lithium and cobalt are needed to make rechargeable batteries. With increased production of electric vehicles, there will be negative ecological and human issues to consider.

In January, The Guardian reported that 60% of cobalt comes from the DRC (Democratic Republic of the Congo) where men, women, and children are miners. Unregulated mines and contaminated discharge is life threatening. The Lithium Triangle of South America (Chile, Argentina, and Bolivia) has experienced groundwater depletion and the spread of deserts. In Tibet, a leak from a lithium mine poisoned a local river. According to the UN, an electric car boom will result in devastating ecological side effects.

Consumer Reports provided much of the information for this article. For additional interesting statistics regarding electric vehicles, see this website.

To Buy or Not to Buy?

In spite of the potential of electric cars, I plan to drive my good, used gasoline-powered cars as long as I can, while observing what happens within the auto industry. I expect the cost to purchase battery-operated cars to come down and the overall performance to improve, with more and more technological advances in the near term.

Speaking of gasoline-powered cars, I recommend that you buy a used car, paying cash for one that will hold its value. The world will sell you lots of reasons to buy a new car, but, remember, a car is simply a way to get from point A to point B. Driving an older, reliable car can be an excellent financial decision in addition to keeping you humble.

Hope that helps!

Originally published on The Christian Post on February 26. 2021

Dear Chuck,

My 13-year-old wants a credit card since her best friend has one. Seems young to me. Would you say yes or no?

Credit for Kids?

Dear Credit for Kids,

My first reaction is, no! However, it has some potential upside, so let’s vet this a little closer.

Far too many young people are learning how to be consumers and not producers. In other words, they become expert spenders but have not been taught how to generate income.

Setting that aside, this credit card idea has some possible benefits.

Upside

Giving your teen a credit card is an opportunity to teach responsibility and restraint. Ideally, no child should leave home without understanding Biblical stewardship. Knowing how to manage God’s property impacts one’s eternal destiny. If a credit card can reinforce that, welcome it.

Why Make Your Teen an Authorized User on Your Card

Authorized users are dependent on your credit history to build theirs. If you have good credit, it will show up on their credit report. Adding your teen to your card has the potential to:

Different cards have different age requirements for cardholders. There are starter cards for college students or those with no credit which can be opened in their own name if 18 or 19 years old. If younger, they can be added as authorized users on a parent’s card. Look for no-annual-fee cards, and be aware that some charge fees to add authorized users.

Making your teenager an authorized user on your account while teaching him/her wise use can build a positive credit history for him/her. Timely payments, low credit utilization, and the age of the card will be added to the teen’s history. Good credit will prevent the need for co-signing in the future, which the Bible warns against anyway. The Balance states the following reasons for teens to build credit:

Guidelines

A teen who is mature and teachable will welcome the responsibility you give him/her. It demonstrates your trust, which will boost his/her self-confidence and the desire to handle a card wisely.

Before having a card, teens should have a checking account. Knowing how to write checks or make online payments, keeping their check register up to date, and balancing the checkbook monthly will help them understand the connection between cash and credit. Have them write the check or make online payments for their monthly spending.

Teach them how a credit card works, how it affects their credit score, and the financial consequences of not paying in full each month. Explain the dangers of losing one, not keeping track of spending, and exceeding limits. Give them a credit limit, and show them how to keep track of spending. Require them to cover specified charges. This will vary among families depending on the maturity level of the child. They must guard the number and never share it with friends. Check their credit score periodically, and celebrate their good work.

Have a plan in place should they overspend. Give them the opportunity to work for you, to pick up extra work somewhere, or to sell something of value. Bailing them out will only weaken their resolve to be responsible.

Warnings

Credit card debt is a problem for many. If you struggle with it, please do not give your teen a card until you get your finances in order. Use your situation as a teaching tool for your teens. They may be the encouragement you need to systematically pay off your debt.

You are legally responsible for any authorized users. If the card is mishandled, your credit score and theirs can be negatively affected. Text message alerts for charges can be helpful.

If you prefer that they not have access to your account and its credit limit, then apply for a new card, and set a low credit limit for their use. Then, continue using your original card for your daily-use. Should they lose their card, it can be canceled immediately and replaced, without disturbing your primary card.

Resources

Training young people in the proper use of credit will prepare them to be wise stewards.

For a list of recommended credit cards for teens, check out Credit Karma and Wallet Hub.

For help teaching, see ThePennyHoarder.com, Credit cards 101, and How to Use a Credit Card.

Stress the importance of being a manager of all that God provides, and set before them the goal of hearing the words: “Well done, good and faithful servant.” Crown offers several courses that may be of benefit to you. Your Life: Financial Stewardship for Teens is one such course. You can find it as well as many others at www.crown.org.

This article originally published on The Christian Post on February 19, 2021.

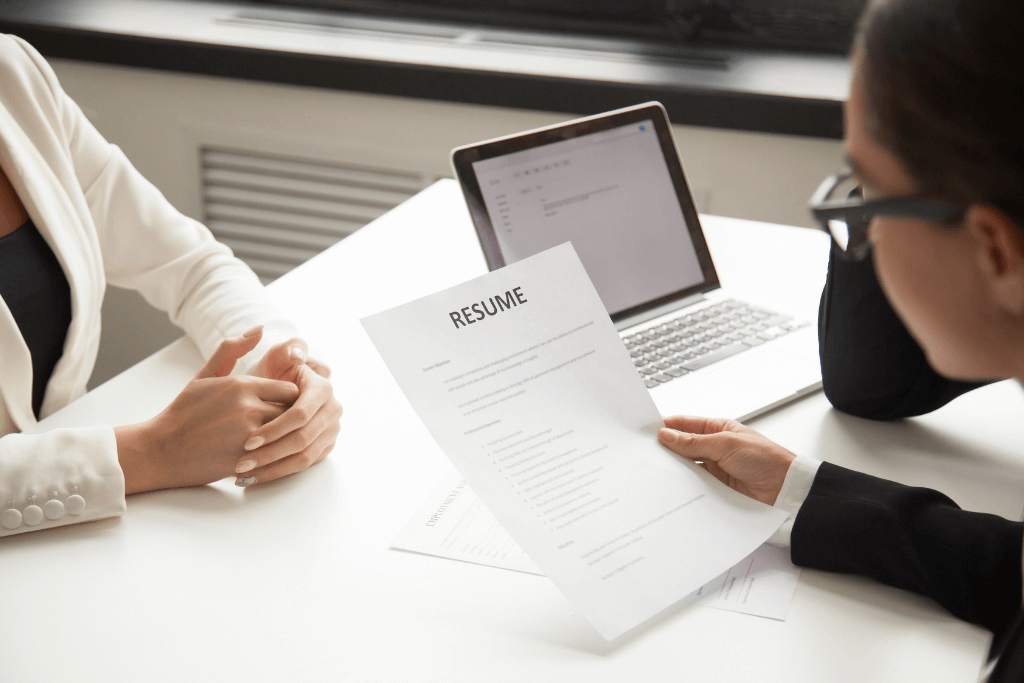

Dear Chuck,

I was laid off because of COVID. My company may rehire me soon, but I am thinking of getting out of the travel industry completely. Should I wait it out or move on?

Stuck in Unemployment Land

Dear Stuck in Unemployment Land,

I am sorry that you are feeling stuck. Having been laid off twice in my life, I understand the dilemma you face. Let’s start with the big picture and, then, get practical.

The job market has been affected, if not permanently changed, as a result of COVID. But, the dynamic change is being led by many other factors. In 2018, the World Economic Forum reported that automation, robotization, and digitization would impact the workplace. So, it is important to prepare yourself for what lies ahead, regardless of whether you’re unemployed or are considering a career change.

According to CareerBuilder.com, a few trends are obvious:

Get Busy

View your job search as a full-time job. Currently, there is actually an upside of unemployment, but it is your responsibility to maximize this time. Do not expect others to do it for you. Avoid the temptation to fall into bad habits or squander time during this period of unemployment. Invest in yourself. When a professional athlete gets cut by a team, he/she still has to stay in shape and strive to improve in order to win a spot on another team. Keep that in mind.

Read, study, and research. Then, gain the necessary skills to make yourself more valuable and, thus, attractive to potential employers.

The best investment you can make is in your gifts, talents, and professional abilities. Develop a daily schedule, and set deadlines while working toward specific goals. Take time to clean up your social media. It is almost as valuable as a resume in today’s world.

A Career Direct assessment could help you get to know yourself. You’ll gain an understanding of your personality, skills, interests, and values. We have coaches to help you find a new direction should you decide not to wait out the time to potentially be rehired.

Find a mentor who will be direct while offering encouragement, accountability, and guidance. Think through your relationships at church, with family, in the workplace, or in your neighborhood. Ask the Lord to direct you to the right person.

Some Practical Tips

Next Avenue recommends the following job search tactics:

Build hard skills with courses, certificates, and degrees online. Coursera offers training from leading universities and companies.

Don’t Overlook Soft Skills

Develop your soft skills as well. These are more personality focused and are highly underestimated. A study at MIT Sloan revealed that training in these skills grants a substantial return on investment to employers, while it also benefits employees. Communication, leadership, time management, problem-solving, adaptability, positivity, learning from criticism, and working under pressure are essential in being able to interact well with others.

The top five soft skills cited for 2020 by Business.linkedin.com included creativity, persuasion, collaboration, adaptability, and emotional intelligence. Different companies offer training. Udemy offers 130,000 courses online with a special division for Soft Skills development.

Mind the Gap

There are several reasons to consider a temporary job. Besides providing income and relieving despair, it keeps you productive. It can fill in gaps in your resume, allow you to explore a field that may prove to be interesting, and even be a step to a job you love. A temporary job provides the opportunity to develop new skills while broadening your network. It will give you some understanding of a position before committing to it full time.

Work can be a positive witness for the Lord or a negative one. Give it your all, exercising common sense, diligence, and excellence. Set yourself apart by striving to do your very best.

“Whatever you do, work heartily, as for the Lord and not for men, knowing that from the Lord you will receive the inheritance as your reward. You are serving the Lord Christ.”

(Colossians 3:23-24 ESV)

We are all hoping for the economy to be fully open soon. Yet, the travel industry may be the one most affected in the short-term. My advice is to get an interim job, pursue new opportunities, and wait on the Lord to show you where He wants you to work. Let us know if we can help.

Dear Chuck,

Can you explain what happened with the GameStop fiasco this week? It is very confusing to understand why it was such big news.

Shocked by GameStop

Dear Shocked by GameStop,

Like you, I was stunned by the hysteria to own shares of this seemingly small, struggling retailer called GameStop. It was certainly never one on my personal radar as a choice investment opportunity.

The saga of what happened as the stock soared from $40/share until it peaked at $468/share within one week will go down in the annals of Wall Street history. It turned out to be the biggest “short squeeze” in the past 25 years.

To explain it simply, an angry mob of small day-traders decided to try to injure the largest hedge fund on Wall Street. It was the classic “little guy vs. big guy” fight. Billions of dollars were lost (by most everyone involved) as this extraordinary event unfolded.

My understanding is that a box-office movie is already being planned to showcase what some are calling an uprising of “the ants vs. the elephant” in a life or death battle.

There is a lot to learn from this incredible story, especially in regards to the biblical principles of investing.

Some Background

GameStop bills itself as the world’s largest retail gaming destination for Xbox One X, PlayStation 4, and Nintendo Switch games, systems, consoles, and accessories. They also sell gamer-centric apparel, collectibles, and more. However, the company was clearly struggling. They once operated nearly 6,000 stores worldwide, but the move to online gaming was hurting the company badly. They closed 600 stores in 2019, and by September of 2020, they announced they would be closing another 450 stores due to the strain placed on the company by COVID. The publicly traded stock under the symbol GME fell to $4-$7/share during that time.

Identifying the Key Players

It is important to understand how this epic financial struggle between the so-called “little guys” and the “big guys of Wall Street” developed. Let’s identify a few of the key players:

If we go much deeper, it will only get more complicated. For now, this will help set up the main point of what happened.

The Story

Melvin Capital and a number of other hedge funds took a short position in GameStop/GME, which means they were betting that the company would fail. This is perfectly legal, but some accuse hedge funds of using their power and connections to help accelerate their desired objective, thus hurting all the “little guy investors” who may be betting that the company does not fail.

Some astute day traders noticed that the hedge funds had over-shorted their positions, and the potential for a “short-squeeze” was possible if they could drive up the price of the stock. It was a clear opportunity to make an investment out of revenge to cause Melvin Capital massive losses. The rallying cry was to make a YOLO trade, which means “You Only Live Once.” The idea was to throw off concerns about one’s money and make the big guys lose, for once in a lifetime. Millions of small investors did just that. Using their Robinhood app, many day traders shrugged off the risk and bought GME shares for the joy of “putting it to the big guys.”

Melvin Capital and others lost billions of dollars on their short positions as the stock soared against all logic. However, after reaching the incredible overvalued price of $468/share, self-interest overruled mob justice, and millions of the “ants” began rushing to sell their stock. The price plummeted as small traders experienced the pain of owning shares in a company that was wildly overvalued. Now, their personal losses mounted.

What to Learn?

The irony of the entire story is the name of the company that found itself at the center of this dramatic, high-stakes game of poker: GameStop. Millions were mobilized to think of investing as a game. The painful losses will hopefully forever remind them to, indeed, stop.

“For the love of money is a root of all kinds of evils. It is through this craving that some have wandered away from the faith and pierced themselves with many pangs.” (I Timothy 6:10 ESV)

Events like the GameStop frenzy can be unsettling, which is why I recently wrote Seven Gray Swans: Trends That Threaten Our Financial Future, where I discuss global trends that have the potential to shake up our world, economy, and stock market. By preparing wisely for these “gray swan events,” we have the opportunity to be salt and light to the world should they occur.

This article was originally published on The Christian Post on February 5, 2021.

Dear Chuck,

I am a young investor and need advice. Bitcoin looks like a great investment. Is now a good time to start investing in it?

Bitcoin or No Bitcoin?

Dear Bitcoin or No Bitcoin,

Before you make the decision to “invest in Bitcoin,” be sure you understand the risks. People are buying Bitcoin with the hope of making big money without fully considering the big risks. While it is the leading form of cryptocurrency in the world right now, most of the people I respect consider it more of a wager than an investment. They look at it like buying a lottery ticket in that it may be a big winner or loser.

Early in January, Britain’s Financial Conduct Authority warned crypto traders to be prepared to lose all of their money. “Consumers should be aware of the risks and fully consider whether investing in high-return investments based on crypto assets is appropriate for them,” the article states. There are two key issues: volatile prices and no guarantee that digital currencies can be converted back into cash.

Crypto Currency?

Some perceive Bitcoin as inflation protection while serving as an alternative to gold. But, Nouriel Roubini, professor of economics at NYU’s Stern School of Business, strongly disagrees. He argues, “First of all, calling it a currency – it’s not a currency. It’s not a unit of account, it’s not a means of payment…it’s not a stable store of value. Secondly, it’s not even an asset.”

According to Roubini, Bitcoin has no intrinsic value because it does not provide income, capital gains, or some form of utility like bonds, stocks, real estate, or precious metals do. It is purely speculative. He further explains that academic research suggests that the “pseudo stable coin Tether has been created by fiat and is …used literally to manipulate the price of Bitcoin.”

Crypto Volatility

Bitcoin peaked above $41,900.00 on January 7th. Then, prices began dropping. Reuters reported on January 19th: “Nearly 90% of respondents in Deutsche Bank’s monthly investor survey said financial markets now had a number of price bubbles, with cryptocurrency Bitcoin and U.S. tech stocks top of the list.”

On January 21st, Bitcoin fell 11%. Two things happened. During Janet Yellen’s confirmation hearing, she suggested that lawmakers curtail Bitcoin use because of its association with criminal activity, including terrorism. In addition, “double spend” was thought to have occurred. It is a feared flaw in which someone can spend the same Bitcoin twice. In reality, two blocks were mined simultaneously. But, confidence was shaken.

The Financial Press addressed the price drop as well. Scott Minerd, with Guggenheim Partners, claimed that prices may fall back to $20,000 despite the fact that several weeks ago, he forecasted a price of $400,000. However, Michael Saylor of MicroStrategy says Bitcoin could reach $14 million.

Volatility is clearly evident. Manipulation, regulation, fear, and greed are only a few of the factors playing into it. On January 26th, at 10:00 a.m., Bitcoin was up to $31,320.90. BlackRock, the world’s largest asset manager, authorized two funds to invest in cash-settled Bitcoin futures. Marathon Patent invested $150 million on the 25th. Who will be next?

Crypto and Electricity

Creating Bitcoin requires specialized hardware called Application Specific Integrated Circuit (ASIC). They are large and require a lot of electricity which gives incentive for companies to establish locations where electricity is cheap.

There is a growing concern about the centralization of mining. China supposedly accounts for 50-65% of the mining. Cheap electricity, inexpensive labor, and proximity to ASIC manufacturers are driving this. According to an article on Bitcoin.com, the Iranian government is blaming power shortages and rolling blackouts on Bitcoin mining. “Police in Iran have reportedly seized 45,000 bitcoin mining rigs for illegally using subsidized electricity from the state,” the article states.

Defenders claim renewable energy will make mining more affordable. Others claim it is far less expensive than mining gold.

Crypto Opportunity?

Some find price drops as opportunities to buy. Bitcoin magazine reports that over $30 billion has been accumulated for the long term: 2.814 million Bitcoin or 15.16% of the total in circulation. Supposedly, less than 15% is actively traded. The majority of people are accumulating, not trading.

Others see a correction as a case for creating a Bitcoin exchange traded fund (ETF) that would allow for smaller trading sizes. An ETF is a basket of securities that is listed on exchanges and traded like stock. ETF share prices fluctuate with trades being made throughout the day, while mutual funds trade once after the market closes and not on an exchange.

Invest or Pass?

Frances Coppola, at coindesk.com, has an interesting take on the topic.

So the faith of bitcoiners is what gives bitcoin its value. If they were to lose that faith, the currency’s value would fall to zero. But, is their faith alone enough for bitcoin eventually to replace the U.S. dollar as global reserve currency?…The sort of social and political collapse that would destroy the dollar would surely also destroy global civilization.

What does the Bible say?

“Do not toil to acquire wealth; be discerning enough to desist. When your eyes light on it, it is gone, for suddenly it sprouts wings, flying like an eagle toward heaven.” (Proverbs 23:4-5 ESV)

“As for the rich in this present age, charge them not to be haughty, nor to set their hopes on the uncertainty of riches, but on God, who richly provides us with everything to enjoy. They are to do good, to be rich in good works, to be generous and ready to share, thus storing up treasure for themselves as a good foundation for the future, so that they may take hold of that which is truly life.” (1 Timothy 6:17-19 ESV)

My view is that there are better, more stable opportunities to begin your investment experience. If you think you want to own Bitcoin, start small, be in a position to lose it all without regret, and diversify.

This article was originally published at The Christian Post on January 29, 2021

Dear Chuck,

I don’t think I have ever felt more uncertain about America’s economic future than I do now. Do you see any light at the end of the tunnel? My anxiety levels are growing!

Anxious American

Dear Anxious American,

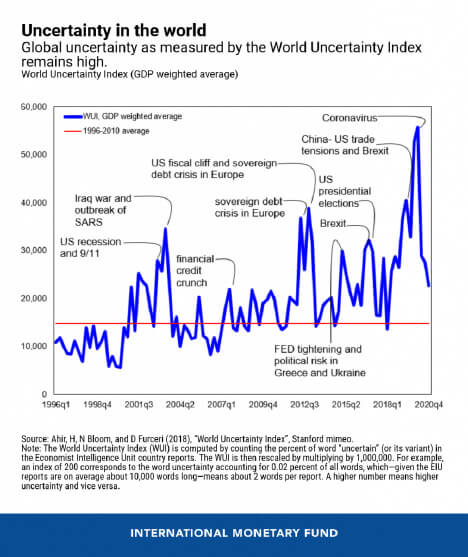

Your question prompted me to see if there was some measurement of the sense of uncertainty that so many of us are feeling and I found one! The International Monetary Fund published a graphic of the “World Uncertainty Index” in context over the past twenty-five years. The interesting takeaway for me is that the index peaked with news of the Coronavirus but has decreased by about 60% since the middle of last year. Take a look:

The point is, you are not alone. The world is in a history-making shift right now and most of us are experiencing greater levels of concern and anxiety.

Dealing with Our Unknown Future

If we focus our minds on all of the uncertainty we are truly in right now, it will no doubt breed anxiety. Financial anxiety begins when we start projecting how our future will be impacted by current events. Not knowing if our needs or expectations will be met creates worry. Dwelling on the unknown can propel us into a vortex of hopelessness. Doubt, disbelief, and negativity will eat away the peace and confidence that God wants us to experience.

In July of 2020, AnxietyCentre.com released an article with data and facts worth reading to get an idea of how serious this issue is. It states:

According to The Economic Burden of Anxiety Disorders, a study commissioned by the ADAA and based on data gathered by the association and published in the Journal of Clinical Psychiatry, anxiety disorders cost the U.S. more than $42 billion a year, almost one third of the $148 billion total mental health bill for the U.S.

Anxiety can raise its ugly head concerning health, money, education, careers, family, on and on. However, this is not new to humanity. An idiom came into use in North America during the mid-1800s. You’ve probably heard some form of it: “don’t borrow trouble.” Worrying solves nothing. It wastes time and energy and distracts us from more important things. Most of what we worry about never happens and reveals our lack of trust.

That idiom is nothing new. The Bible addressed the issue centuries ago:

Because we cannot know the future, we will always be prone to experience financial anxiety if we dwell on all the “what if” scenarios that race through our minds. Here is a simple framework that may help. When financial anxiety is rising, remember S.O.S. Stop. Organize. Start.

Stop!

If you are overspending, accumulating debt, and living with financial stress to make it to the end of the month, declare that you will stop repeating those mistakes now. This is the first step in gaining financial wisdom that will reduce your anxiety. Stopping is progress!

Humble yourself and recognize your need to place full confidence in the Lord. Repent of mishandling the money He entrusted to you. Don’t blame others or beat yourself up. Simply agree that you want to discontinue old bad habits with your finances.

Organize!

Make a plan to repair the problems you have created. They will not disappear by winning the lottery or ignoring them. Get help and seek training to address your issues and establish goals.

Begin a process to right the wrongs. Ask the Lord to help you persevere through this step with discipline, self-control, and hope. This will reduce your anxiety even more. God promised that we will experience tribulations and storms but He will never leave us or forsake us.

Start!

Once you have stopped and organized, you are two-thirds of the way there. God wants you to start doing what is good and faithful with money. His goal is not that we simply have freedom, but that we use money for His purposes, not our own.

It can be helpful to find wise mentors and gain knowledge from others who can guide and encourage you. Prioritize your life around the basic principles of giving first, saving second, and living on the rest. Restructure your lifestyle within a defined budget and renew your mind daily.

Light at the End of the Tunnel

I truly do not know what lies ahead, although I enjoy watching trends and keeping up with events that threaten our financial future. I just released a new book called 7 Gray Swans where I discuss many of these trends. I also know that there is always a reason for hope. Most of what we worry about will never happen. If it does, God will work it together for our good. We can find His Light shining brightly, no matter how dark our circumstances may seem.

We offer a variety of online courses and other resources to ground you in Biblical financial principles and fortify you for the days ahead. Christian Credit Counselors can help you eliminate credit card debt. Their Christ-centered values and experienced team of professional counselors can help you overhaul your finances. That step alone will reduce your anxiety.

Pray for our nation. We are in a turbulent time. We need you and all believers to be the salt and light that Jesus created us to be for such a time as this.

This article originally published on The Christian Post on January 22, 2021