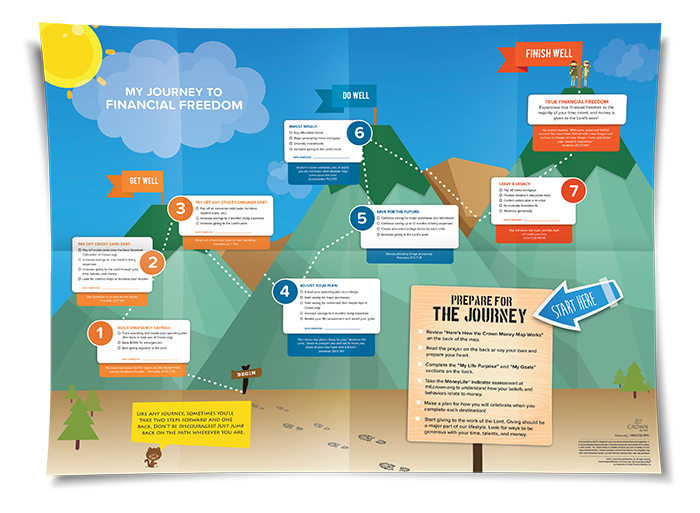

Download the FREE Money Map

The Money Map is a FREE step-by-step guide to help you:

- Save and Invest

- Create a budget

- Get out of debt

- Leave a lasting legacy

- And more!

No matter where you are in your financial journey, you CAN find freedom. With the Money Map, you'll receive practical tools and support for each step of the way.

1A. Track spending and create your spending plan

If you do not already have a budget, creating one can be freeing! It can bring you peace and break the bonds of being a slave to money. Is this the first time you have written out where all your money goes? If so, it can seem daunting to create an initial budget, because you may not even know exactly how much you need in each category. Crown's Creating a Spending Plan Guide will help you complete this step!

1B. Save $1,000 for emergencies

The first step is to open a savings account at your local bank for your emergency savings. You’ll want this money to be available to you immediately without penalty or cost for withdrawals.

Begin to save a portion of your gross income (1-10%). One way to do this is to use automatic deductions from your paycheck. Save a small portion of all your income until your emergency fund reaches at least $1,000.

Need more ideas to save quickly? Check out our blogs on Savings, we especially recommend reading this one on tips from the Crown Staff.

1C. Start giving regularly to the Lord

Your home church should be a great place to start your giving, and you may also have other ministries that you would like to support. You might not be able to give a full 10% of your gross income at this point, but you can always start small and build to it.

Tips on Starting Tithing

- Consider giving first to the Lord before paying other bills.

- Commit to a percentage to tithe, and do it consistently.

- You might also want to give the same percent on bonuses, commissions, and other unexpected income.

- This will probably be a step of faith for you. It will be one that the Lord will honor.

2A. Pay off credit cards

The first step is to stop borrowing (using your credit cards) and develop a debt payoff plan.

We recommend the Debt Snowball Calculator to create a plan. This tool will help you choose which cards to pay off first. You can also accelerate your debt reduction if you put extra income (ex: bonuses, raises, unexpected income, etc.) toward your debt payoff plan.

2B. Increase savings to one month living expenses

Revisit the Savings Calculator to determine a new amount to save each month. Visit crown.org/savings

Remember to plan for major repairs (ex: auto, appliances, housing, etc.) as you save. If you lost your job and had no income, what expenses would you delete or reduce from your spending plan? Think about eating out, subscriptions, or even items like income tax that you would not have to pay. The non-negotiable, “bare bones” items that are left are what make up your actual living expenses.

2C. Increase giving to the Lord through your time, talents, and money

Consider volunteering a portion of your time each week at your church or a ministry you are passionate about. Take time to pray about increasing your percentage giving at this point.

2D. Look for creative ways to increase your income

You may want to consider a part-time job or a side job like cutting your neighbor’s lawn, pet sitting, repairing friends’ cars on the weekend, etc. Don’t sacrifice your family time, and remember to keep a balance.

3A. Pay off all consumer debts

Now that your credit cards are paid off, you can begin to eliminate other types of debt! (auto, furniture, student loans, etc.) Renegotiate with lenders as needed, if possible.

Visit the Debt Snowball Calculator, and make a debt payoff plan for your consumer debt. Remember that you can accelerate your debt reduction if you put extra income toward your plan. For extra help planning to pay off your car, use one of Crown’s automobile calculators. Visit crown.org/auto and crown.org/car-lease.

3B. Increase savings to 3 months' living expenses

Imagine the relief you will feel once you reach this goal, and start thinking of the ways you will be able to honor God as your family’s finances become more stable! Before you begin working towards this goal, visit the savings calculator to determine a new amount to save each month. Remember to plan for major repairs (i.e. auto, appliances, housing, etc.).

4A. Adjust Your Spending Plan Accordingly

Congratulations! You’ve made major progress to get to Destination Four where you evaluate how you are doing. Compare your current spending plan with Crown's budget guidelines. Are you on track? Do you need to adjust your categories or percentages? Are there ways you can increase giving, debt reduction, and savings?

4B.Start saving for major purchases

The most expensive purchase you will most likely ever make is your home.

4C. Start saving for retirement

There are many different retirement plans, and there is not one “best” plan that is guaranteed to work for everyone.

The best retirement investment that will fit into any retirement plan is to have a debt-free home. If you have a mortgage, pay it off as soon as possible. Then, use the money that was paying mortgage payments to start a retirement account or to reinforce an existing one.

Start saving early, especially if your employer offers a matching contribution to your 401k or 403b. When it comes to investments, remember that they are for the long-term. Diversify them, but always make sure that they align with your values. As you make these choices, seek godly counsel, such as Sound Mind Investing.

4D. Increase savings to 6 months' living expenses

Continue to grow your savings. Revisit the Savings Goal calculator. Remember that this money is to be kept in an account that you can easily withdraw from without a fee. Visit www.crown.org/savings

4E. Start your Maintenance Plan

Becoming a good steward of God’s resources is a lifetime pursuit. Over the past weeks, you have established a balanced budget based on your goals, income, expenses, and family needs.

A balanced budget allows you to manage the resources God has provided for you while living within your means. Maintained, the budget informs you when you spend more than you allocated. It also provides the tools to help you make wise financial decisions. It can minimize the influence of emotions in making those decisions since you have information to guide you. As you move from creating a budget and establishing a balanced budget, the next step is maintaining the budget.

The Maintenance Plan provides the user with steps to follow to control spending, by category, and to know your financial well-being, continuously. Therefore, the system should be simple while still accomplishing its goal. The Crown Spending Tracker Sheet, by month, is the document utilized for the Maintenance Plan.

5A. Continue saving for major purchases and retirement

Allocate your savings according to your goals and reevaluate your planned major purchases by asking these questions:

- Is it necessary?

- Does it reflect my Christian ethic?

- Does my spouse agree with this purchase?

- Does it add to or detract from my family?

- What will the upkeep costs be, and can I afford them?

Consider what the Bible says about retirement.

5B. Continue saving up to 12 month of living expenses

This is likely the max you will need to save, enabling you to be prepared for any emergency, job loss, or unexpected expense without hoarding your money.

5C. Create education/college funds for each child

Research options that will work for your family. encourage your children to contribute to it as well through job, birthday, Christmas, and chore money they earn.

5D. Increase giving to the Lord's work

Find ways to give more generously, even ways discretely and in private so that only the Lord knows what you are doing. He will reward you for it.

6A. Buy an affordable home

Shop around for lenders to get the best rate and to get a general idea of what lenders are offering. Ask them and your realtor about all the fees that you will

be charged. These can add up into the thousands, but if you are aware of them, you can often have the seller pay them or negotiate to lower them.

There are many choices when it comes to the type of mortgages you can apply for. Research them all, and with the help of wise counsel, choose the one right for you.

6B. Begin pre-paying your home mortgage

Make ownership of your home your first priority. Pay directly towards your principal on top of your regular monthly payments. Even $100 a month can save you thousands in interest over the life of your mortgage. Consider putting your bonuses and tax returns towards your mortgage after you have generously given from them.

6C. Diversify investments

Investments should not change your lifestyle or cause stress or worry for you or your family. Don’t allocate money for investing if your family budget doesn’t allow for it. Remember that you are investing God’s money. Always pray about your investments and ask yourself if they are a good use of God’s resources. Biblical strategies can be learned in Crown's Money Map Companion Guide course (see below) or through Sound Mind Investing's Multiply study.

6D. Increase giving to the Lord's work

Find ways to give more generously, even ways discretely and in private so that only the Lord knows what you are doing. He will reward you for it.

7A. Evaluate your Kingdom impact for the next generation

There are many types of “legacies” one can leave behind— financial, spiritual, material, etc. Saint John Chrysostom said, “If you wish to leave much wealth to your children, leave them in God’s care. Do not leave them riches, but virtue and skill.”

7B. Pay off home mortgage

Continue to increase your payment to the principal of your mortgage monthly, as you are able. Consider making two payment a month, or once every 4 weeks to decrease how much you owe until your mortgage is paid off! Plan a celebration for your family when you've accomplished this incredible goal!

7C. Finalize children's education fund

If you haven't yet, research options that will work for your family. Encourage your children to contribute to it as well through job, birthday, Christmas, and chore money they earn. Increase and maximize your investment here as you are able.

7D. Confirm estate plan is in order

The vast majority of people do not have a will or a trust, but it is poor stewardship not to. Read The Most Asked Questions Regarding Wills and Trusts and consider downloading our free "Planning Your Legacy" guide.

7E. Re-evaluate investments

Investments should not change your lifestyle or cause stress or worry for you or your family. Don’t allocate money for investing if your family budget doesn’t allow for it. Remember that you are investing God’s money. Always pray about your investments and ask yourself if they are a good use of God’s resources. Biblical strategies can be learned in Crown's Money Map Companion Guide course (see below) or through Sound Mind Investing's Multiply study.

7F. Maximize generosity

Have you had an audacious giving goal that you have yet to accomplish? Maybe it's to give 100% of your income away. Watch one man's testimony on how he maximized his giving.