Dear Chuck,

My parents are extremely fearful about the future of Social Security benefits. How can I help them with their concerns?

Fearful About Social Security

Dear Fearful About Social Security,

A recent Gallup report reveals that 52% of Americans worry about the Social Security (SS) system. It has been at the top of the minds of millions who are approaching or in their retirement years. Although this is not a new fear, it has been making headlines of late.

The Department of Governmental Efficiency (DOGE), in an effort to eradicate mistakes and fraud at the agency, has caused quite a stir among SS recipients. Political opponents are seizing the opportunity to create fear and unrest through the airwaves. As a result, many people are being misled by presumptions.

Some fear that cost-cutting measures will impact their benefits. The reality of it is that those who are receiving payments fraudulently should be afraid. Those who received overpayments and never reported them should expect repercussions. But what about the unrealistic fears that people are feeling?

Stirring the Pot

Former SSA commissioner Martin O’Malley, interviewed on CNBC, made comments which would indeed be unsettling if one didn’t recognize that his presumptions were opinions, not facts. He stated:

CNBC also referenced comments made by Jill Hornick, a union official at the American Federation of Government Employees Local 1395, representing SS offices in Illinois. She noted that “it will take a while for the effects to be felt, but they’re coming,” predicting that changes in SS will be “far worse” than the Medicaid planned cuts. In addition, she thinks processing new claims could be delayed due to an understaffed workforce.

Both people based their negative response to SS changes on presumptions. According to James 4:14, these types of statements are misleading, for no one knows “what tomorrow will bring.”

Facts Can Reduce Fear

What Now?

I believe it was Milton Friedman who said we can always expect the government to pay people their benefits, but the purchasing power of the benefits when received cannot be guaranteed. This is a very good point, since inflation can lower the purchasing power of future retirement income.

As Christians, we should assume the responsibility ourselves for saving and investing by living and planning as if Social Security will not be there. Prior to 1940, Americans did not receive Social Security benefits. President Roosevelt (FDR) signed the Social Security Act in 1935. The collection of taxes began in January 1937, and monthly payments started three years later.

It is better to rely on the Lord and follow His precepts.

“Wisdom is good with an inheritance, an advantage to those who see the sun. For the protection of wisdom is like the protection of money, and the advantage of knowledge is that wisdom preserves the life of him who has it.”

(Ecclesiastes 7:11–12 ESV)

“Moreover, it is required of stewards that they be found faithful.”

(1 Corinthians 4:2 ESV)

Live Contrary to the Way the Government Does

Our government has low or no savings and excessive debts, but so do many Americans. This should increase our motivation to do the opposite. Do not run up unnecessary debt. This requires sacrifice and self-control.

“Owe no one anything, except to love each other, for the one who loves another has fulfilled the law.”

(Romans 13:8 ESV)

“The rich rules over the poor, and the borrower is the slave of the lender.”

(Proverbs 22:7 ESV, emphasis mine)

Many people carry excessive credit card debt and find themselves trapped in a cycle of borrowing. Anyone experiencing this burden should get in touch with our friends at Christian Credit Counselors. They have helped hundreds of thousands of families experience freedom from debt.

Do Not Fear

Assure your parents that no one knows what tomorrow holds. So why waste time and emotions concerned about changes in Social Security? Instead, live frugally, give generously, save regularly, and invest wisely. Put your hope in the Lord, not man or government programs.

“Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.”

(Matthew 6:34 ESV)

“Trust in the Lord with all your heart, and do not lean on your own understanding.

In all your ways acknowledge him, and he will make straight your paths.”

(Proverbs 3:5–6 ESV)

I’d like to invite you and your parents to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will provide encouragement by bringing God’s Word into your daily life.

This article was originally published on The Christian Post on April 18, 2025.

Dear Chuck,

With the new Trump tariff wars, I fear the stock market will tank, and my retirement savings will be gone. Are you advising people to get out of the market during this downturn?

Terrified of the Tariffs

Dear Terrified of the Tariffs,

I can’t give you investment advice; however, I can address some issues that are expressed or implied in your question. My intent is to offer you some Biblical principles to avoid the most common mistake any investor makes, which is to buy high and sell low.

Perspective on the Market

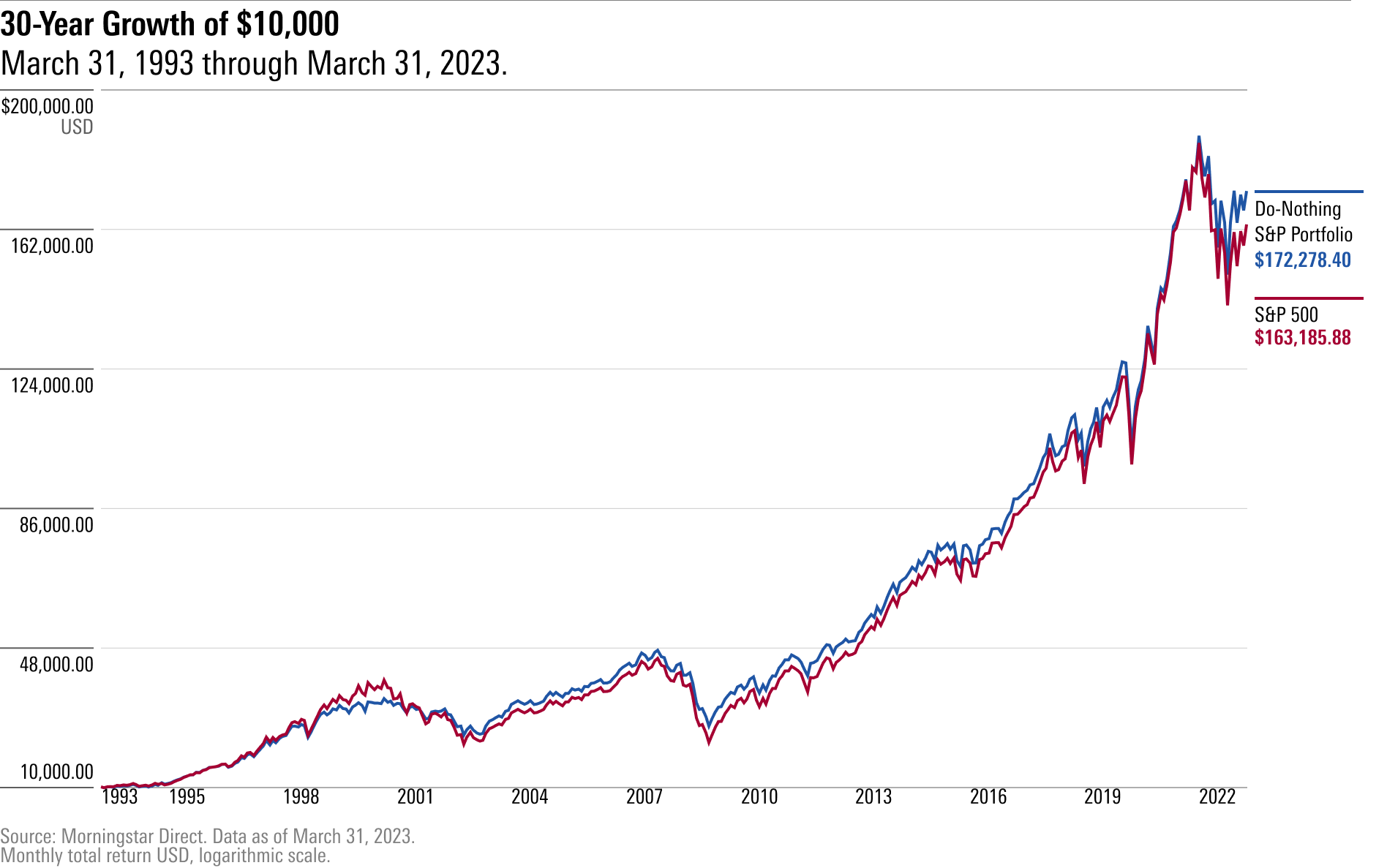

The year 2025 is shaping up to be one of the most volatile in recent history. We have seen declines in the markets year-to-date, with more declines possible. But remember, the S&P is still up more than 100% over the last five years, a historical bull run. While some panic, for many, it is an opportunity. It helps to think of it like a roller coaster that has ups and downs but consistently grows over time, increasing in value.

In a recent interview, Warren Buffett said something to the effect that if the value of your house went down, would you immediately decide to sell it? Surely not! Wouldn’t you continue to live there and wait to sell until the value increased? Owning stock in a company is very similar. Forget about the ups and downs of the stock market price.

“Some people should not own stocks at all because they get too upset with price fluctuations. If you’re going to do dumb things because a stock goes down, you shouldn’t own a stock at all.” –Warren Buffett

Historically, recessions typically last an average of 13–18 months, and then growth returns. The key is to be able to endure the fluctuations in your stock portfolio without making a reactionary decision to liquidate when the prices are at their worst. Obviously, the stocks you own should be evaluated consistently to factor in market changes, poor management, and other forces that could impact long-term value.

Age-Adjusted Risk

Investments should be analyzed by risk as you age. If they have historically weathered the storms, adjustments may be unnecessary. Most professional advisors stress the importance of reducing risk prior to and after retirement. In addition, the Bible stresses the importance of diversification, which is another way to reduce risk.

“Give a portion to seven, or even to eight, for you do not know what disaster may happen on earth.” (Ecclesiastes 11:2, ESV)

Seek many counselors. Think of investing like planting a tree. It needs decades to grow. Digging it up and moving it every time there is a storm will interrupt its opportunity to grow.

Buy Low, Sell High

Markets move on sentiment or emotion. People take action when they are fearful or greedy. The goal is to avoid following the crowd in the wrong direction. Like someone yelling fire in a theater, many may be crushed by the panic to escape instead of waiting to see if there really is a fire.

John Templeton famously said the best time to buy stocks is at the point of peak pessimism and fear, and the best time to sell stocks is at the point of peak optimism.

Buffet says that the poem If by Rudyard Kipling is good to ponder during market turmoil. It is a reminder to avoid panic in the midst of market fluctuations, to ignore the fears created by the “what-ifs,” and to patiently wait things out.

Dealing with Fear

We are called to live one day at a time. Only our heavenly Father knows the future. When we try to enter His realm, we can be overcome with fear and anxiety. That’s why Jesus’ instruction in Matthew 6:33–34 is so important:

“But seek first the kingdom of God and his righteousness, and all these things will be added to you. Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.” (ESV)

“He will give them to you if you give him first place in your life and live as he wants you to. So don’t be anxious about tomorrow. God will take care of your tomorrow too. Live one day at a time.” (TLB)

I’d like to invite you to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will provide encouragement by bringing God’s Word into your daily life.

This article was originally published on The Christian Post on April 11, 2025

Dear Chuck,

I have plenty of money but no peace. What is there not to worry about right now? I have generalized stress about the economy, political divisions, cultural influences on my kids, wars, hatred… the list is long. How can I escape this spiral of non-stop worrying?

Anxious About Everything

Dear Anxious About Everything,

Thank you for your honesty. There is plenty to worry about through the lens that you are viewing the world.

We’re witnessing societal unrest (turmoil) from people whose meaning and purpose in life are linked to current events. Pessimism is rampant. Journalists, who get paid by the size of their viewership, are filling the airwaves with doom and gloom, which is creating fear, uncertainty, and anger. If you watch TV, read the news, or listen to podcasts, you will see and hear people who are anxious, devoid of joy, filled with fear, and possibly even paranoid. Their emotions are spilling over into acts of hatred and violence.

Grumbling

Like the Israelites who were rescued from slavery in Egypt, many within our population are fixated on what they perceive to be their losses. Their grumbling outweighs their gratitude.

“Now the rabble (disorderly mob) that was among them had a strong craving. And the people of Israel also wept again and said, ’Oh that we had meat to eat! We remember the fish we ate in Egypt that cost nothing, the cucumbers, the melons, the leeks, the onions, and the garlic. But now our strength is dried up, and there is nothing at all but this manna to look at.’”

(Numbers 11:4–6 ESV, parentheses mine)

Seeing Through God’s Lens

Rather than dwelling on God’s miraculous rescue and His abundant provision, they chose to focus on what they missed. Instead of giving thanks for the day’s gift, they were trapped in discontentment and projecting a future of deprivation.

Regardless of the actions of any government, believers must place their hope and dependence on God. Filled with the Spirit of God, we can be strong and courageous, knowing that the Lord our God is with us. Our hope is not in this world but in the world to come.

We may be tested and even suffer financially. Or we may prosper! Only God knows the future. Our responsibility is to obediently follow Him and live in such a way that we reflect the source of our hope to the anxious world that has no hope.

As the Apostle Paul said, “I have learned in whatever situation I am to be content. I know how to be brought low, and I know how to abound. In any and every circumstance, I have learned the secret of facing plenty and hunger, abundance and need. I can do all things through him who strengthens me.” (Philippians 4:11b–13 ESV)

The writer of Hebrews said, “Keep your life free from love of money, and be content with what you have, for he has said, ’I will never leave you nor forsake you.’” (13:5 ESV) The implication is that money is temporary, but our relationship with God is eternal.

Biblical Solutions to Fight Off Anxiety

We have so much here to be thankful for. Yet, without an attitude of gratitude, many bring mental suffering upon themselves and others. I conclude that they are:

Is it productive to worry about possible financial scenarios? No! Worry is like a rocking chair; you are constantly expending energy but getting nowhere.

Instead, follow God’s financial principles and do your part in diligently preparing as He directs. Do not depend on the government for your financial security. Do not place your identity in a job or company. Do not spend more than you make; make necessary sacrifices to get your house in order.

Direct any spun-up emotion into productive activities so that you can “laugh at the days to come,” like it says in Proverbs 31:25b. With your confidence placed fully in the Lord, you can ask Him for wisdom to protect your home and business financially.

Take These Actions Every Day

Pray: John 15:7

Trust: Proverbs 3:5–6

Depend on God: Philippians 4:19

Walk by the Spirit: Galatians 5:16–26

Suffer well: Romans 5:1–5

Give thanks: 1 Thessalonians 5:16–18

Prepare to defend your hope: 1 Peter 3:14–17

Rest Your Mind

God will give each of us problems that money cannot solve, but He will also give us true riches that money cannot buy. We can be anxious about our problems, or we can be joyful about all that we do have, even when we are suffering.

“You keep him in perfect peace whose mind is stayed on you, because he trusts in you.”

(Isaiah 26:3 ESV)

“Count it all joy, my brothers, when you meet trials of various kinds, for you know that the testing of your faith produces steadfastness. And let steadfastness have its full effect, that you may be perfect and complete, lacking in nothing.”

(James 1:2-4 ESV)

Are you interested in receiving encouraging ministry updates from around the world? Do you want more tools and tips on financial stewardship? Sign up to receive the Crown Newsletter emails by using the form on the homepage at Crown.org.

This article was originally published on The Christian Post on April 4, 2025

Dear Chuck,

My husband and I have lived frugally since getting married ten years ago. We’ve been paying off student loans, cars, and credit card debt. I’d like to use our tax refund for a vacation, but my husband insists that we pay off more debt.

Divided Over Tax Refund

Dear Divided Over Tax Refund,

Congratulations on the perseverance demonstrated by paying down your debt. I agree it can get tiring, old, and even depressing. That is why it is essential that you focus on the goal and give thanks for a husband who cares enough to protect your financial situation. At the same time, there needs to be room for some celebration that meets both of your objectives.

Affordable Celebrations

Find ways to celebrate how far you’ve come without blowing through the refund. Maybe your dream vacation can be postponed until more debt is reduced. In the meantime, consider alternative ways that will not cost money but will bring you joy together. Time spent in nature hiking, biking, and picnicking can be rejuvenating physically and emotionally. I have friends who love to hike and bike in the Smoky Mountains. Others take hammocks, books, and a picnic to relax. Perhaps you prefer pickleball, tennis, public gardens, museums, camping, etc.

Avoid Going Crazy

Unfortunately, many people fail to realize the importance of stewarding their tax refund. An article at Credit Karma says Americans blow their refunds like it’s free money. Results of a study conducted on their behalf revealed that by this time last year, “more than a quarter reported they already used or plan to use their refund to splurge on things they otherwise wouldn’t buy such as clothing and accessories (45%), electronics (40%) and shoes (37%). This trend was more pronounced among younger generations with 39% of Gen Z and 36% of millennials admitting plans to splurge.”

Here are just a few ways people (in debt) foolishly spend their refunds:

Good Stewardship of Your Refund

These are my three suggestions regarding tax refunds for people in debt:

Stay United

Whether debt is an issue or not, this article explains how to put a refund to good use. More important than what you do with the money is how you work to stay united as a couple. A tax refund is money the government owes you. It is not a gift or financial windfall. It is money

you worked for, so wisely put it to work for you. Your husband may already have a plan to maximize your return. Be honest with each other, consider all your options, pray, and ask the Lord to bring you to an agreement. I hope the two of you will ask the Lord to bless your efforts and unite your hearts with common goals. Hopefully, these ideas are a starting point for your unified approach.

Commit your work to the Lord, and your plans will be established.

Proverbs 16:3 ESV

If you need extra help in making a plan to pay off credit card debt, consider reaching out to Christian Credit Counselors, a trusted partner of Crown. They are a valuable resource to help consolidate debt and get on the road to financial freedom.

This article was originally published on The Christian Post on March 28, 2025.

Dear Chuck,

We have a young child with disabilities. Can you advise us on how to prepare financially for her care?

Special Care Needed

Dear Special Care Needed,

For the many friends that I have who love and care for their child (or children) with special needs, there are additional financial, emotional, and, at times, spiritual burdens. Some have questioned God, and some have been able to rejoice that they were chosen to be faithful stewards of God’s very special, unique, and marvelous creations. I have been blessed to hear their testimonies that celebrate the faithfulness of God to bless their families in ways that would have never happened without the child God entrusted to their care. I am so glad you are preparing financially for their long-term needs.

Your situation is far from uncommon. I researched the prevalence of people living with disabilities in the US. The research will provide some helpful context.

Making Plans

It is important to make financial plans so you can take care of the entire family while also setting reasonable goals to ensure your child gets quality care. It is equally important that you have people to call on and resources to handle the additional demands on your life.

According to the National Institutes of Health, the yearly cost of raising a child with disabilities in 2001 was $8,742. The estimate for 2025 is nearly $16,000. According to a 2020 study, a household containing an adult with a disability that limits their ability to work requires an average of 28% more income.

Raising a child with autism spectrum disorder can cost at least twice as much as raising a typically developing child. M&L Special Needs Planning reports that lifetime expenses for these children can reach $3.2 million, depending on circumstances. In some cases, government assistance is available.

Don’t allow these estimates and large numbers to overwhelm you. God is our Provider. He is faithful to meet the challenges and needs of each day.

Financial Challenges

Best Practices

Discover Resources and Financial Aid

An ABLE account is a savings and/or investment option for people with disabilities who qualify. It falls under Section 529A of the Internal Revenue Service tax code. The ABLE Act allows a person whose disability began before age 26 to save money in the ABLE account without affecting most federally funded benefits based on need. (Note that on January 1, 2026, the age of ABLE eligibility will be expanded to include people with a disability that began before age 46.) The money in the account may be used to pay for qualified disability expenses (QDEs). Any growth in the account from investments is not taxed and does not count as income if the funds are used for QDEs.

These accounts:

SSI provides monthly payments to people with disabilities and older adults who have little or no income or resources. Payments are subject to multiple factors but should be a consideration.

If your child with a disability is uninsured, needs additional services, or needs wrap-around Medicaid coverage to help with finances and uncovered services, your child probably needs a Medicaid waiver or program. These programs waive one or more Medicaid rules in order to extend eligibility and/or services to children. For children, the most common rule to be waived is the way income is calculated, meaning the program is based on the child’s income instead of the family’s income. Since most children don’t have any income, these programs allow the vast majority of children to qualify, regardless of how much money their parents make.

Your Local Church

Reach out to your local church. If it does not have a program serving families like yours, consider initiating the conversation to educate and make the need known. Request help from trustworthy friends and community programs. Joni & Friends has been serving people with disabilities since 1979. They offer practical help along with the saving love of Jesus.

Be Strong and Persevere

Raising a special child takes humility, strength of character, and dependence on others, primarily the Lord. He entrusted you with the child and will strengthen you for the days ahead. When you don’t know what to do, run to Him, remembering the words from James 1:5:

If any of you lacks wisdom, let him ask God, who gives generously to all without reproach, and it will be given him. (ESV)

There will be days you will have to depend on Him for mercy and strength to carry on. He promises to supply your needs. Despite the challenges you may face, know that He is with you, He loves you, and He will not forsake you.

Not only that, but we rejoice in our sufferings, knowing that suffering produces endurance, and endurance produces character, and character produces hope, and hope does not put us to shame, because God’s love has been poured into our hearts through the Holy Spirit who has been given to us. (Romans 5:3–5 ESV)

My hope is that these few directives will provide you with direction, encouragement, and helpful resources. Thank you for your question. Blessings to you and your special family.

I’d like to invite you to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will provide encouragement by bringing God’s Word into your daily life.

This article was originally published on The Christian Post on March 21, 2025.

Dear Chuck,

Should I participate in my company’s offer of a Health Savings Account? I don’t get sick often and feel it is too expensive.

Help with HSA

Dear Help with HSA,

A Health Savings Account (HSA) is a great way to manage the cost of healthcare. If you are qualified and able, I suggest that you take advantage of the opportunity; however, there are some possible downsides.

The program was established for those who elect to have high deductibles on their health insurance coverage. The idea is that high deductible coverage lowers the cost of being insured but requires more out-of-pocket cash when the insurance coverage is needed. Thus, an HSA account allows for automated savings to be used when cash is needed to cover the higher deductibles.

Imagine that you elect to have a $5,000 deductible on your health insurance policy to bring your monthly premium payments down. This means you will need to be ready to pay up to $5,000 out of pocket when you have a medical procedure. An HSA is intended to help you have this amount set aside.

How It Works

The program is an automated savings vehicle for funds that are deposited into a restricted-use account for future medical needs. You set the amount from payroll deductions. The amount is tax-exempt, which is a significant benefit over a personal savings account. Even though you may not presently use it often, the funds can be invested to grow and increase for future needs as you age.

HSAs cover certain medical expenses while helping you save money and strengthen retirement planning. The rising cost of healthcare in America warrants wise building and management of this asset.

Currently, HSAs are only available to those with a high-deductible health plan. They are so beneficial that Senator Rand Paul wants to expand the qualifications so that everyone can have access. He is sponsoring the Health Savings Accounts for All Act. I hope it passes so more people can participate.

HSA Facts

Eligibility is denied if you are:

To contribute in 2025, you must be enrolled in a high-deductible health plan of at least $1,650 for self-coverage and $3,300 for family. Total out-of-pocket costs are limited to $8,300 for self-only or $16,000 for a family.

In 2025, you can contribute $4,300 to an HSA if single or $8,550 if you have family coverage. At age 55, you can make catch-up contributions of an additional $1,000 if not enrolled in Medicare. The 2024 tax deadline for contributing to your HSA for 2024 is April 15. Contributions for 2024 are $4,150 (single) and $8,300 (family).

Prior to using your HSA, make sure you understand the eligible and ineligible expenses. Keep good records, and track your contributions to claim eligible deductions to make tax filing easier.

Some Words of Caution

Contributing to an HSA does not eliminate the need for an Emergency Savings account or setting aside money for retirement. You don’t want to make contributions to a restricted, tax-exempt account only to find you have to withdraw the money for another emergency. You will face the possibility of penalties and lose any advantages you may have initially gained.

Prioritize establishing a minimum of three months of living expenses in your Emergency Savings account before you begin contributing to your long-term retirement accounts or an HSA.

Money contributed to an HSA can remain in cash and money market accounts or be invested in mutual funds. If you invest it, know that it is at risk of decreasing in value. Your health issues and age are determining factors in planning. If you anticipate the need for funds in the near future, you may want to avoid possible loss due to market volatility and stick with cash or money market funds. Research your options because fees, interest rates, and investment options vary. I recommend seeking wise counsel from several sources. For more information, check the pros and cons at Bankrate, Wallethub, and Investopedia.

Those with high medical needs may benefit from plans with lower deductibles and copays, which would presently disqualify you from participating in an HSA. Each person must seek the route that best suits their unique needs and, ultimately, the Lord for guidance in decision-making.

With God are wisdom and might; he has counsel and understanding.

Job 12:13 ESV

This is an update to an HSA article from 2017.

For help with budgeting so that you can begin saving more, consider a Crown budget coach. He or she can work with you to develop a customized spending plan and debt-elimination strategy.

This article was originally published on The Christian Post on March 7, 2025.

Dear Chuck,

I got some crazy tattoos while in the Marine Corps when I was single. Now my wife wants me to get rid of the ones she does not like. I tell her that besides being super painful, it is a waste of our money. Any advice?

Split over Tattoos

Dear Split over Tattoos,

Your wife is certainly not alone in her position. This topic is front and center since tattoos have gone mainstream over the past decade. In the US alone, about $1.5 billion was spent on tattoos in 2024.

Tattoo Regret

The trend on social media called “tattoo regret” is leading many to consider removal. Comedian and former “Saturday Night Live” cast member, Pete Davidson, has been in the process of “burning” off most of his 200 tattoos. He describes the experience as “horrible.” Regardless, the removal market has grown exponentially due to the availability of safe options. $478 million was spent in 2019, and over $1 billion was spent in 2024. An estimated $3.57 billion is projected to be spent by 2032, according to Allied Market Research.

Reasons for tattoo removal:

Types of Removal

Since tattoos are designed to be permanent, complete removal is difficult. Skin color variation and scarring may occur regardless of the method used to eradicate the tattoo. Methods vary due to size, color, age, location, and clinician or physician’s experience. The following may be used: laser, dermabrasion, surgical excision, subcutaneous injections, chemical peels, and removal creams.

Here are some evolving removal processes:

They deliver energy pulses in trillionths of a second, breaking down ink into tiny particles that are easier for the body to naturally eliminate. Less scarring occurs, and fewer sessions are required, thus reducing costs.

These treatments are customized based on the colors and depths of the ink. The risk of skin damage is minimized, making it safer for varied skin tones.

Unique needs are met with this data-driven approach that maximizes effective treatments and minimizes discomfort and side effects. It can analyze before-and-after images, effectiveness, and needed adjustments.

Cryogen-based and air-cooling systems are used to numb the skin before and during laser treatment. Topical anesthetics are becoming more effective and giving longer-lasting relief. Virtual reality (VR) is being researched by some clinics to distract clients from discomfort during treatments.

Cost of Removal

According to the American Society of Plastic Surgeons, the average cost of laser removal is around $700. However, additional fees must be considered: facility, surgeon, and anesthesia fees, medical tests, and prescriptions. Also, many trips are required, and healing time out of the sun is necessary, which may cut into your work hours or vacation time. Some estimate that the removal of many tattoos can spiral up to hundreds of thousands of dollars before they are all removed.

See a cost chart here: https://www.healthline.com/health/tattoo-removal-how#methods.

See a cost calculator here: https://ctrlcalculator.com/misc/tattoo-removal-cost-calculator/.

To Remove or Not to Remove?

The story of Pete Davidson is worthy of consideration. He spent more than $200,000 over a multi-year period to completely remove his tattoos. His advice is to make sure you really want to get it in the first place!

If it is just a few tattoos your wife finds offensive, consider the cost, save the money to be able to afford it, and honor her requests. The best solution is the one that brings peace to you and your spouse. Explore the data I have provided, and do your own research. Then the two of you will need to discuss, pray, and make a unified final decision. Thanks for the question.

If credit card debt is another regret, Christian Credit Counselors is a trusted partner of Crown. They are a valuable resource to help consolidate debt and get on the road to financial freedom.

Dear Chuck,

Our “Dear Leader” Elon Musk seems to have taken over the federal government. Are you concerned yet?

No Fan of DOGE

Dear No Fan of DOGE,

Today’s question is taken from an actual offline conversation I had with a friend who sarcastically used the term “Dear Leader” to refer to Elon Musk. We ended up in a polite and meaningful exchange over whether the Department of Government Efficiency (DOGE) is a blessing or a curse. I decided to provide a more thoughtful reply for the many who may be wrestling with the same concerns.

Egotistical Dictator or Heroic Innovator?

Referring to anyone as “Dear Leader” is typically used to criticize a government official or political leader, suggesting authoritarianism, excessive control, or a cult of personality. The phrase is most famously associated with Kim Jong-il, the former dictator of North Korea. His leadership was characterized by extreme propaganda, strict control over citizens, and suppression of dissent. Having studied the motivations and methods of economies ruled by authoritarian leaders, this comparison falls flat because the goals of DOGE are exactly the opposite. Elon Musk has been tasked as a non-compensated, non-employee to provide technology tools to identify fraud, waste, and abuse of government funds. He has aptly framed the challenge as an effort to empower the people (taxpayers like you and me) vs. bureaucratic engines that have operated without real accountability for the stewardship of taxpayer funds.

To better understand the man and his modus operandi, I will refer to Walter Isaacson’s 2023 authorized biography entitled Elon Musk. I read the book with great interest as soon as it was released, which was well before Elon became actively involved in President Trump’s reelection campaign. The famed journalist and best-selling biographer followed Elon for two years, interviewing his friends, family, and adversaries. I found the book surprisingly transparent and balanced.

The book chronicles Elon’s sweeping achievements through investing in or leading modern companies that disrupted the status quo in multiple industries, ranging from online payments (PayPal) to automobile manufacturing (Tesla) to tunnel boring (The Boring Company) to satellite-based internet service (Starlink) to transforming the social media platform formerly known as Twitter (X.com) to the most successful private rocket venture in history (SpaceX). While pointing to his unparalleled commercial successes (which made him presently the richest man on the planet), the book does not attempt to gloss over his immoral lifestyle and challenging personality. Elon is able to quickly identify and focus on the key challenges, solve them, and move on to the next. He is generally impervious to what others think of him and has been known to fire employees on the spot without concern for their feelings throughout his storied career.

My key takeaway from the book, which is relevant to the question at hand, is the method Elon developed to create these remarkable, powerful ventures. He suffered enormous stress while attempting to save Tesla (currently one of the most valuable automobile companies in the world) from bankruptcy and created what he now calls his “algorithm” to solve complex problems.

Things happening with DOGE will become much clearer by looking at an abbreviated format of his algorithm (quotes taken from Isaacson’s book):

Here are some ancillary thoughts and principles regarding Elon’s management approach:

Staving Off Bankruptcy for Uncle Sam

In 1994, Crown’s late founder, Larry Burkett, wrote a nationwide best-selling book titled The Coming Economic Earthquake. It warned of the dangers of an economic collapse if our federal government was unable to control its spending and borrowing. He called for better stewardship of our national assets for the benefit of every American. Saving our nation from fiscal ruin should not be a partisan issue. Musk, who happens to be the largest individual taxpayer in American history, with an estimated $11,000,000,000 (11 billion) in taxes paid, has voiced the same concerns.

Elon has openly stated many times that he believes America is on the path to bankruptcy—and quickly. If you are paying close attention, he is not exaggerating his concerns:

“America is headed for de facto bankruptcy very fast,” Musk posted to X, quoting a warning from a finance account: “The U.S. government is on pace to spend about $1.4 trillion for interest payments on the $36 trillion in debt during 2025. That will be about 28% of all government revenue going to interest payments.”

The consequences of a collapse of the US Dollar would have far more devastating and lasting consequences than the temporary pain and turmoil being caused by the painful and abrupt reduction in the largesse of our federal bureaucracy.

America has long needed to gain control of our runaway federal spending and subsequent debt and return to a place of real credibility in the “good faith and credit of Uncle Sam.” Traditional efforts to adopt a bipartisan “austerity plan” in which the federal budget is tightened, we learn to live within our means, and we collectively work toward paying down our $40,000,000,000,000 (40 trillion) of debt have failed. We have all heard it talked about, hotly debated, and even feebly attempted, but no meaningful action resulted—until now.

While unorthodox and unsettling to some, Elon’s “algorithm” is the basis of how DOGE is approaching the seemingly impossible task of steering the American government away from the cliff of national bankruptcy. It has worked for him repeatedly in business, and now he is using this approach in government—something most never expected would happen.

Elon Musk has put everything on the line to fix a massive problem. Saving the nation from bankruptcy could be the single greatest achievement of Elon Musk’s life. It may not only save America, but in the long term, it will also bless every citizen, every creditor of our nation, and every freedom-loving country that depends on us for economic prosperity and national security. If we survive and prosper, millions around the world will also survive and prosper. If this ship sinks, we are in the boat together.

He is not a perfect man nor a “Dear Leader.” He is, however, a courageous man willing to take the stress, heartache, rejection, and hatred necessary to attempt to save us from our fiscal madness. For that, we should be grateful, without placing our faith and confidence in a man, regardless of their achievements.

“Some trust in chariots and some in horses, but we trust in the name of the LORD our God.”

Psalm 20:7 ESV

Most of us can agree this fiscal exercise is necessary, but it does come with a painful human toll. Some will experience loss, grief, and career displacement. For those, we should be empathetic. Believers should demonstrate genuine compassion to those suffering job or funding loss, shock, and fear. Neither good stewardship of our national funds nor compassion for our neighbors should be a partisan issue.

Do you want more tools and tips on financial stewardship? Are you interested in receiving ministry updates from around the world? Sign up to receive the Crown Newsletter emails by using the form on the homepage at Crown.org.

This article was originally published on The Christian Post on February 21, 2025

Dear Chuck,

I’m a small business owner concerned about the decline in real friendships. My business is built on them, but most of my young staff think social media is enough. Have you ever written about friendships and business growth? If so, where?

Friends Are Priceless

Dear Friends Are Priceless,

What a great topic! I have never written about this but totally understand your concern and correlation to business. I have asked my staff to do some research on your questions.

While friendships are personal and often a challenge to realistically quantify, we are witnessing some of the harmful effects in our society of mandatory COVID isolation, remote schooling, and work-from-home situations. Plus, for some, technology has become a substitute for human relationships. As a result, many do not know what they are missing.

Friendships are a blessing from God that enriches our lives. They bring happiness, wisdom, encouragement, and laughter while stretching us to be our best. They comfort us during stressful times and bolster us with courage when fear threatens peace. They add a level of accountability and discipleship to our lives. I have always said that my true friends multiply my joy and divide my sorrow.

God said, “It is not good for man to be alone.”

God, our Creator, knew that we needed companionship. We are designed to live in fellowship with Him, our spouse, our family, and each other. These relationships are the source of our true riches, which are all the things money cannot buy.

The number of friends is less important than the quality of friends. Research shows that the average person has three to five very close friends, 10 to 15 people in their circle, and 100 to 150 acquaintances in their social network. Close friends are those you can trust with anything and vice versa. For believers, these relationships will make you a better person. They are those who willingly speak truth into your life and expect the same of you; they are those with whom you can be completely transparent without the worry that they will reject you.

Science-Backed Benefits of Quality Friendships

Make you healthier

Make you happier

Make you feel safe

Strengthen immunity

Improve mental health

Are associated with a longer life

Linked to financial strength

Expert Tips for Making Friends

Tracey Brower PhD: “Make strategic investments of your time to enhance your sense of belonging. When you reach out to initiate activities, open up and also support others, you’ll achieve terrific friendships and fulfillment—leading to experiences of closeness and wellbeing.”

Marisa G. Franco Ph.D.: “When you assume people like you, you are friendlier, and the more they really will like you. Affirm, compliment, and praise others for what you appreciate about them or something they said. It wins friends.”

Jane Story at The Gospel Coalition: “We all want to be known and loved.… Initiate and respond.… Listen and ask questions.… Move toward difficult things.… The real secret sauce of the deepest relationships is their endurance through tough things.… You’ve got to lean in… even if you have no words to say…. It’s more important to show up and feel uncertain than it is to be perfect.… It is because we are already loved and secure that we can offer friendship to others. Extend the love of Christ to those around you. Lifelong friends will appear.”

If you desire to get to know someone better, invite them to:

Run errands with you.

Walk or work out.

Volunteer with you.

Attend a community event, museum, arboretum, lecture, etc.

Have coffee with the goal of getting below the surface.

Attend a small group or Sunday School class with you.

Shop and share bulk products.

Financial Benefit of Friendships

Social skills are a key determinant of wealth because they are necessary to effectively interact with people. There’s a saying, “Your network is your net worth.” Friends impact our financial health in a number of ways: when seeking employment or a career change, for counsel about handling money or running a business, and to connect to a broader network of individuals. They pray with and for us, encourage us, sharpen us, lend a helping hand, and strengthen us. You never know how a friend of a friend can help in time of need.

What the Bible Says About Friendships

One of the greatest examples of friendship we read about in the Bible is between David and Jonathan. 1 Samuel 18:1 says that “the soul of Jonathan (the son of Saul) was knit to the soul of David, and Jonathan loved him as his own soul.” (ESV, parentheses mine)

John 15:13: “Greater love has no one than this, that someone lay down his life for his friends.” (ESV)

Proverbs 17:17: “A friend loves at all times, and a brother is born for adversity.” (ESV)

Proverbs 27:9: “Oil and perfume make the heart glad, and the sweetness of a friend comes from his earnest counsel.” (ESV)

Ecclesiastes 4:9–12: “Two are better than one, because they have a good reward for their toil. For if they fall, one will lift up his fellow. But woe to him who is alone when he falls and has not another to lift him up! Again, if two lie together, they keep warm, but how can one keep warm alone? And though a man might prevail against one who is alone, two will withstand him—a threefold cord is not quickly broken.” (ESV)

Luke 6:31: “And as you wish that others would do to you, do so to them.” (ESV)

Proverbs 18:24: “A man who has friends must himself be friendly. But there is a friend who sticks closer than a brother.” (NKJ)

Proverbs 18:1: “Whoever isolates himself seeks his own desire; he breaks out against all sound judgment.” (ESV)

Proverbs 22:24–25: “Make no friendship with a man given to anger, nor go with a wrathful man, lest you learn his ways and entangle yourself in a snare.” (ESV)

Thank you for the great question. I hope you will share this with your staff too.

I’d like to invite you to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will provide encouragement by bringing God’s Word into your daily life.

This article was originally published on The Christian Post on February 14, 2025.

Dear Chuck,

Valentine’s Day seems bogus to me; yet I’m feeling the pressure to do something special. Any tips for someone who is broke?

Broke on Valentine’s Day

Dear Broke on Valentine’s Day,

I feel your pain, having been exactly there a few times in my past. While the holiday may seem bogus to you, it may not be to the one you love. So many feel the pressure to go all out on gifts for Valentine’s. Bombarded with advertisements, it is easy to spend far more than one can truly afford.

Last year, total spending for Valentine’s Day approached $26 billion! The average American spent $136 on significant others and family members. Most money went toward jewelry, but candy or flowers were purchased more than anything else. Gifts were also purchased for pets, classmates, teachers, friends, and coworkers. Yet some research suggests that more than nine billion dollars of gifts were unwanted by the recipients. Ouch!

Expressing Your Love Does Not Have to Be Expensive

With a little time and thought, you can express your love in ways that won’t jeopardize your financial well-being. Be creative. Write a letter, make something, or plan an experience instead of buying gifts. Prioritize time with loved ones. Research shows that experiences are often remembered longer than gifts.

Setting a budget will free you from overspending. Giving what you can afford will prevent unnecessary stress. In fact, you can make an eternal impact this Valentine’s Day by committing yourself to be a godly steward. You will demonstrate love to God and your family that can impact generations.

Keep an Eternal Perspective

Jesus didn’t die on the cross so we could pursue what the world says is important. We were bought at a price, and by His love and grace, we are beckoned to come, serve Him, and build His Kingdom—not our own.

You become a steward when you acknowledge that you are not an owner but God’s temporary manager. And in that role, you are required to be faithful to His purposes. Regardless of whether He’s entrusted you with a little or a lot, seek Him first, and allow Him to have total control over your finances.

Paul told the Galatians: “I have been crucified with Christ. It is no longer I who live, but Christ who lives in me. And the life I now live in the flesh I live by faith in the Son of God, who loved me and gave himself for me.” (Galatians 2:20 ESV)

Our ambition should be to become rich toward God, not rich in the eyes of men. When that becomes your heart’s desire, you’re on the path to hearing, “Well done, good and faithful servant.” (Matthew 25:23)

Your self-worth isn’t tied to purchasing gifts, so why spend more than you can afford? If you’re worried about impressing someone, perhaps you need to rethink that relationship!

We love because God first loved us. So love one another free of financial stress and worldly expectations. Here are some no/low-cost ideas my wife gathered:

Loving well doesn’t have to cost a lot. Just make people feel special by showing thoughtful consideration of their importance and value to you. Devote time talking together and listening carefully, remembering that we love because He first loved us.

Crown’s course Money Dates helps spouses and engaged couples connect on the topic of money. Making financial decisions together as a unified couple will help to eliminate financial stress.

This article was originally published on The Christian Post on February 7, 2025.