Dear Chuck,

I am being hit hard by the cost of gasoline. Haven’t you written about how to save money on this in the past?

Shocked By Gasoline Prices

Dear Shocked By Gasoline Prices,

Yes, I have answered this question before but not during a time when prices were rising this sharply! You and millions of others are feeling the pinch at the pump along with all the other products impacted by the rising cost of oil.

Prepare to Pay More

Patrick DeHaan of GasBuddy says, “As Russia’s war on Ukraine continues to evolve and we head into a season where gas prices typically increase, Americans should expect to pay more for gas than they ever have before. Shopping and paying smart at the pump will be critical well into summer.” The chart below shows the trendline of gas prices from the last 18 months.

Here is a short list of things you can do to save some money:

Here is a short list of things you can do to save some money:

Effect on Consumer Prices

The cost of crude oil affects the prices of everything we buy due to the impact on shipping and trucking. Expect to pay more for food at the grocery store, when dining out, on heating bills, and on things made with petroleum, like plastics and fertilizer. Those who need a bigger car should be on the lookout for used models that sellers will unload if gas prices get exorbitant

Keep It in Perspective

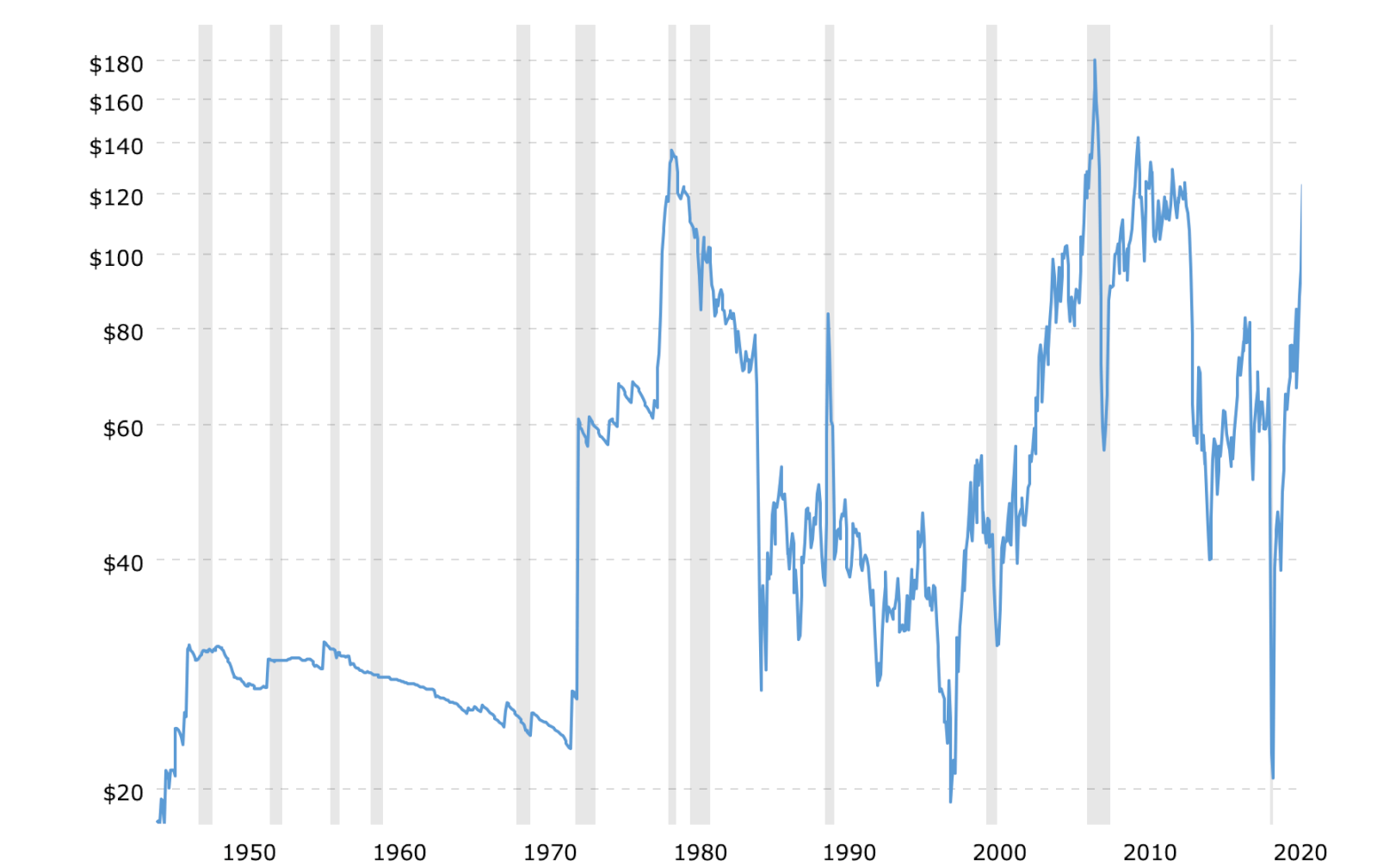

Crude oil prices fluctuate between extremes—often very quickly. Over the past 70 years, you can see in the chart below that these sharp spikes seldom last very long. Many believe that with the rise in purchases of electric vehicles, we will see a steady decrease in the price of oil. In the shorter term, a peaceful resolution to the war in Ukraine will hopefully reset the price—all the more reason to pray for peace.

A Recession?

Experts pose the possibility of this leading to a recession.

Troy Vincent, DTN senior market analyst, told CNET that if crude oil continues to rise, $6.50-$7.00 per gallon would not be impossible, though it could trigger a global recession.

Nicholas Colas, co-founder of DataTrek Research, covered the auto sector earlier in his career. He recently told msn.com: “The rule of thumb I learned from auto industry economics in the 1990s is that if oil prices go up 100% in a one-year period, expect a recession.” Thursday, March 4, 2021, crude oil was $63.81. Friday, March 4, 2022, WTI crude was $115. Monday, it touched $130 but dropped. In recent cycles, when oil gained 100% in a 1-year period, a recession occurred. This happens because consumers readjust their budgets so they can cut back, and spending declines. According to Kiplinger, the average length of recessions from 1857 forward is less than 17.5 months. This includes the 65-month recession of 1873 and the Great Depression, which lasted 43 months. (Check the website for more recession facts.)

Adjust Your Budget

Adjust Your Budget

Consider what you can give up to cover the higher cost of gasoline and consumer goods.

Turn down the thermostats, and dress in layers until temperatures rise this spring and summer.

Start a garden, grow some food, and shop at farmers’ markets. Supply an emergency long-term food pantry buying nonperishable food in bulk. Analyze vacation plans. Avoid extra airline fees when flying. Consider alternate means of transportation. It may be necessary to have a staycation or find a creative way to spend less while taking necessary time off.

Do Not Fear

When facing the lingering impact of the pandemic, a war, and inflation, there are many concerns right now. We can take comfort in God’s Word that reminds us that we have nothing to fear

Psalm 37:16 – “Better is the little that the righteous has than the abundance of many wicked.”

Psalm 112:7 – “He is not afraid of bad news; his heart is firm, trusting in the Lord.”

The Crown God is Faithful devotional provides inspiring and practical biblical wisdom. You can sign up to receive the devotionals daily to help transform not only your finances but also every area of your life.

This article was originally published on The Christian Post on March 11, 2022.

Dear Chuck,

I’m single and have saved enough money to buy a house and have a sizable emergency fund for any surprise repairs. Do you consider this a good time to enter the real estate market?

Single Home Buyer

Dear Single Home Buyer,

Reuters released an article on February 24th on the rise of the solo American homebuyer, which highlighted Bank of America’s recent survey of potential buyers. Results showed that singles do not want to delay a home purchase. Kathy Cummings, a Bank of America senior VP, relates: “9 out of 10 single women dismiss the idea of being married before buying a home. They see that as old-fashioned thinking.” In addition, the article noted:

Considerations on Buying a Home

The higher your credit score, the better opportunity you have to lock into a good mortgage rate.

Get pre-approved so you can act quickly when the right house becomes available. I recommend a minimum 20% down payment so you can avoid private mortgage insurance.

When budgeting the cost of buying a home, include insurance, property taxes, utilities, repairs, maintenance, HOA fees, landscape, trash pickup, appliances, window coverings, furniture, renovations, etc.

In purchasing a home, you lose flexibility but gain fixed costs and equity. A roommate can help with bills. Do you think you will stay put for a while, or is there a chance you will have to relocate? If relocation is a possibility, would you sell, or could you rent the home?

When Jesus taught a crowd about the cost of discipleship, He gave the example of building a tower. First, sit down and calculate the cost to complete it (Luke 14:28-30). Everyone who contemplates buying a house must do the same.

Interest Rates

The national average 30-year fixed mortgage rate on Tuesday, March 1, 2022, was 4.30%, an increase of 8 basis points from the previous week. The national average 15-year fixed mortgage rate was 3.5%. The national average 30-year fixed refinance rate was 4.23%, while the 15-year fixed refinance rate was 3.49%.

Greg McBride, chief financial analyst at bankrate.com, recently stated, “Although the national average on a 30-year fixed rate mortgage is above 4 percent, plenty of sub-4 percent rates are available for borrowers that shop around. Conducting an online search can save thousands of dollars by finding lenders offering a lower rate and more competitive fees.”

McBride recommends steering clear of adjustable-rate mortgages for now. He says, “While rapidly rising mortgage rates may temper the demand somewhat, don’t expect home price appreciation to come to a halt. A more modest pace of appreciation is the likelier outcome.”

Check bankrate.com for the latest rates and offers below the national average.

Is Now the Time?

Many are asking, is now the time? From a personal standpoint, you need to consider if you are financially stable and ready to lock into a mortgage, with no guarantee that the home will retain its value over 15–30 years. Is your career inflation-proof? Can you afford a plumber or electrician, or can you make repairs? If you are okay financially, remember we are in the midst of the lowest inventories of available homes in decades.

In today’s market, depending on the state that you are in, you may have to consider how high you are willing to bid on a home. One of our staff members placed an offer on a home in February that was 15% higher than the listing price! The seller received better offers than theirs, so they were not able to purchase the home they really wanted.

It was not very long ago, during the Great Recession (2008-2009), that people were contacting us for help after the value of their home dropped below the amount they had financed to purchase it! It was a painful and devastating time as many families experienced foreclosure.

Only God knows the future. I surely do not. If you believe you are ready for the responsibility of homeownership, there are many advantages, not the least of which is benefiting from building equity and from inflation. Using the qualifying questions above, it can be a blessing. Pray for wisdom, and seek wise counsel before you enter into a contract for purchase. Be patient. Allow the Lord to guide you to the home that is best for you. Thanks for the question.

In the meantime, if you find yourself needing help with credit card debt, Christian Credit Counselors is a trusted source of support. They specialize in assisting people with getting out of debt and on the road to financial freedom.

This article was originally published on The Christian Post on March 4, 2022.

Dear Chuck,

Inflationary prices are hitting our family, and I am getting worried. What can we do to ride this out?

Inflation Fears

Dear Inflation Fears,

Gasoline is way up, oil is way up, food is way up, rents are rising, and housing prices are soaring. The price of used cars is nuts—in my opinion. Inflation is definitely impacting us all!

My wife and I lived through the inflationary period of the ‘80s and survived. We were a young, married couple and didn’t always make the best decisions, like buying our first home with an adjustable-rate mortgage when mortgage rates for 30-year fixed-rate loans hit 18%. But I learned some helpful lessons that I can pass on here.

Make Some Key Adjustments Now

As the price of goods and services increases, our purchasing power decreases. There are several things you should do because things could get a lot worse before they get better.

It is important to know and understand your true financial picture. Last year, the Penny Hoarder conducted a budgeting survey of 1,900 Americans. Results showed that those who kept a budget were more likely to know how much they spent the previous month and less likely to splurge on a purchase that hindered their ability to pay bills. More than half (56%) of the respondents did not know how much money they had spent the last month.

Of those who use a simple budget, 40% use a spreadsheet, 14% use an app, and 12% use the most basic method of all—the cash envelope system. Here’s how to get started. You may benefit from the advice and helpful assistance of a Crown budget coach.

Prioritize God’s Way

Give first to honor the Lord with all that He has provided. He offers us the only guaranteed return with money—treasures in Heaven. After giving, pay yourself next (save); then prioritize what you can spend on your bills. Warren Buffett says, “Do not save what is left after spending, but spend what is left after saving.” This will give you financial margin and increase your options to overcome the erosion of your spending power by being able to invest in assets that benefit from inflation. That is the best way to keep up with the rising cost of goods and services.

Evaluate Your Income

Determine if your company is benefiting from inflation or getting hurt by it. If your career is in a field that cannot make adjustments to rising costs, your employment may be threatened should inflation persist. Consider alternative sources of income, or begin looking for employment that can endure—or even thrive—during inflation. If you have children nearing adulthood, emphasize the importance of inflation or recession-proof careers. Here are some suggestions along with some work-from-home ideas.

Hyperinflation

Hyperinflation, though rare, usually occurs when a government prints too much money. The more money in circulation, the less a currency is worth. As value drops, more money is needed, so more is printed, and prices rise faster. Consider what happened in the following nations:

America is not near hyperinflation levels, although our government has indeed printed an excessive amount of money before and during the pandemic. It is difficult to control inflation, so we must keep a watchful eye for signs that hyperinflation has become a real threat.

I have traveled to parts of the world where people survived hyperinflation. They have lived through what many would consider the Americans’ worst nightmare: losing all we have in terms of our worldly wealth. Yet the Christians who lost everything really did not lose “everything.” They became rich in the things money cannot buy. They learned to trust God in the midst of their financial pain. Things become less important than relationships. People sacrificially shared with one another and discovered the joy of giving and serving. One family believes it was the best thing that ever happened to them since they gained far more “true riches” than they lost in the temporal wealth of this world.

Be Prudent

I will write more about this as we watch changes in fiscal and monetary policy; however, you are wise to be prudent and make adjustments now. We are not guaranteed what the future will hold, but we can weather all storms when our house is built upon the Rock.

The Crown Stewardship Podcast is a valuable resource during these uncertain times. It is a wonderful tool to help guide you in the many facets of God’s financial principles. You can subscribe for alerts of new episodes. I hope you find it beneficial.

This article was originally published on The Christian Post on February 25, 2022.

Dear Chuck,

My female boss frequently laces her comments with profanity in the office. While it is never directed at me personally, it makes me cringe when I hear it. I have lost respect for her leadership and want to change jobs. Should I approach her or quietly find another place to work?

Tired of the Profanity

Dear Tired of the Profanity,

Many people in the workforce likely have had similar experiences and thoughts about what to do. I hope I can help you make a good decision regarding the choices you have presented.

Profanity at Work

While I did not find a lot of current research on the topic, according to a 2016 Wrike survey, it is far more common than we may think.

A majority of people (57%) say they swear in the workplace; however 41% feel that swearing is too casual and unprofessional. Here are some other findings:

I actually found some research claiming that people who cuss at work are considered smarter and more honest than non-cussers. I would disagree on both conclusions. Fortunately for you, the cussing by your boss has never been directed at you personally. Unfortunately for me, I have been personally cussed out on the job—not once, but twice. It happened when I was 16 and again at 26. These are experiences I will never forget.

Taming the Tongue

Although incensed by each experience, I somehow did not return curse for curse or condemnation for condemnation. Believe me, I had plenty of colorful things I wanted to say in retaliation for the stinging blow to my pride. In both cases, I was falsely accused. In both cases, I remained calm, refusing to get into verbal battles. In both cases, I later received an apology from the person who issued the tongue lashing. One, who in anger described me as similar to an uneducated donkey (among other things), went out of his way to call me, apologize, and explain that he was also disarmed by my self-control during the call when his outburst happened.

Like you, I have been around successful business leaders who, while not cussing me or anyone else out, used the F-bomb and foul language in their normal interactions with others. Without fail, I have thought less of them for their lack of discernment.

The word profanity means unholy, debased, irreverent, or impure. As Christ followers, we are admonished to avoid cursing. Words are powerful.

“Death and life are in the power of the tongue . . .” (Proverbs 18:21 ESV)

“Answer not a fool according to his folly, lest you be like him yourself.” (Proverbs 26:4 ESV)

“The heart of the righteous ponders how to answer, but the mouth of the wicked pours out evil things.” (Proverbs 15:28 ESV)

“A soft answer turns away wrath, but a harsh word stirs up anger.” (Proverbs 15:1 ESV)

Those who are in Christ are new creations. Christ reconciled us to Himself, made us His ambassadors, and gave us the ministry of reconciliation. In all our verbal interactions, we should be conscious of this fact. We represent the Lord wherever we go. Those who know us as Christians will observe our work ethic, our treatment of others, and the words we speak.

Speak Up or Change Jobs?

My suggestion is to pray for the right attitude, then set a time to privately speak to your boss. With gentle, non-condemning words, let her know you would prefer not to be subject to her (or others’) profanity on the job. If she receives it well, you have won a friend. If she is offended by your comments, be prepared to seek other employment, but give it a chance for improvement—before slipping silently away.

For inspiration and instruction on a number of financial and career topics, tune in to the Crown Stewardship Podcast. It is a wonderful tool to help guide you in the many facets of God’s financial principles. You can subscribe for alerts of new episodes. I hope you find it a valuable resource!

This article originally published on The Christian Post on February 18, 2022.

Dear Chuck,

We have to cut our spending this year, but I really don’t know where to begin. When I bring up the subject, my spouse always has an excuse. If we don’t get things under control, we are going to face eviction from our landlord.

Cash Crunch

Dear Cash Crunch,

I’m so glad that you wrote to me and are ready to make some big changes. My hope is that if you set a clear direction, your spouse will be inspired to join in the effort. Forced eviction is devastating emotionally; it is expensive and wrecks your credit score. Let’s work hard to avoid it!

Some of the obvious ways to reduce spending include eliminating the big expenses, like a car payment or rental/living costs in excess of 40% of your net spendable income. Look at both of those expenses closely, and determine if you need to make any changes. If not, there are some not-so-obvious ways you can save money each month that really add up over time. Cutting what seems like a necessity may seem impossible, but over time, the sacrifice will prove rewarding. Here are a few examples I want you to consider.

Do You Really Need Amazon Prime?

Membership fees jump for new members on February 18th. Renewals take the hit on March 25th. The annual cost will be $139/year plus taxes or $14.99/month plus taxes. An alternative is to keep a shopping list until you reach a total that qualifies for free shipping from Amazon or other companies. You may have limited shipping options, but this leads to better planning and less impulse purchasing. You can also use Amazon gift cards to limit spending since a credit card is not linked to your account.

Do You Really Need That Streaming Service?

According to The Streamable, in 2021, the average viewer had five or more subscriptions. The top five include Netflix, Amazon Prime, Disney+, Hulu, and HBO Max. In May 2021, Bloomberg reported that the average streaming consumer spends $40 per month. That comes to $480 per year! Different streaming prices can be seen here. The average cost of cable TV comes in at $64 but can run from $11 to $127 or more per month.

Do You Really Need Audible or Spotify?

Free audiobooks are available via Overdrive and Hoopla with a library card. Spotify and other small monthly fees that seem insignificant can really add up. Nothing is too small to eliminate to help you avoid eviction!

There’s More

Look at your spending with a critical eye. What could you realistically eliminate? What are your real needs? What do you need to reprioritize? Small daily purchases can add up quickly.

Analyze what is spent on subscription services, fast food, coffee, bottled water, shoes, clothes, gym membership and gear, house plants, manicures, pedicures, tattoos, haircuts and color, lottery tickets, toys for children, etc.

Challenge

Ask your spouse to join you in tracking all spending for the next 30 days. When Ann and I did this years ago, we found that recording each dollar spent made us more aware of our actions. We realized that we had some costly habits. Write down your expenses. Don’t leave anything off your list so that you know where your money is really going.

After 30 days, come together and share what you learn. It may only take a few days before a heightened awareness sets in. Prayerfully discuss what you could sacrifice for six months or a year. I suggest you gently educate your spouse on the long-term benefits. Can you agree to get the help of a mentor or come under the accountability of trusted friends? How about planning a reward when reaching your goal? You can likely cut back on your spending 25% by just changing some of your habits.

Once you get your spending under control and avoid eviction, there are many other reasons people decide to better manage their money. Reduced spending builds the habit of saving, and with the help of automatic deductions, people learn to live without. The possibilities can include:

Years ago, a woman confided in my wife that she was tired of her husband limiting her spending. She felt like she was being treated as a child. Ann listened and then asked, “Have you considered the possibility that he loves you so much that he wants to protect you and save for your future together?” The thought had never entered the woman’s mind. It changed her entire perspective and opened the door to healthy dialogue about their finances.

We enter marriage with a philosophy of money. Most often, we marry an opposite. The goal is uniting around God’s principles regarding our finances. Pray about how to lovingly communicate with your spouse. Treat him/her with respect and love so you can make progress. My desire is to see God’s people free and marriages united, strong, and thriving. We must recognize the errors in what the world has taught us about finances and have our minds renewed by God’s truth. With Valentine’s Day just days away, consider this effort to lead the way out of this crisis the best gift you can give your spouse.

If credit-card debt is a source of frustration in your marriage, consider contacting Christian Credit Counselors. They specialize in assisting people with getting out of debt and on the road to financial freedom, and they are a trusted source of help.

This article was originally published on The Christian Post on February 11, 2022

Dear Chuck,

My wife and I are aggressively saving for a down payment on a house. We’ve toyed with the idea of selling one of our two cars. Is that too radical?

First-Time Homebuyers

Dear First-Time Homebuyers,

This is a great question. Because of the inflationary market we are in right now, it is somewhat risky to sell a car and buy a house. As opposed to telling you what to do, I think some context will help you make a wise decision. I also have some Bible verses for you to consider.

Sell The Car or Keep Two?

One of my sons recently totaled his car after hitting black ice. By God’s grace, neither our son nor any of the other people in the six-car pileup were injured. He borrowed mine so he could get to work until insurance took care of his car. My wife and I were able to make do because we work remotely. When one of us needed a vehicle, we simply planned ahead and combined errands. Fortunately, our flexible schedules made it work. However, your question of what to do with the second car depends on three factors:

Let’s take a quick look at each question. First, if the car is older, it likely has marginal value, and it may be best to hang on to it because used cars are very expensive to replace if you suddenly realize that you need a second vehicle.

Second, whether or not it is radical to sell one of the cars depends on where you live. Is it radical for someone living in New York City? No. What about for the Amish? No. How about for an American suburban family? Yes. But, hey, being radical does not mean it is bad. Many financial decisions require us to go against the flow of what everybody else is doing.

The third question about lifestyle is important because as a first-time homebuyer, you may have two incomes right now, but a family may be in your future that could change your transportation needs quickly.

The cost savings of going from two vehicles to one can quickly add up. Lizzie Nealon at Bankrate reports that the total cost of owning a new car last year was $9,666. A report in June 2021 revealed that American households spend an average of $5,435 a year just on auto loans and insurance. The costs add up quickly when owning a vehicle, yet most people are unaware of the total expense. Consider this in your equation apart from what you would get for the price of the used vehicle. You will save on:

Options besides owning a car can include public transportation, walking, biking, carpooling, or car sharing through companies like Enterprise or Zipcar. If needed, you can reserve an Uber or simply rent a car. We’ve done that for road trips on numerous occasions.

So there is some great upside to unloading an unnecessary car in the current seller’s market. Besides getting your equity together, you can use the savings for building an emergency fund, paying down debt, saving for a major purchase, going back to school, starting a business, etc. If you decide that going from two cars to one is just too difficult, consider ways to lower the cost of ownership. Minimize depreciation by finding a car that holds its value. Look for good fuel economy. Shop around to get a good rate for insurance. Try to drive less by planning ahead and combining errands. Then find a reputable mechanic who will perform routine maintenance and any necessary repairs.

First-Time Home Buying

Buying a home right now is risky, too, because it is so expensive. Yes, a home is a good hedge against inflation and is the number one source for wealth building in an average American household. However, the first-time buyers I have been counseling feel they are being forced to stretch $50,000 to $100,000 more than they are comfortable spending just to get a house in an area they want. On top of that, all of the costs of homeownership are rising, such as insurance, taxes, utilities, maintenance, and remodeling. Our oldest son recently told me that the decision to rent for 10 years helped them be ready for buying their first home. They bought a fixer-upper that had been foreclosed upon. It looked like a disaster to me. Yet their eye for design and sweat equity paid off in a handsome profit and led to a comfortable purchase of their future homes.

Here are my rules of thumb for first-time home buyers. Have a 20% down payment. Don’t pay Private Mortgage Insurance. Have at least $10,000 in emergency savings after you move in. Be sure you can live there 5–7 years. Do you meet that high bar? If so, go for it.

Reflect on These Proverbs

“Better to be a nobody and yet have a servant than pretend to be somebody and have no food.” Proverbs 12:9 ESV

“One person pretends to be rich, yet has nothing; another pretends to be poor, yet has great wealth.” Proverbs 13:7 ESV

The Bible supports the idea that we should avoid putting on appearances to impress others when, in reality, we are living foolishly. We often have to make sacrifices to get ahead. So if you decide to go “radical,” let me know how you get along.

In the meantime, if you need help navigating any current debt, Christian Credit Counselors is a trusted source of help.

This article was original published on The Christian Post on February 4, 2022.

Dear Chuck,

My adult children rarely cook. They eat out and have groceries or meals delivered. I’m on a mission to teach my grandchildren how to cook—to prepare them to save money and become more self-sufficient in the future. I want to make it fun but could use some tips.

Cooking Up Some Savings

Dear Cooking Up Some Savings,

Food and entertainment can average 15% or more of the average American budget. This is a great way to help your grandchildren (and maybe your children too) learn to save a lot of money over their lifetimes. However, I am pretty limited on how to make cooking fun. So, I have asked my wife, Ann, to help me out here. She does a great job holding our food costs down!

My Limited Experience

While I was in college, my Dad paid for all my meals. Most were eaten in the campus cafeteria. When I got married, we ate most of our meals at home as a means to save money. Since Ann knew how to cook and I did not, my experience at it remains very limited. That was in 1978. Today, many young people, married or single, do not know how to cook or even how to shop for groceries.

Twenty years ago, Ann and I led a group of teenage Boy Scouts through the Crown Bible Study for Teens so they could earn a particular merit badge. They learned basic financial concepts—the importance of keeping a budget, avoiding debt, and so on. Before graduating, we wanted them to learn how much they could save by cooking their own food vs. eating out. We had them bring $5 for a meal that Ann cooked. They loved it. The following week, they brought $5 to eat out, and they chose a pizza buffet. Even those teenage boys noticed how much farther their money went by eating at home versus eating out.

Look at the Numbers

Yahoo! Finance reported that a survey by Visa found that the average American spends about $20 a week eating out for lunch. That comes to over $1,000 per year—for just one person. Priceonomics conducted research and found that “on average, it is almost five times more expensive to order delivery from a restaurant than it is to cook at home. And if you’re using a meal kit service as a shortcut to a home cooked meal, it’s a bit more affordable, but still almost three times as expensive as cooking from scratch.” The average price per serving based on 86 meals revealed the following costs:

Why People Eat Out

Why People Do Not Cook

Many recognize the need to change their habits. They want to save money, eat nutritiously, and impact their children’s futures. Start by learning to make one meal well. Learn to master something. Me? Well, I like to cook eggs and make smoothies. Let’s get Ann’s take.

Tips From Ann

With the goal of making cooking and eating at home appealing, prepare ahead by knowing what you plan to cook and gathering all ingredients. Consult cookbooks, websites, YouTube, or cooking shows to plan your menu. Search for budget-friendly, nutritious foods. After a few tries, you will gain confidence and should venture out into other meals.

Aim to make mealtime special by including the entire family. Rotate preparation, cooking, and clean-up chores. Teach children how to set the table, then let them be creative with cloth napkins, dinnerware, and centerpieces. Consider eating in different places, indoors and out. Turn off the TV and put away electronics to allow for family communication. Invite friends to join you. Ask relatives to demonstrate how to prepare favorite foods. Invite internationals in to teach you to cook specialties of their culture. Pick a night of the week to have a certain meal. This will cut down on menu planning: Meatless Monday, Taco Tuesday, Crockpot Night, Soup and Salad, Pizza or Pasta, Breakfast for Dinner, etc. Also, consider a baking competition where someone judges the dishes your grandchildren make. You will be surprised what a little recognition will do to motivate them.

Discover salvage and surplus grocery shopping to stock your pantry at reduced rates. Take the grandkids with you to learn. It is always a treasure hunt. Skip the prepackaged, microwavable stuff, and learn to eat fresh foods. God made them for us, and they are full of vitamins. Limit the foods that cause inflammation in your body, and you will save money and also improve your health.

My Tips

Eating out is a treat in our home. Ann and I have our favorite spots. We try to find coupons or ways to save while enjoying the splurge. We prefer to eat lunches out when we can since they are less expensive than dinners. We have not ordered a beverage at a restaurant in years. Water is good for you and saves a crazy amount on your total bill. Sometimes, we split an entrée, and we seldom order desserts.

It is interesting to note that the ant is considered wise for planning and storing its food supply in advance. “Go to the ant, O sluggard; consider her ways, and be wise. Without having any chief, officer, or ruler, she prepares her bread in summer and gathers her food in harvest. (Proverbs 6:6-8 ESV) Good stewardship eliminates the waste of time and money.

Hope it goes well! Thanks for contacting Crown. We invite you to listen to our Stewardship Podcast series; you will find many ideas on how to best manage God’s resources. Enjoy!

This article was originally published on The Christian Post on January 28, 2022

Dear Chuck,

My husband’s sales job has not produced good income since the pandemic. We’re in our early 60s, have $10,000 in a savings account, $25,000 in our 401(k), a paid-off home, and no debt. We’ve considered downsizing. Do you advise drawing down on our 401(k) now?

Managing Cash Flow

Dear Managing Cash Flow,

Unfortunately, for many who are in sales positions, lingering effects of the pandemic have caused inventory challenges, a decrease in demand, or a slow down in normal sales volumes in some industries. However, I think you have better options than turning to your retirement savings right now.

Rejoice in the fact that you are debt-free and in no immediate need of the money. If you can cut expenses and pick up some extra income, you may not need to draw down from your 401(k) at this point. If you have no other option, do not feel guilty about possibly borrowing some money to get you through a tough time. Do some deeper analysis with your husband on what I’ve suggested below, and then, consider my recommendations together.

Analyze Your Overall Picture

The fact that you have no debt and no mortgage gives you better options than depleting your retirement funds. How much income do you need per month to fill in the cash-flow gaps? This is the most important number to guide you in determining your best option.

Do you know what your home is really worth in today’s market? Seriously evaluate all available housing options: staying where you are, selling, buying something smaller, renting, or moving into a tiny house, an RV, or even a friend’s temporary guest house. Decide whether renting or buying is the best choice for you. Can you rent out your home for more than you could rent something else? Is it in an area that could produce Airbnb or VRBO income for you? Think creatively because a temporary move may be necessary until your husband regains stable income. More importantly, will downsizing relieve you of your income shortages long term? If not, don’t be too quick to downsize, as it is expensive to relocate.

How long does your husband plan to work? Have you or your husband considered temporary part-time work as a way to bridge the gap until his industry recovers? Do you have any other means of income? Have you looked for different jobs where his skills may generate more income?

When do you plan to start drawing Social Security benefits? What will your income/overhead look like when you get to that point? Since retirement is not too far away, it is better to think about building your 401(k) than shrinking it.

The rules for 401(k) withdrawals depend on the kind of account and where it is. Is it with a current employer or previous employer? You may be able to withdraw from your 401(k) based on your age, but you also may have to pay income tax on it. Check with your plan administrator. See if there’s an “in-service” withdrawal. Also, consider a 401(k) loan. See details here.

Alternative Stop-Gap Recommendations

Invite the Lord to Help

I know this is a stressful time for you, and it can feel very daunting to be short of funds for day-to-day expenses. Don’t panic; rather, see this as an opportunity to experience greater trust in the Lord’s faithfulness to show you which way He wants you and your husband to go. My wife and I have been through similar challenges a few times in our married life!

Pray with your husband every day, asking the Lord to show you His way forward. Be honest, transparent, and open to do whatever He may lead you to do. Ask a group of close friends to pray with you and for you. Remember God’s promises: “Again I say to you, if two of you agree on earth about anything they ask, it will be done for them by my Father in heaven. For where two or three are gathered in my name, there am I among them.” (Matthew 18:19–20 ESV)

Humbling ourselves before the Lord in the company of trusted friends opens the door for Him to do more than we can dream or imagine. We’ve seen it happen over and over. I am confident that this challenge will pass, and you will be in much better shape as you analyze your options, unite with your husband, and seek the Lord’s path forward.

You may be interested in some of our recent Crown Stewardship Podcasts; you will find much wise advice on managing resources for God’s glory. Thank you for writing. Keep us posted!

This article was originally published on The Christian Post on January 21, 2022

Dear Chuck,

My home is in need of multiple costly repairs. My neighbor just did a major update on his home, and he told me he did it with a cash-out refinance. We also need a new car. What should we do?

Refi Home

Dear Refi Home,

There is a lot in your question that I hope I can assume correctly and give you some solid advice.

I must assume you are free of all consumer debt and have built your emergency savings fund to three to six months of your current living expenses. Also, I assume your car is paid for and you will not borrow money from your equity to buy a new car. Getting out of debt and having emergency savings are higher priorities than doing repairs on your home or buying another car, and these are certainly not things that I recommend that you borrow against your home to achieve. With that aside, let’s talk about what you may be able to do with a cash-out refinance.

Bankrate.com says homeowners pulled $70 billion in equity from their homes in cash-out refinances in the third quarter of 2021. It was the highest rate in over 14 years. Back in ’07, the housing bubble was about to burst, holding many vulnerable to foreclosure. Borrowers last year had higher credit scores and pulled cash at a third of the rate of ’07. Higher home values reflected lower loan-to-value ratios. It’s led to the lowest total market leverage ever recorded, with the average borrower’s mortgage debt at just 45%. This is a sign of the inflation in real estate values that we are experiencing.

Refi Advice

Rates are on the rise, so if you hope to lock in a decent rate, you need to act quickly.

I recently recommended a cash-out refi for one of my sons. His historic home needed a new roof and some interior work. Because he is an army veteran, he was able to get a fantastic rate with no closing costs. His property has appreciated, so his refi provided enough cash to cover all repairs at a lower mortgage payment. It was a complete win for his family.

A traditional refinance involves retaining a financial institution to trade your existing mortgage for a new one at a better rate. With a cash-out refi, you borrow more than your remaining mortgage balance and convert equity in the form of a check or wire transfer to your bank account. In other words, you pull equity from your home to use for the repairs.

There are pros and cons with the length of the loan. A 30-year note offers lower monthly payments but a greater interest rate and higher total costs over the life of the mortgage. A 15-year note will cost less in the long run but has higher monthly payments. Decide on the length of loan that serves you best. Just remember: the shorter the term, the better the rate.

Careful Use of Funds

A cash-out refi makes sense if you need some money for home improvements or repairs. Using your mortgage to get a new HVAC or roof may be the cheapest money you’ll find. If you want to update kitchens or bathrooms, research what brings lasting value. Be mindful of resale potential for your area. Increasing the home’s market value will add to your home equity. My rule of thumb is to always use the funds to put back into your home to protect its value. Avoid using your home equity as an ATM for your impulse spending or lack of self control.

Using a cash-out refi to pay down private student loans at high rates makes sense, but not on Federal loans with reasonable interest rates. Using your equity to invest in your career can be beneficial. On the other hand, don’t refinance for cash to go on vacation or buy consumer goods. Instead, find ways to increase your income or decrease expenses. You could also do a simple refi to get a lower payment which would enable you to pay down debt. Some financial pros say that cash-out refi can be wisely used to boost retirement savings if placed in a diversified portfolio. For most people, pulling out home equity to invest is a risk that I don’t advise taking. By all means, don’t use it for day-trading or buying volatile stocks like crypto.

Dangers of a Cash-out Refinance

Risk of Foreclosure: A larger home loan can increase your mortgage payments. Never take out more than you can comfortably cover because you could fall behind in payments and lose your home.

Closing Costs: Costs vary by lenders. Make sure you understand all charges in order to accurately compare and assess quotes.

Overspending Cycle: Paying off high-interest debt with low mortgage rates makes sense if you have self discipline to avoid repeating your mistakes. Control your spending, and manage your finances wisely, or you could end up in the same predicament in the future.

Some other considerations involve how long you plan to stay in the home and whether you have a prepayment penalty on your mortgage. If a larger loan reduces your equity to less than 20%, you may have to pay private mortgage insurance (PMI). Avoid this.

If you already have a low mortgage rate, a home equity loan or line of credit may serve your purposes. Whatever you choose to do, proceed with caution. Do your research on the lender, the terms of your note, and the costs involved. Most of this is available online or by asking your lender for full disclosure documents. Read all the fine print. Ask questions. Don’t assume that you are not vulnerable to being ripped off. Seek wise counsel, and pray for wisdom. God gives it generously. (James 1:5)

We have several Crown Stewardship Podcasts that you may find beneficial. Some of our recent ones include preparing for inflation, finding relief from debt, and lowering expenses while increasing faith.

This article was originally published on The Christian Post on January 14, 2022.

Dear Chuck,

I dread making financial resolutions every new year because I usually fail at keeping them. Can you offer any simple tips to help me manage money better this year? Something that’s fail-proof?

Fail-Proof Financial Resolutions

Dear Fail-Proof Financial Resolutions,

First, Happy New Year! It is always exciting to me to roll the calendar over to a fresh start on the 365 days ahead. As of today, we have 358 remaining to plan a new path forward!

While there is no such thing as a “fail-proof plan,” I can give you Biblical advice that has stood the test of time when it comes to your financial resolution for 2022. Here it is: Give First. Save Second. Faithfully follow this plan, and you will experience true financial freedom! Now, let’s break it down into some action steps.

Give First

Invite the Lord into your finances. Ask Him to give you the motivation to make giving your highest financial priority for 2022 and beyond. Proverbs 3:9 tells us to “Honor the Lord with your wealth and with the firstfruits of all your produce.” (ESV) Do you truly honor Him first? God wants to conform us into His image. He does that by asking us to trust Him by first giving away a portion of what He provides. Ask yourself whom you are honoring in the way you use what He provides.

Generous living is one of the greatest blessings of financial freedom. Once you develop the habit of giving first, you will discover the joy in it, and soon, it will become part of your normal routine. When giving comes from a heart of sincere love and gratitude, it will change you. If God increases your income, increase your standard of giving, not just your standard of living. I believe starting with a goal to give away 10% of your total income (gross amount) is a clear standard set forth in Scripture. While not a law, it is an objective target for honoring the Lord.

Save Second

We can save when we follow the warning in Hebrews 13:5: “Keep your life free from the love of money, and be content with what you have, for he has said, ‘I will never leave you nor forsake you.’” Contentment is what makes us able to actually enjoy frugality. It is what gives us flexibility in our budget so that we can save as needed. Automatic deposits insure consistency. Save 3-6 months in an emergency account. Then, set some short- and long-term saving goals for things like vehicles, a house, vacation, and retirement.

Resolve to Take Action

Should you make “Give First, Save Second” your New Year’s resolution, you will fail if you do not take action. The first attack will be to think you cannot afford to give first or save anything because you are constantly short of the funds to accomplish one or both goals. Let me introduce you to another principle that will ensure your success this year.

The way you accomplish this is by exercising what Bob Lotich calls The Never 100 Rule.

Do not spend everything you earn. Never spend 100% of your income! Get that? Never!

King Solomon said it this way: “The wise man saves for the future, but the foolish man spends whatever he gets.” (Proverbs 21:20 TLB) The simplified version of that is: “If your outgo exceeds your income, your upkeep will be your downfall.” If you spend more than you earn, the stress of keeping up will be overwhelming! Abide by the Never 100 Rule, and you will find margin to give and save.

Most people have to adjust their spending habits to make this work. If you don’t have a budget yet, I highly recommend one. Download our Easy Guide to a Budget You Love, or use an app. Track your spending for a month or two so you can estimate how much you need to allow for each category. You will likely discover holes in your “bucket.” Plug them. Here’s how:

Find Joy in the Journey

Charles Dickens said, “There is nothing in the world so irresistibly contagious as laughter and good humor.”

My suggestion is to face the year ahead with a good attitude. Make it fun to deny yourself things you once compulsively purchased. Laugh, and enjoy it because you know God is orchestrating your steps for His purposes. Do your best with what He gives you to manage. Be proactive, and face 2022 with laughter, expectancy, and renewed purpose. Resolve to see this year through the lens of an eternal perspective. Acknowledge God as your Provider, then give and save out of devotion to Him.

The Crown Stewardship Podcast is a wonderful tool to help guide you in the many facets of God’s financial principles. You can subscribe for alerts on new episodes. I hope you find it a valuable resource; enjoy!

This article was originally published on The Christian Post on January 7, 2022