Dear Chuck,

I bought a car a few years ago from a dealership. It came with a limited one-year warranty. How do I know if any of these extended-warranty offers are legitimate?

Warranty Worries

Dear Warranty Worries,

They say there are now three guarantees in life: death, taxes, and receiving a “final notice about your car’s extended warranty.” It is so common to get these calls or letters that they have become a joke. However, the gullible can fall prey to a ripoff.

An extended car warranty is a service contract between you and a warranty company. Warranties are included in the sales price of vehicles, but an extended car warranty or service contract is not. Some after-market warranties are legitimate, but the vast majority are scams.

I have never purchased an extended warranty for a car or any other product. Many contracts for legitimate warranties have details in the fine print for maintenance or qualifications that make it unlikely that you will ever receive a settlement on your claims. Instead, I recommend buying reputable cars and saving money in a specific account for car repairs and maintenance.

Phony Letters

We seem to get phony offers at least once a month. An authentic extended-warranty offer will identify the dealership where you purchased your car. Scam letters do not. Here is an excerpt from the most recent one we have received.

THIS LETTER IS TO INFORM YOU: That if your factory warranty has expired, you will be Financially Liable for all repairs. Our records indicate that you HAVE NOT CONTACTED us to get your service contract up-to-date. You have the option to protect your vehicle beyond the factory warranty. Please respond by… EXTREMELY URGENT AND TIME SENSITIVE – THIS IS NOT A BILL. PLEASE CALL IMMEDIATELY.

Phony Calls

You may receive phone calls from so-called “representatives” of car dealers, manufacturers, or insurers warning you that your policy is about to expire. The scammers offer extended-service warranties at the touch of a certain number or by staying on the line. You will then be pressured with talk designed to create fear of out-of-pocket costs for broken or worn-out parts. They may actually have information about your car and warranty to further convince you of their legitimacy. The goal is to gain your credit card information by getting you to purchase the offer. If you do not hang up, or ignore the call, then ask questions, knowing that legitimate companies will provide any information you request.

Unwanted calls are the FCC’s top consumer complaint. In February, the Commission proposed a $45-million fine against a robocaller who made hundreds of thousands of false calls about the pandemic to sell health insurance. Learn how to stop unwanted robocalls and texts here. In addition, join the FTC’s National Do Not Call Registry. Do not join the company’s do-not-call list. Your number could be sold to other companies. Do not answer numbers you do not recognize. Someone who needs to talk with you will leave a message and call-back number. Ignore the instruction to press a number on your phone. This action confirms to scammers that they have reached a working number, so they will call again.

Protect Yourself

Use of the words urgent or time sensitive are red flags. Offers to extend a factory warranty can only be done by a vehicle’s manufacturer. Even if a letter appears authentic, do not call the number given. If you do have an extended warranty, check the details.

Even if a number appears legit and the caller is “professional,” never give information to a telemarketer. Professional criminals engage in caller ID “spoofing,” which falsifies the Caller ID display. Do not provide your social security number, credit card information, driver’s license number, or bank account information.

Should you need a legitimate extended warranty, do your homework carefully! I suggest you check WalletHub’s list of company ratings.

In these inflationary times, I recommend you check out Squeeze—a trusted Crown resource. The company shops household bills to bring you the lowest rates and best deals. Savings are quick and can last a lifetime. Sign up for free, and squeeze your first bill in under five minutes.

This article was originally published on The Christian Post on May 13, 2022.

Dear Chuck,

Do you, as an expert on money matters, know what I should do with all the foreign coins I’ve collected from the many countries I’ve visited? They include Lei, Bani, Forint, Drachma, Schilling, French Franks, Turkish Lira, Bulgarian Lev, Macedonian Denar, Rand, Old English sixpence, penny, farthing, halfpenny, florin, half crown, threepence, Croatian Kuna, Serbian Dinar, and Peseta.

Please advise me on the best options. Cheers.

Currency Collector

Dear Currency Collector,

First of all, I am no expert on currency matters although I do have my own collection. Having traveled throughout the world teaching God’s financial principles, I have learned that money is a common language wherever I go. If someone simply rubs their thumb aggressively against their first two fingers or opens their palm and displays it about waist high, I immediately know they want money. I have also found that financial problems and stresses are universal.

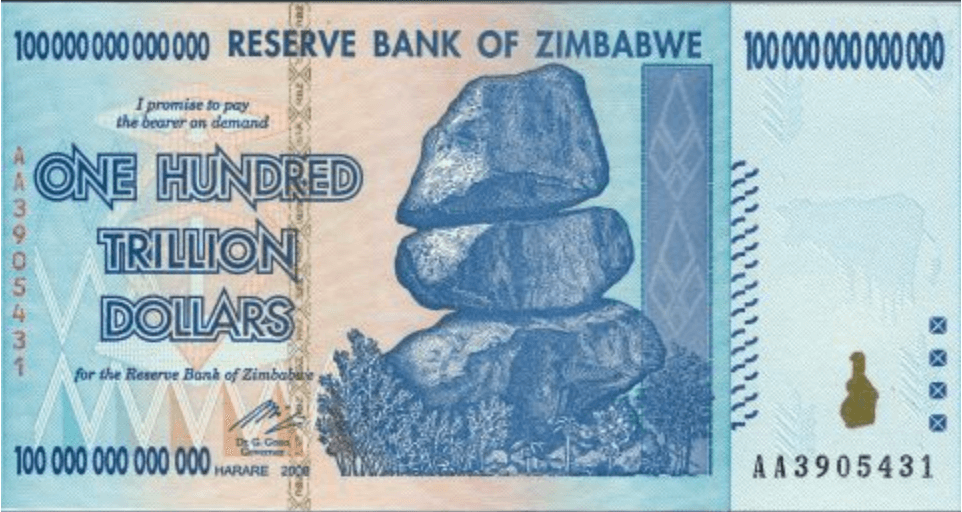

My accumulated currency is left over from traveling in various countries. Besides many of those you have collected, I have several that you have not mentioned from Switzerland, Zimbabwe, Hungary, Singapore, China, UK, Brazil, etc. Most were left over and cheaper to hold on to than pay exchange rates at the airport. They are interesting to me as expressions of the culture of the nations where I’ve traveled and reminders of the people who live there. Many are beautiful and exotic.

I will give you a few tips regarding how to value your currency and the way that I view my own collection.

Tips for Collectors

I recommend you do some basic research to determine current values based upon foreign exchange rates. It is highly probable that they have devalued if used as a currency. However, any that are rare or no longer in circulation may be of interest to collectors. I learned that my $100 Trillion Zim bill is sold online now for $100 or more depending on the condition . . . nice return so far! Since I have a zero cost basis in this Zimbabwean currency that expired in 2008, I intend to hang on to it. Before it expired, it was worth less than toilet paper. Since it is the largest denomination ever printed on a single bill, it has great interest to collectors. Interestingly, the government considered a $100 Quadrillion bill but never printed it. There may not have been room for all the zeros!

Here are a few other ideas that you can do with your currency collection. Divide your collection between printed currency and coins. They are generally viewed very differently by collectors. If you think any may indeed have some collector value, start a spreadsheet for the currency or coins by country. Do some research to determine the condition of each. Do not try to clean anything old, rare, or potentially valuable. Leave that to an expert.

A good place to start is with the Professional Coin Grading Service (PCGS). Market reports, news and articles, events, dealers, coin values, clubs, and education are listed on the website. A link to a beginner’s guide will set your research in motion. The American Numismatic Society (ANS) provides information along with Coin World and Accredited Precious Metals Dealers. The Standard Catalog of World Coins by Krause Publications can be found at libraries or booksellers.

Coin values are defined as follows:

Some other possible options on what to do with them include to:

Have them appraised, attend a numismatics trade show and talk to dealers, or learn prices by studying those offered on eBay. If you are interested in selling coins on eBay, this article may be helpful. For me, I simply check places where the currency or coins that I have are being sold and form my own ideas of the potential value. You may want to consider selling your collection as individual lots or the entire collection as one unit.

Be wise and discerning to avoid being scammed. There may be someone in your church who also collects rare coins or currency who can give you counsel. Moses’ father-in-law, Jethro, gave him advice that I would use in your situation: “But select capable men from all the people—men who fear God, trustworthy men who hate dishonest gain . . . ” (Exodus 18:21a NIV).

Thanks for writing. Let me know how it goes!

We can all observe God’s presence in global economic affairs. My new book, Economic Evidence for God: Uncovering the Invisible Hand That Guides the Economy, may be of particular interest to you. May you discover new evidence of the reality of God Almighty—the One who boldly and unilaterally claims not only to have created all things but also to sustain all things.

This article was originally published on The Christian Post on May 6, 2022.

Dear Chuck,

My wife and I hardly ever use cash anymore. Do you think we are going to be totally cashless soon? Does it worry you as much as it does me?

Cashless Is Coming

Dear Cashless Is Coming,

We are and have been trending toward a cashless society for many years. And, yes, it worries me, but I am not sure if I am worried as much as you. By the way, I do track this trend and have written about it in my book Seven Gray Swans: Trends That Threaten Our Financial Future. Let’s walk through some trends before I answer your question about fear and worry.

Trends Towards Cashless

The Federal Reserve is researching and developing the use of a United States CBDC (central bank digital currency), which is set to arrive sometime between 2025 and 2030. Implementation would threaten financial middlemen, who earned $110 billion in transaction fees in 2020. Presumably, a downloadable app would allow citizens to make and receive payments. Some see this as beneficial in that it would give the unbanked (5% of American households) easier access to e-commerce and digital payment services. It would also allow the government to send payments to citizens for tax returns or economic relief.

On April 4th, the UK announced its vision for becoming a hub for crypto technology. They want to regulate some cryptocurrencies and recognize stablecoins for digital payments. The “coins,” less volatile than cryptocurrencies, are linked to traditional currencies or assets like gold. The UK thinks it will attract investment and create many new jobs. Stablecoins are already used in the United States for trading, lending, and borrowing of other digital assets.

BlackRock CEO Larry Fink says that the conflict in Ukraine could accelerate the development of digital currencies around the globe. “A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption.” Just last May, he voiced concerns.

A report by accounting firm PwC (PricewaterhouseCoopers) reveals that 80% of central banks are considering, or have already launched, a digital currency. The Bahamas is the first country to launch theirs, the Sand Dollar, and the Jamaican Jam-Dex is expected to launch this year.

Prepping for Cashless

Bear in mind, none of these developments in digital money and/or cryptocurrency mean that cash will become irrelevant or unavailable. We know that the growing trend in cryptocurrencies and CBDCs will make it more likely, but it is not certain. We must not waste time in fear and speculation. However, there are a number of ways to prepare for a cashless society if that should happen. One is to grow in wisdom. It allows you to look at the facts and make appropriate decisions. If we do move that direction, it will be wisdom which proves of greater value than our money. Secondly, our lives must not be defined or controlled by money. The Bible tells us over and over to keep our lives free from the love of money. Our true riches are stored in Heaven.

If we are ever forced to make a decision between operating in a cashless system and serving God, we will need to be prepared to lose all that we have to honor Christ above money. The Bible is so complete in its teachings about money that we learn in Hebrews 10:34 that we can lose everything on Earth with joy because we have “better and last possessions” beyond this temporal life.

Should We Be Worried?

Many people are justifiably concerned about privacy if cash totally disappears. They do not want the government to gain insight into their finances, and they want to prevent becoming victims of cyber-attacks. With the loss of economic privacy, the loss of economic freedom is soon to follow. However, surveys indicate that almost a third of retail transactions are still done in cash in the United States. It is not likely that this will go away as quickly as we may think for two reasons: retailers want to retain the customers who use cash, and policy makers want to be sure that the “unbanked” are not discriminated against.

Satan uses fear to rob our joy today and prevent us from being fruitful. Regardless if we are cashless or not, we know that God will never leave us or forsake us. We can live one day at a time relying upon our Lord to faithfully provide our needs, whatever form that need may become.

God’s presence has and always will be unmistakable in global economic affairs, and this should be a comfort to you. I’ve written about it in my new book, Economic Evidence for God: Uncovering the Invisible Hand That Guides the Economy; I hope you find it encouraging.

This article was originally published on The Christian Post on April 29, 2022.

Dear Chuck,

Our 28-year-old niece moved in with our family several years ago. At the time, we thought it would be a temporary solution to help her get on her feet. She works full-time. We assumed she would help pay bills and do some chores. She does not. We have tried to serve her well but feel it may be time for her to go. How do we ask her to leave or get her to take some responsibility?

Frustrated Aunt

Dear Frustrated Aunt,

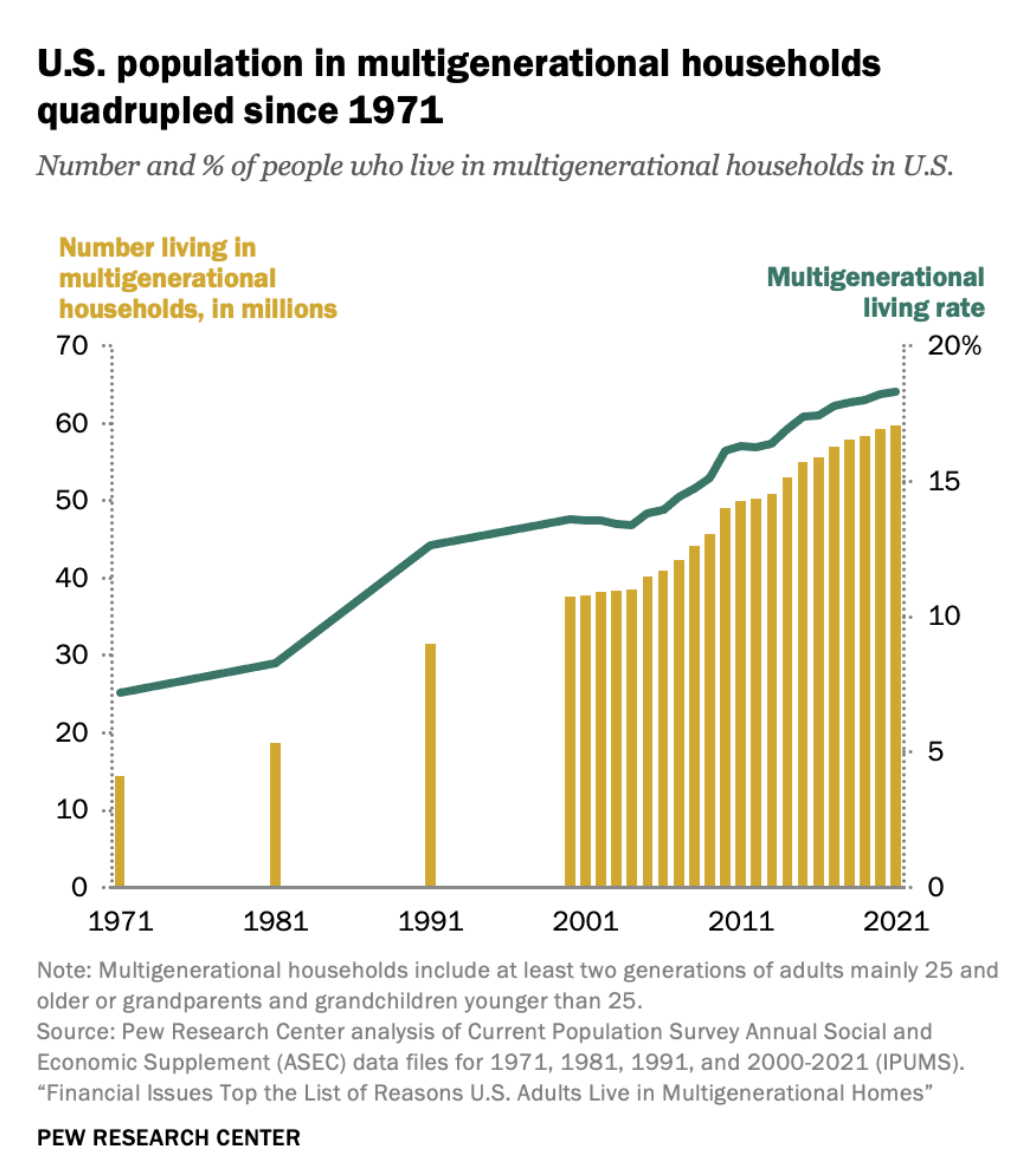

You are not alone. Many families are now receiving adult children, nieces, nephews, and in-laws back into their homes. A new study by Pew Research Center reports a significant shift in American households. From 1971–2021, the number of people living in multigenerational homes quadrupled, and that number is expected to continue rising.

Stressful Yet Rewarding

Financial needs and caretaking are the primary reasons, but it appears greater among certain cultures and immigrant families. “About a quarter of adults in multigenerational homes say it is stressful all or most of the time, and more than twice that share say (sic) it is mostly or always rewarding.” Pew reports, “Living in a multigenerational household appears to confer a financial benefit by buffering residents against poverty, according to census data. Americans living in multigenerational households are less likely to be poor than those living in other types of households. This is especially true of some groups that are economically vulnerable, such as unemployed people.”

Inflation is negatively impacting many families. Add in the experience with Covid and the Ukraine situation, and it is easy to see why more and more families are struggling with stress. There can be benefits to housing a family member in one’s home, but the cost, loss of privacy, and space can be challenging. Let’s look at your options.

Resolving Your Dilemma

Although your mistake was making the assumption that your niece would take some responsibility, God can work this together for good. Before you tell her she must go, consider extending grace and an opportunity to make things right. Clear, loving, written communication is essential going forward. The sooner you talk, the better. This will prevent the build-up of resentment or bitterness.

First, meet with your spouse. Voice your concerns, listen well, and honor one another. Seek unity with a defined course of action, knowing this decision will also impact your children if they are still at home or may one day want to move back in. As the Apostle Paul said in Colossians 3:12–14:

Put on then, as God’s chosen ones, holy and beloved, compassionate hearts, kindness, humility, meekness, and patience, bearing with one another and, if one has a complaint against another, forgiving each other; as the Lord has forgiven you, so you also must forgive. And above all these put on love, which binds everything together in perfect harmony.

Next, set a day to talk with your “guest.” Pray, fast, and be prepared to present her with a choice: either begin taking financial responsibility or self-select to relocate. Giving her an either/or choice shifts the tone of your interactions so your guest does not feel surprised, rejected, or attacked. Ask for her help in resolving the dilemma you face.

Have a written financial plan that shows what is expected for rent and bills, as well as some chores that need to be accomplished. Be sure to include a timeline for when this new agreement needs to begin: immediately, 30 days, 60 days? Outline when the bills are due and the consequences for being late. Holding a deposit of one month of expenses may be helpful to let her know this is no different than renting from a third party. If you like having her with you, and she is willing to be responsible, could you remodel, build a guest house, or move to a home with an attached apartment to make it more functional for all?

If she has no interest in the financial contract, present well-researched, alternative housing options and moving costs. This will allow her to compare your offer to the next best alternatives. Then present your solution to the current living situation by asking her to make the choice of either signing an agreement to help with expenses and chores or setting a departure date. Give her a day or two to think about it, and pray with her. Have a written agreement ready for signatures. Remember, this is a way to help her be prepared for real life.

If she elects not to take any financial responsibility, a target date for departure in 2–3 months may be necessary, depending on the situation. You also may want to help her with some expenses incurred with the move.

Ask the Lord to give you words to communicate in a spirit of love and peace. Aim to make it positive by affirming any growth you have seen during her stay with you. Thanks for the question. Let us know how it goes.

If credit card debt is a financial burden for your niece, consider directing her to Christian Credit Counselors. They are a trusted source of help and can guide your niece towards financial freedom.

This article was originally published on The Christian Post on April 22, 2022.

Dear Chuck,

We invested in some cryptocurrency a few years back. It has appreciated nicely. We want to give some to help the people of Ukraine. Do you have any tips for us?

Crypto Donors

Dear Crypto Donors,

First, may I wish you and our readers a very Happy Easter! Eight in ten Americans plan to celebrate Easter this year. According to the National Retail Federation, U.S. consumers are expected to spend an average of $170—or $20.8 billion total—related to the holiday: 90% on candy, 88% on food, 63% on gifts, 49% on clothing, and 48% on decorations. It is good to think more about being generous during this season that marks the greatest event in human history. He is risen!

Giving Crypto

The war in the Ukraine has brought this topic into focus with many people around the world. On April 5th, CoinDesk reported that crypto donations are skyrocketing. The ease of transferring crypto across the globe has become very beneficial for charities.

Crypto donors are, on average, much younger than traditional givers. 60% of crypto users are under 40. Younger people respond to needs publicized on social media. They like supporting a particular cause.

Benefits of Crypto Giving

Fidelity Charitable reported last year that a third of cryptocurrency investors have donated some of their cryptocurrency to charity. They were driven by the tax benefits and a desire to do good. 46% said it was difficult to find charities that accepted cryptocurrency, and 44% said it was a cumbersome process. Fidelity sees digital assets becoming a strong source of funding for the future. However, there are challenges: navigating volatility, simplifying the process, making the exchange of donations to traditional currency easier, and ensuring security for donors and charities.

The Drum reports that charities that accept cryptocurrencies in the U.S. experience far greater generosity among average crypto donors compared to cash donors. The Giving Block found that the average crypto donation was 82 times larger than the average cash gift, but this will likely decrease as more volume is generated. Emergency appeals for the Ukraine crisis raised millions.

The value of crypto gifts can fluctuate wildly, so churches are advised to put those donations to use quickly or liquidate them into traditional dollars, rather than speculate on their growth.

Last month, President Biden signed an executive order for government oversight of cryptocurrency. Due to the growing popularity of cryptocurrency, there is a possibility that the central bank will create its own digital currency. Surveys show that roughly 16% of Americans (40 million) have invested in crypto. 43% of men 18-29 years old have put money into some form of cryptocurrency. 90 central banks are experimenting with or piloting central bank digital currencies (CBDCs).

Tax Ramifications

Crypto donations can be treated as itemized deductions and can possibly reduce your income tax liability. Donating crypto is tax free and deductible as long as the donation is to a registered charity. Organizations with 501(c)(3) status qualify. The amount that is tax deductible depends on how long the asset was held. Crypto held for more than one year can be deducted at fair market value. Crypto held for less than a year can be deducted at the lower of either the fair market value or your cost basis (the difference in the sale and purchase price).

Avoid Scams

Millions of dollars generously given to help Ukraine were lost to thieves in crypto scams.

To verify that crypto donations are going into the right hands, the Federal Trade Commission (FTC) advises that donors do the following:

God’s Call to Seek Wisdom and Give Generously

I am on the Board of Directors of TrustBridge Global, which provides expert assistance to donors transferring funds across international borders. I recommend that you consider seeking their advice and services when giving to the people of Ukraine, whether making a traditional or crypto gift. Thank you for your question and generosity!

My new book, Economic Evidence for God: Uncovering the Invisible Hand that Guides the Economy, is now available. As you press into the evidence, it will become more and more exciting as you begin to see the world and even your own economic activity through an entirely new perspective. Money―and our personal and collective use of it―can be examined to reveal our faith, or lack thereof, and God’s ever-present reality in our affairs. I hope you enjoy it!

This article was originally published on The Christian Post on April 15, 2022.

Dear Chuck,

I am seriously worried about our finances. We are struggling to keep up, even with two incomes. We need God’s intervention!

Desperate for Hope

Dear Desperate for Hope,

Inflation is on everyone’s mind. There is pain at the gas pump, pain in the grocery aisles, pain in the car markets, pain if you go to eat out… I get it!

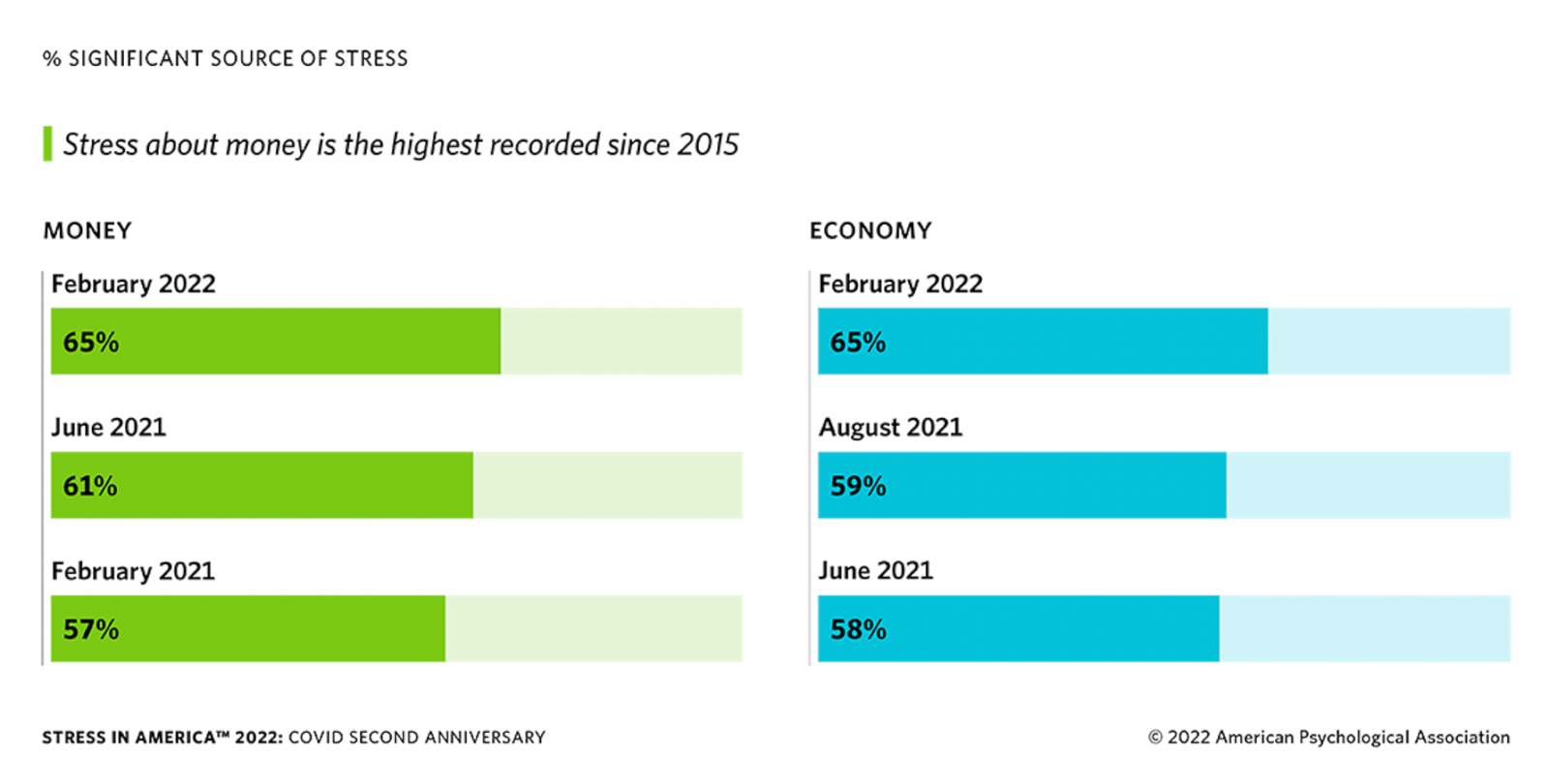

The American Psychological Association partnered with The Harris Poll to conduct a survey between February 7–14, 2022, along with a late-breaking poll fielded March 1–3, 2022. The later findings were “alarming,” with more adults rating inflation and issues related to the invasion of Ukraine as stressors than any other issue asked about since the Stress in America survey began in 2007. Top sources of stress: prices of everyday items due to inflation (87%), supply chain issues (81%), and global uncertainty (81%). Like you, financial stress is at the top of mind for a majority of Americans.

While there are many practical steps you can take, like reducing your expenses by the overall inflation rate and seeking to adjust your investments to keep up with the impact of inflation, I want you to consider fasting.

Fasting for Financial Breakthrough

Fasting is a way to stop looking at things of this world in order to focus more fully on the Lord.

The Bible addresses fasting for repentance, sorrow, deliverance, guidance, and help. It is to be done with genuine humility in order to draw closer to God.

Anna, the prophetess mentioned in Luke 2, served God day and night with fasting and prayers. John the Baptist taught his disciples to fast. Jesus said in Mark 2 that His disciples would fast after his death.

Nate Shurden, pastor of Cornerstone Presbyterian of Franklin, TN, writes:

“When we fast, we say, ‘No’ to something we enjoy. Whenever we do that, we pick a fight with our flesh. For whenever we abstain from something, we expose how strong our desire is for certain earthly things. By denying ourselves in this way, we clean out the soul, making room for God. This is why prayer goes hand-in-hand with fasting. For when you desire whatever-it-is you’re fasting from, instead of turning to that thing, you turn to God in prayer. In feeling the pain of emptiness, you take time to be filled up with God—to taste and see that He alone is your true sustenance.”

My Personal Experience with Fasting

Multiple times in my life, I have done extended fasts from all food, including two times when I fasted for 40 days drinking fresh juice only. To prepare, I read many books on the topic and followed step-by-step advice from experienced advisers.

On another occasion, my wife and I limited our food intake to 750 calories a day for 21 days to experience the same hunger that millions of others in the world do. This was a form of fasting that denied our flesh in order to increase our empathy for people and raise awareness of the need for our work in low-income nations.

Suggestions on How to Begin Fasting

Financial Fasting

This method of fasting is designed to break detrimental spending habits, eliminate debt, and/or jumpstart a path toward certain goals. You design the parameters, but some basics include setting a time frame, purchasing only what is absolutely needed, and keeping a spending journal. There are many references to this kind of fasting online. One popular idea is to fast from eating out or buying more groceries by eating only what is in your pantry or freezer for as long as you can make those supplies last.

Whether seeking His will in financial decisions or dealing with financial pain, fasting should be considered. Turn to Him. Only He can satisfy your deepest longings.

“Is not this the fast that I choose:

to loose the bonds of wickedness,

to undo the straps of the yoke,

to let the oppressed go free,

and to break every yoke?

Is it not to share your bread with the hungry

and bring the homeless poor into your house;

when you see the naked, to cover him,

and not to hide yourself from your own flesh?Then shall your light break forth like the dawn,

and your healing shall spring up speedily;

your righteousness shall go before you;

the glory of the Lord shall be your rear guard.”(Isaiah 58:6-8 ESV)

While seeking the Lord’s guidance, if credit card debt is a source of your financial pain, Christian Credit Counselors is a trusted source of help. They can help your family get on the road to financial freedom.

This article originally published on The Christian Post on April 8, 2022.

Dear Chuck,

Is it wrong to carry a mortgage in retirement? We are both preparing to retire but have 20 years left on our home mortgage.

Senior Mortgage Concerns

Dear Senior Mortgage Concerns,

My general response is to recommend that you (and everyone else) get completely out of debt before you retire. This verse makes it clear that any form of debt can be dangerous: “The rich rules over the poor, and the borrower is the slave to the lender.” (Proverbs 22:7 ESV)

Why not do everything possible now to avoid the potential for financial slavery? But that may or may not be possible in your circumstance, so I need to give you the full picture—pros and cons.

From a Biblical perspective, debt is not sin; however, it is strongly recommended that we avoid it or pay it off quickly. God does not want us in financial slavery. But Americans do not often follow God’s financial advice!

Retirees and Mortgage Debt

Many people choose to retire with a mortgage. A 2019 Harvard University study found that 46% of homeowners ages 65-79 carried mortgage debt with a median balance of $77,000. 26% of homeowners age 80 and above carried mortgages with a median balance of $43,000. 30 years ago, only 24% of homeowners ages 65-79 and 3% of those over 80 had outstanding mortgages, home equity loans, or home equity lines of credit. The median balance for those 65-79 was only $16,800. Those 80 and above carried $7,500. Causes in the shift may include low mortgage rates, the refinancing trend, or the lack of resources to pay off the debt.

The Pros of Paying off the Mortgage before You Retire

A paid-off home frees you from the stress of wondering what to do or where to go if you can’t pay the mortgage. Many homeowners suffered greatly during the Great Recession. 1.65 million homes went into foreclosure in the first half of 2010. Those who owned their homes avoided that pain. Without a mortgage, you have the flexibility to give as the Lord leads, assuming you are not burdened with other debt. Inflation will increase the cost of insurance, property taxes, utilities, repairs, and maintenance. Renters could be severely impacted by adjusted rental costs, whereas those who own their homes or are locked into a fixed mortgage are protected.

The Cons of Paying off the Mortgage before You Retire

There are few negatives to paying off the mortgage before retirement, but one con to a paid off mortgage in your case may be reduced liquidity if you have not saved properly for retirement and need a lot of your retirement savings to pay it off now. Also, if a large sum of money is needed in the future and is not available in a bank or investment account, you may have to borrow against the home, rent it, or sell it. However, if the home has appreciated greatly, this may not be as big a concern except for the interest rate charged for a loan.

Unfortunately, many retirees today are burdened with total housing costs and other debt.

Those on fixed incomes who retire with a mortgage should avoid credit card debt, signing on student loans, and other indebtedness that strains finances. Indebtedness causes stress that negatively affects health and marriage which then impacts finances. The Fed’s planned rate hikes will increase the U.S. prime rate and impact credit card interest rates. Rates on current mortgages are likely a fraction of rates charged for credit card debt.

My Advice

Rather than worrying about paying off a mortgage if you are both getting ready to retire, I recommend that you first pay off all your consumer debt. Then avoid consumer debt in the future, and make additional payments towards your mortgage reduction each month until retirement. Depending on how long before one or both of you retire, getting completely debt free may be realistic by rearranging your financial priorities.

To pay down consumer debt:

Another option to consider is down-sizing your home to save money on utilities, repairs, maintenance, and property taxes. Think about a granny pad on your children’s property, or take in a renter. Is your home one in which you can age in place? If not, what kind of renovations are needed, and what would they cost?

Having a place to live that is paid for helps you avoid stress, financial bondage, and insecurity. I hope you will be motivated to get completely out of debt to be totally free in your senior years.

My latest book, Economic Evidence for God: Uncovering the Invisible Hand That Guides the Economy, is now available. In it, you will experience the reality of the God who created economic laws and principles to show Himself to us. Once you’ve read it, I’d love to hear your feedback. You are invited to send your comments to me at chuck@crown.org.

This article was originally published on The Christian Post on April 1, 2022.

Dear Chuck,

Many of our friends are moving to the South. We are reluctant to leave our family, but the financial benefits seem worth it. What do you advise?

Considering a Move South

Dear Considering a Move South,

In January, I went to the dentist where I live in Tennessee. The dental assistant was new, so I asked her to tell her story. Since I could not really talk, I learned a lot! She, her husband, and their two children had recently relocated from California. She had done extensive research on all of the “lower 48” states looking for lower taxes, lower housing costs, access to outdoor recreation, mild weather, and a strong job market. Tennessee came up the overall leader according to their criteria, so they moved. But even more remarkable to me was that 12 other members of their extended family from California followed them! They all bought homes in close proximity to each other.

Relocation Trends

Extraspace.com reports that more than one in ten Americans moved in early 2021 alone. The shifting economy, remote work, and the desire for less densely-populated areas—all sparked by the pandemic—led to a migration to several key states. 35 million addresses changed last year.

Politics and crime are influencing others to relocate. People are moving to be near family. Others want bigger homes in the suburbs with yards for children and pets along with affordability and good schools.

North American Moving Services released a 2021 migration report. The top five states that people left are Illinois, California, New Jersey, Michigan, and New York. The top five states they moved to are South Carolina, Idaho, Tennessee, North Carolina, and Florida. The main reasons given include:

Other reasons people move are to escape high taxes, heavy traffic, and crowded cities, as well as the desire for better weather and proximity to outdoor recreation. I have included numerous charts that provide helpful information if you’re considering a move to another state.

Here are some practical helps: 42 moving tips and how to cut moving costs should you decided the benefits outweigh the overall risks.

Family

Pandemic restrictions revealed the desire for many families to live near one another. Assuming healthy boundaries can be established or are already in place, you will find numerous financial benefits of living close to your family. A few of these include free babysitters, reduced travel costs to visit at holidays, sharing tools and equipment, and passing down knowledge and skills. Young and old benefit from living close to one another as long as parameters are respected. Children and grandchildren benefit from serving older relatives. Older family members gain meaning and purpose in life by helping younger ones. Healthcare costs can decrease also.

In your case, moving away from family may be the determining factor whether you should move or not. One couple I met said they were able to budget for annual travel to see their family, and they were also to pay for airfare for some family members who wanted to visit them in their new location. This, too, can be an expensive consideration to factor into your decision.

Making a Wise Decision

An important aspect to consider is finding a new church. Research options in the city where you want to move. Stream services, and reach out to staff. If you can plug in before you move, it will make the transition much easier. We need the Body of Christ. Seek to get involved in a class and/or small group. They can help you navigate a new city, find doctors and repairmen, and answer other questions you may have. We have benefited from the weekly fellowship in our small group.

Pray, seek lots of wise counsel, and speak to your family about their views. Ask God for wisdom and direction to place you where He wants you to be, then come to unity with your spouse and children. It may be He wants you right where you are. I hope this information will help you make the best possible decision. If you come to Tennessee, be sure to say hello!

My new book, Economic Evidence for God: Uncovering the Invisible Hand that Guides the Economy, is available as of today. As you press into the evidence, it will become more and more exciting as you begin to see the world and even your own economic activity through an entirely new perspective. Money―and our personal and collective use of it―can be examined to reveal our faith, or lack thereof, and God’s ever-present reality in our affairs. I hope you enjoy it!

This article was originally published on The Christian Post on March 25, 2022.

Dear Chuck,

We’re trying to buy a house, and our realtor suggests we sign an “Appraisal GAP” clause in our offer that is above the asking price. Should we do it?

First-Time Homebuyers

Dear First-Time Homebuyers,

For some, it is a crazy real estate market right now! A member of our staff is trying to purchase her family’s first home, which has required them to offer up to 20% over the asking price in a very competitive real estate market. When they texted me this question, I did not know what they were talking about since I have never bid above asking for a home we tried to purchase. It took some research to understand the implications of this new trend in real estate.

Appraisal Gap

When a buyer makes an offer and the appraiser finds that the home’s value is less than the offer, a gap occurs. The home “doesn’t appraise” for the amount the buyer is willing to pay. When this happens, buyers may not find a lender willing to take the risk on a home that is valued for less than the purchase price. So the buyer must be willing to pay the difference in cash. An appraisal gap clause is an addendum to a contract confirming that the buyer will cover any difference between a home’s appraised value and the offer.

The rise of appraisal gaps is happening in parts of the nation where housing inventory is low and the demand for homes is high. Appraisals may not reflect the current value of a home. This happens when home prices accelerate fast. It gives sellers comfort in knowing a contract won’t fall through because of a low appraisal. It protects buyers from having to back out of a deal.

When a home is appraised, buyers have several choices to make. They can:

Consider Your Options

With an appraisal gap clause in your offer, you must buy the home even if it appraises lower than your offer. I recommend you avoid this due to the possibility that a market correction could create a situation where you are “upside-down” on your home or have “negative equity.” This would mean that you owe more or have more invested in your home than it is worth. Another option is to cap how much you’re willing to pay to cover the gap. This prevents you from spending more than you can really afford. Far safer for the buyer is to request an “appraisal contingency.” If the appraised value does not match a buyer’s offer, he/she can back out of the contract and keep any earnest money.

First-time homebuyers face many expenses other than the purchase of the home, such as moving costs, repairs, and upgrades or modifications to the house. It is wise not to overextend on the purchase price and deplete your savings. You will place yourself under enormous stress that can be unhealthy for your marriage and family.

Even though you may be renting now, you have a place to live, more time to accumulate savings for your eventual purchase, and the opportunity to take advantage of a better deal should market conditions change.

This is a good time to be patient and wait on the Lord. He knows your needs and will guide you to the best home for you in His time.

“Delight yourself in the Lord, and he will give you the desires of your heart. Commit your way to the Lord; trust in him, and he will act.” (Psalm 37:4-5 ESV)

While you are waiting on the Lord’s plan in the purchase of your first home, if credit card debt is an issue for your family, Christian Credit Counselors is a trusted source of help. They can help your family get on the road to financial freedom.

This article originally published on The Christian Post on March 18, 2022.

Dear Chuck,

I am being hit hard by the cost of gasoline. Haven’t you written about how to save money on this in the past?

Shocked By Gasoline Prices

Dear Shocked By Gasoline Prices,

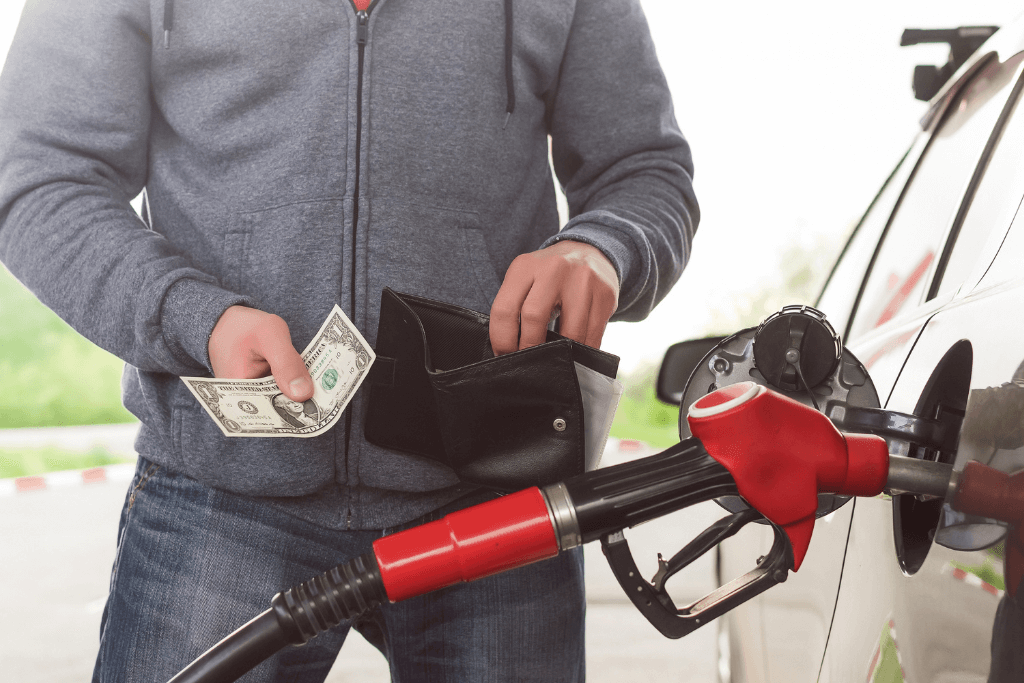

Yes, I have answered this question before but not during a time when prices were rising this sharply! You and millions of others are feeling the pinch at the pump along with all the other products impacted by the rising cost of oil.

Prepare to Pay More

Patrick DeHaan of GasBuddy says, “As Russia’s war on Ukraine continues to evolve and we head into a season where gas prices typically increase, Americans should expect to pay more for gas than they ever have before. Shopping and paying smart at the pump will be critical well into summer.” The chart below shows the trendline of gas prices from the last 18 months.

Here is a short list of things you can do to save some money:

Here is a short list of things you can do to save some money:

Effect on Consumer Prices

The cost of crude oil affects the prices of everything we buy due to the impact on shipping and trucking. Expect to pay more for food at the grocery store, when dining out, on heating bills, and on things made with petroleum, like plastics and fertilizer. Those who need a bigger car should be on the lookout for used models that sellers will unload if gas prices get exorbitant

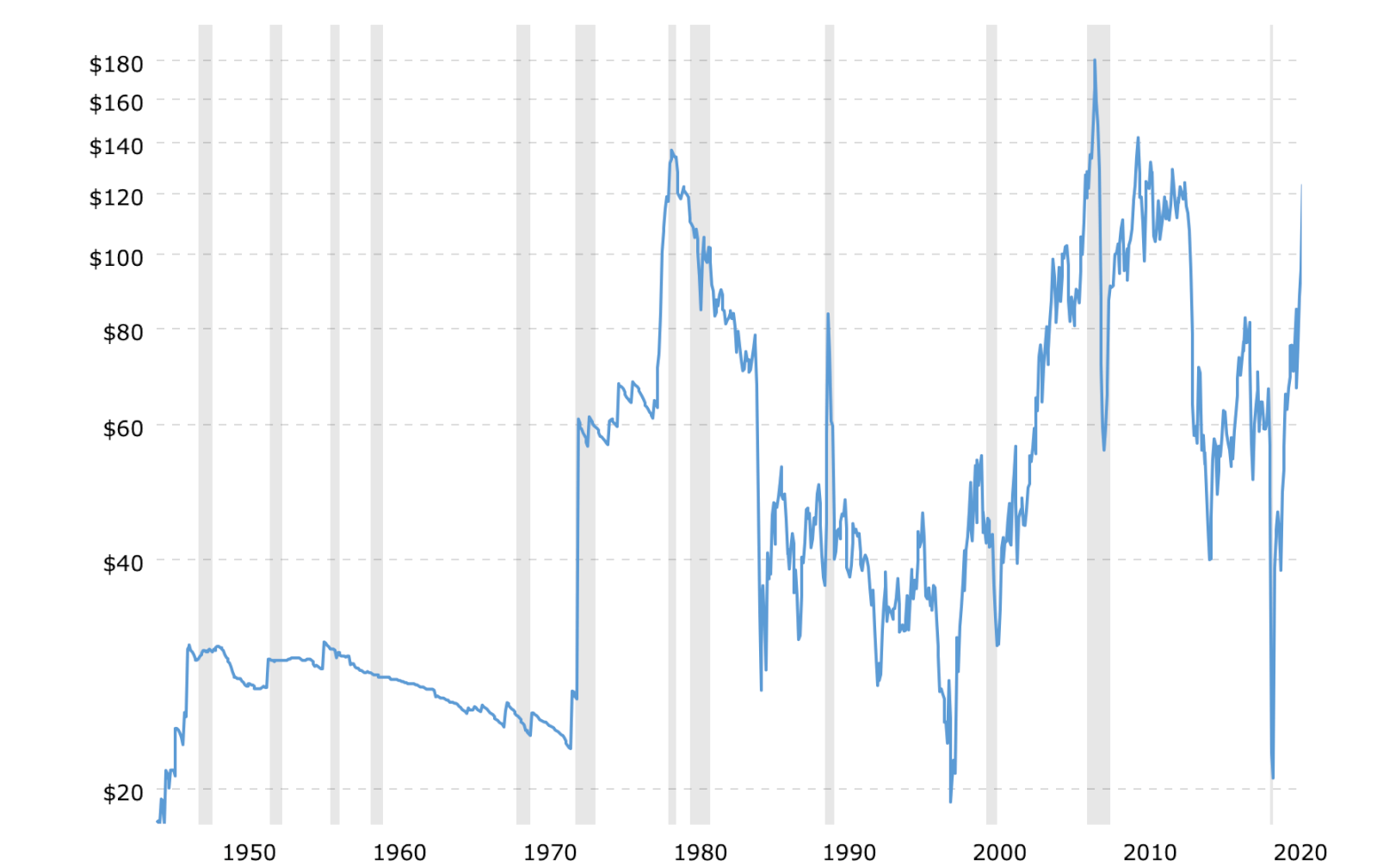

Keep It in Perspective

Crude oil prices fluctuate between extremes—often very quickly. Over the past 70 years, you can see in the chart below that these sharp spikes seldom last very long. Many believe that with the rise in purchases of electric vehicles, we will see a steady decrease in the price of oil. In the shorter term, a peaceful resolution to the war in Ukraine will hopefully reset the price—all the more reason to pray for peace.

A Recession?

Experts pose the possibility of this leading to a recession.

Troy Vincent, DTN senior market analyst, told CNET that if crude oil continues to rise, $6.50-$7.00 per gallon would not be impossible, though it could trigger a global recession.

Nicholas Colas, co-founder of DataTrek Research, covered the auto sector earlier in his career. He recently told msn.com: “The rule of thumb I learned from auto industry economics in the 1990s is that if oil prices go up 100% in a one-year period, expect a recession.” Thursday, March 4, 2021, crude oil was $63.81. Friday, March 4, 2022, WTI crude was $115. Monday, it touched $130 but dropped. In recent cycles, when oil gained 100% in a 1-year period, a recession occurred. This happens because consumers readjust their budgets so they can cut back, and spending declines. According to Kiplinger, the average length of recessions from 1857 forward is less than 17.5 months. This includes the 65-month recession of 1873 and the Great Depression, which lasted 43 months. (Check the website for more recession facts.)

Adjust Your Budget

Adjust Your Budget

Consider what you can give up to cover the higher cost of gasoline and consumer goods.

Turn down the thermostats, and dress in layers until temperatures rise this spring and summer.

Start a garden, grow some food, and shop at farmers’ markets. Supply an emergency long-term food pantry buying nonperishable food in bulk. Analyze vacation plans. Avoid extra airline fees when flying. Consider alternate means of transportation. It may be necessary to have a staycation or find a creative way to spend less while taking necessary time off.

Do Not Fear

When facing the lingering impact of the pandemic, a war, and inflation, there are many concerns right now. We can take comfort in God’s Word that reminds us that we have nothing to fear

Psalm 37:16 – “Better is the little that the righteous has than the abundance of many wicked.”

Psalm 112:7 – “He is not afraid of bad news; his heart is firm, trusting in the Lord.”

The Crown God is Faithful devotional provides inspiring and practical biblical wisdom. You can sign up to receive the devotionals daily to help transform not only your finances but also every area of your life.

This article was originally published on The Christian Post on March 11, 2022.