Dear Chuck,

Many of my single friends (divorced, widowed, and lifelong singles) are struggling to make ends meet. Is there an approach to managing money for those who are single and may never marry?

Advice for Lifelong Singles

Dear Advice for Lifelong Singles,

Thank you for the question. This is a very important trend that needs our attention. According to the U.S. Census Bureau, 28% of our population consists of one-person households. In 1960, that number was 13%. Today, half of American adults live with a spouse, down from 52% a decade ago. The number of those over 18 living with a partner but not married is up to 8%, double the number twenty years ago. People are delaying marriage and making critical life decisions later than previous generations. Birth rates have been dropping for decades, referred to as the “baby bust.” The number of younger people living with parents is also up. (Stats are from this article.)

Some singles delay marriage in hopes of getting their finances in order. Others have financial challenges as a result of divorce, death, pregnancy outside of marriage, or frivolous lifestyles.

Singles often miss the traditional milestones of buying a home, having children, and long-term financial planning. They must be extra cautious with their income and expenses while fully trusting God.

Financial Considerations for Singles

Living on one income today in preparation for tomorrow requires wisdom. My advice to singles, young and old, is to learn how to steward money. Handling money from a Biblical point of view will enable one to face the future without fear. Here is an approach that will help:

“Listen to advice and accept instruction, that you may gain wisdom in the future.”

(Proverbs 19:20 ESV)

Find trusted advisors who can direct one to take a short- and long-term view of finances. Goals must be set, and the same principles I give to others apply to singles:

Good Housing Decisions Are Key

Many singles cannot afford to buy a home nor have the resources to maintain one. Housing tends to be the largest fixed expense. Downsizing or relocating can eliminate some of the financial stress. Rising rents are now a problem; consider alternative housing options. If in a large home, it may be necessary to sell or rent out a portion. Temporary measures can be taken. Here are a few other options. Find a roommate, or move in with family members. If it’s an amicable relationship, one might be able to build and occupy a guest house on their property which will bless children and grandchildren for decades. Form a pod. It can serve to help everyone who lives together.

At one point, one of our sons and his wife lived in a big home with two other couples from their church. Each had their own wing, and it worked fine—until they started having babies. Living with others can solve loneliness and provide a measure of accountability. Housing prices and property taxes vary greatly across our country, so relocating can help if one can work remotely.

Living near family is important, but one must seriously consider the cost of living. Here are a few links to help make better decisions of where to live:

Prepare for Economic Turbulence

Inflation and recession are concerns for all of us, single or married. We do not know what the future holds, but we know that economic conditions are always fluctuating. Abiding by Biblical financial principles and making wise choices can cushion the fallout we may experience in the coming months.

In addition, variable expenses should always be closely analyzed. Look back over credit card and bank receipts to see how much is being spent on food, prescriptions, utilities, and entertainment. Seek discounts, eliminate waste, and make some cost-saving sacrifices. I am not a kill-joy; I just know that many people need to find creative ways to reduce their spending. Record all spending for 30 days to see where dollars go. We are facing uncertain economic times, so we need to be extra savvy. Frugality does not mean misery. It can provide freedom!

More Resources

Here is additional information for older adults:

I know an older woman who rotates time living with her adult children and their families. She does not have a permanent residence. It is a mutual blessing for her, the children, and grandchildren. Others are lovingly cared for by nieces or nephews. Sometimes siblings or close friends choose to live together and split bills.

New widows and widowers have to manage money while dealing with grief. It is a difficult time. Here are some tips for survivors. Organized files and records are a gift for those left behind at death.

Thank you for a great question! My hope is you can share this article with those you are trying to help.

A trusted source of guidance for those dealing with credit card debt is Christian Credit Counselors. They can help get anyone on the road toward financial freedom.

This article was originally published published on The Christian Post on July 22, 2022.

Dear Chuck,

I am a single parent trying to manage life on a limited budget. I am extremely fearful about being unable to provide for my two children with the high cost of everything. I have a decent job, but I need to figure out how to afford childcare! It is getting crazy.

Stressed Single Mom

Dear Stressed Single Mom,

I am so sorry. This inflation has taken a toll on so many, but for single parents, it is especially difficult.

My Mom’s favorite verse was Romans 8:28. She actually had a business card with this verse printed on it and her name and phone number beneath it:

“And we know that for those who love God all things work together for good, for those who are called according to his purpose.” (ESV)

Before I give you my tips, I suggest that you memorize this wonderful promise. It brought my Mom through many difficult challenges.

A Childcare Crisis

My wife recently talked with our new dental tech and learned that she is a single mom. When asked what her biggest challenge was, she immediately answered, “Childcare. It’s so expensive.” She proceeded to tell her story of going through an unwanted divorce and living with her parents until her newborn started pre-school. Her mother cared for him during the day so that she could work. She now has her own place. Last year, she gave up childcare for financial reasons, and her 8-year-old went home to an empty house until she got off work.

Cost of Childcare

Parents are concerned with the cost, availability, and quality of care for their children. Many say that we’ve gone backwards in each of these areas. Care.com conducted a cost-of-care survey this year. It revealed that childcare is more expensive now for a majority of parents. Thousands of daycares closed between December 2019 and March 2021. As a result of this and the economic situation of our nation, childcare centers have increased costs and are taking fewer children.

More than half of the families in America plan to spend more than $10,000 a year on childcare. This amounts to more than the average cost of in-state college tuition. Half of the parents surveyed say they spend more than 20% of their annual household income on childcare. 72% report they spend 10% or more. According to the U.S. Department of Health and Human Services, childcare is considered affordable at 7% of the budgeted household income.

The average cost for one child per week in 2021:

Childcare centers across the country are having to raise their prices. One center in Georgia reported that they have had to adjust wages for their employees to cover high gas prices and food. The cost for school supplies at centers has nearly doubled in the past year. Covid and inflation have impacted parents, children, and employees in countless ways.

Effect on parents:

Financial Advice

Becoming Aware and Available

The Body of Christ must be sensitive to the needs of single mothers, fathers, grandmothers, or grandfathers who are entrusted with raising children today. Assistance with housing, cars, insurance, legal issues, and yes, childcare, can bless generations. May God open our eyes to the needs around us. For all single parents and grandparents, may He be your source of strength and wisdom.

“Trust in the Lord with all your heart, and do not lean on your own understanding.

In all your ways acknowledge him, and he will make straight your paths.”

(Proverbs 3:5-6 ESV)

While seeking the Lord’s guidance, if credit card debt is adding to your financial pain, Christian Credit Counselors is a trusted source of help toward financial freedom.

This article was originally published at The Christian Post on July 15, 2022.

Dear Chuck,

I hear you say spend less than you earn. I’ve tried, but I can’t. I really want financial freedom, but how do I get it when I don’t make enough money?

Seeking Financial Freedom

Dear Seeking Financial Freedom,

I am sorry for the pain you are experiencing. The reason I emphasize the importance of spending less than you earn is that regardless of your income, spending more than you earn will make you feel poor and keep you under constant financial stress. It is the key to all good financial management. So how do you do this? Let’s walk through the steps.

Make a Plan

The old saying is true: failure to plan = plan for failure. We have no record of Jesus instructing the disciples in the use of a budget. But we know they used money, contributed to the poor, paid taxes, and had a traitorous treasurer. We also know Jesus taught about the foolishness of beginning a project without knowing the cost and being sure of the resources to complete it. (Luke 14:28-33)

A spending plan (budget) enables you to thoughtfully tell your money where you want it to go rather than regretfully wonder where it went! Well-considered decisions in the planning stage create a template that makes subsequent decisions almost automatic. You will eliminate the “should I or shouldn’t I” sweating over every purchase. The plan knows if you should or shouldn’t!

Find Financial Margin

Most Americans have money but no margin. It is the gap between your income and what you spend—or margin—that restores your financial freedom, regardless of your income.

The following steps will help you find margin. You will discover whether you need to reduce your expenses, raise your income, or both. There are fixed expenses: those that are stable from month to month, like rent/mortgage, insurance, etc. And there are variable expenses: those that fluctuate, like food and entertainment. Invest your time wisely to do this right. Take Solomon’s advice seriously: “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” (Proverbs 21:5 NIV)

For help or accountability, we have online budget coaches who are trained to analyze and assist individuals in their unique situations.

Find Financial Freedom

Margin will grant you the ability to save and invest. This will ultimately reduce financial fear and stress which can promote restful sleep, work productivity, and overall health and happiness. In addition, generosity and contentment will lead to a new level of hope and joy. The greatest thing you will discover is the flexibility to follow wherever the Lord leads you, and that will ultimately impact your eternal rewards.

The goal of Biblical stewardship is not to order your finances in a way that you can spend whatever you want; it is ordering your life in such a way that God can spend you however He wants. This is the ultimate freedom that can be yours regardless of your income.

My personal turning point came when I began to learn God’s financial principles. I learned to give first and save second. This changed my priorities and helped me to be better at spending what remained. When giving and saving were last in my priorities, I struggled in all areas of managing money. Seeing myself as God sees me, as His steward, changed everything. I hope you will experience the same.

Thanks for writing. Let us know how we can help!

The Crown Stewardship Podcast is a valuable resource to help guide you in the many facets of God’s financial principles. You can subscribe for alerts of new episodes. I hope you find it encouraging and beneficial!

This article was originally published on The Christian Post on July 8, 2022

Dear Chuck,

My wife and I are not consistently managing our money well. We are united to eliminate debt so that we can give, save, and invest more. I am looking for tips for the two of us.

Getting on Track Together

Dear Getting On Track Together,

Your goals are great and in the proper order of priority. You can actually give, save, and invest more while also working towards getting out of debt. The journey may be hard, but it will be well worth it.

Lessons from #75Hard

You have probably heard about the 75 Day Hard Challenge or #75Hard. It is for those seeking to build healthy habits and mental toughness. Participants are to follow five rules for 75 days. If you fail on any one day, you must start over from day one. Social media has exploded with photos of people posting their progress. Here’s the challenge:

Now, if you are the least bit competitive, a financial challenge of any length can be beneficial as well. Whether needing to pay down debt, build emergency savings, or give more generously, repetitive days of healthy practices with money is the method that will ensure good habits that you can both follow.

Suppose you do a 60 Day Financial Hard. It might look like the following:

*Suggested Books/Courses

Get Control of Your Spending

Getting out of debt and achieving any financial goal that you set will require the discipline to change the way you spend money. The better you are at spending, the better you will be at managing money overall. It takes wisdom and character to become unwilling to spend all that you earn.

When tempted to buy something on an impulse (not in your budget), develop a means to say no. Try turning your shopping cart around, walking out of the store, or closing your computer to gain perspective. Give yourself at least 24 hours to think and pray about it. Jesus said, “It is more blessed to give than to receive.” (Acts 20:35b ESV) So, when tempted to buy something for yourself, choose to give something away instead.

If friends invite you to participate in an activity that costs money, suggest something else, or take a pass. If you cannot influence them to spend wisely, then perhaps you need to pray about who you spend time with. We are often influenced by others, as evidenced by the negative effects of social media and FOMO (fear of missing out).

It is helpful to remember a verse that the Apostle Paul used when warning against idolatry.

Use this verse when confronted with a desire to spend money when you know you should not.

“No temptation has overtaken you that is not common to man. God is faithful, and he will not let you be tempted beyond your ability, but with the temptation he will also provide the way of escape, that you may be able to endure it.” (1 Corinthians 10:13 ESV) That’s comforting!

For a giving challenge, train like a marathoner. For some saving challenges, check out these ideas:

Tracking Together

Regular, non-judgemental communication will go a long way helping you track with your wife. Consider a weekly event such as an old fashioned walk in the park or a meal out at an affordable restaurant to discuss progress toward your customized 60 Day Financial Hard challenge. Pray about areas where you have challenges meeting your goals, resolve to make needed changes, and press on. After the challenge is complete, keep up the habits that set you on the right track. This can be a life-changing opportunity, so don’t let the Enemy prevent you from making progress!

If trying to steward well, I recommend Squeeze—a trusted Crown partner. The company shops household bills to bring you the lowest rates and best deals. Savings are quick and can last a lifetime. Sign up for free, and squeeze your first bill in under five minutes.

This article was originally published on The Christian Post on July 1, 2022.

Dear Chuck,

I’m concerned about our economy tanking. Larry Burkett wrote a lot about our national debt and out-of-control federal spending that would likely lead to hyperinflation. Where do you think our economy is headed?

Trying to Understand the Times

Dear Trying to Understand the Times,

Only God knows the answer to your question, but He also gave us minds to think and reason. The U.S. economy has proven incredibly resilient over many decades, so I am reluctant to buy into any forecasts of impending doom. At the same time, Proverbs 22:3 instructs us to be “prudent” when it comes to situational awareness. This means we should neither be rash and respond emotionally or be paralyzed by fear. So let’s look at where some of the experts think we are headed.

Where Is the Economy Going?

We heard that inflation was transitory back in 2019, but by the end of 2021, we knew that description was false. Just 2 weeks ago, it was falsely reported that the U.S. had the fastest growing economy in the world, when in fact the U.S. economy shrank in the first quarter of 2022. The cost of inflation is being felt in numerous ways. Food, fuel, consumer goods, housing, and labor costs are challenging most Americans.

One month ago: Elon Musk said he thought the U.S. was already in a recession that could last 12–18 months.

June 11: Michael Burry, the ‘Big Short’ investor, warned that inflation will soar higher, putting greater pressure on the housing market, eroding buying power, and negatively impacting consumers’ savings.

June 13: Larry Summers, former Treasury Secretary, warned that the Federal Reserve’s forecasts on inflation have been “much too optimistic” and that we are on the edge of a recession. He thinks there’s a risk of it occurring in the next year. “We’ve had them for the whole history of the country. We need to be prepared and to respond quickly if and when it happens.”

June 13: A Financial Times poll reported that nearly 70% of leading economists expect that inflation will cause a recession. The majority predict it to hit the first or second quarter of 2023.

June 13: The Daily Torch reported, “The spread between 10-year and 2-year treasuries, a reliable indicator of incoming recessions that has predicted almost every recession in modern economic history, inverted once again overnight on Jun 13 amid financial markets turmoil with interest rates rising rapidly, the dollar strengthening and equities market crashing.” The same inversion occurred March 31 upon the onset of war in Ukraine. A recession typically occurs an average of 14 months after an inversion.

June 15: The Federal Reserve enacted the steepest rate hike in 28 years in an effort to battle inflation.

June 17: Deutsche Bank expects an “earlier and somewhat more severe recession,” a 3.1% contraction of GDP in the third quarter of 2023.

June 20: Economists at Japanese investment bank Nomura believe inflation will “remain elevated” throughout 2022 but a “mild recession” will hit around the end of 2022.

Mark Zandi, chief economist at Moody’s Analytics, recently noted that recession risks are “uncomfortably high and rising.” In addition, “For the economy to navigate through without suffering a downturn, we need some very deft policymaking from the Fed and a bit of luck.”

Understanding the Times

I don’t believe in luck. None of us know what the future holds, but we do know that God holds the future! As you expressed in your question, we need a clear understanding of the times to know what to do. (1 Chronicles 12:32)

We have been hearing about the possibility of a significant recession for more than a decade. It will come in time, so it is good to live ready for any economic change, whether inflationary or deflationary. Here is my advice:

Do Not Fear

“God is our refuge and strength, a very present help in trouble. Therefore we will not fear…” (Psalm 46:1-2a ESV)

“…fear not, for I am with you; be not dismayed, for I am your God; I will strengthen you, I will help you, I will uphold you with my righteous right hand.” (Isaiah 41:10 ESV)

Prepare

To step back from an economic cliff, you must decide to be deliberate and disciplined. Spend wisely. Look for ways to reduce necessary expenses and to eliminate the unnecessary ones. Download our Inflation Survival Guide, and adjust your lifestyle as needed. Pray for self-control, yet celebrate each new day with joy and anticipation.

Recognize the Opportunity

The Crown Stewardship Podcast is a valuable resource during these uncertain times. It is a wonderful tool to help guide you in the many facets of God’s financial principles. You can subscribe for alerts of new episodes. I hope you find it beneficial and encouraging.

This article was originally published on The Christian Post on June 24, 2022.

Dear Chuck,

We tried to live on a budget when we first got married but didn’t stick with it. Now that we have children and are feeling the pain of rising gasoline and groceries, etc, etc., we need to get disciplined with money! Can you help us?

Budgeting for Inflation

Dear Budgeting for Inflation,

We are all having to navigate the dangerous challenges to our finances caused by inflation. To help you get serious about your budget, I reached out to Steve Brooks at Dedicated Money Management. Steve is a dear friend who served on staff with CRU for 21 years and Crown for 27. He has been a trained budget coach for over 20 years, helping tens of thousands of people manage money from a Biblical perspective. He answered a number of questions that will help you get on the right track.

Why don’t more people live on a budget?

Steve: I think there are three main reasons why people do not stay on their budgets:

I teach my clients that God is the Owner of all that they possess. They are stewards of His money and possessions. If they do not get this right, they will never become “good and faithful stewards” of God’s money and possessions. If I do not have a spending plan (budget), I am probably spending God’s money the way I want to spend it instead of the way He wants me to spend it.

What is the best way to get the right perspective on budgeting?

Steve: I ask my budget coaching clients two important questions:

This is the appropriate thing for a money manager/steward to do.

Do people need special skills to make this work?

Steve: I want my clients to become “budgeters,” not “accountants.” The difference is that budgeters check the category balance throughout the month before making a purchase to make sure they have enough money set aside for that purchase.

What tools do you recommend?

Steve: Choose a budgeting tool that works best for you.

What about those who say they don’t make enough to budget?

Steve: If one is unable to live on a budget because income is too low, consider these options:

What are the behaviors needed to budget well?

Steve: This is a great question and an important one to make the budget work well!

What are the beliefs that you want your budget coaching clients to know and believe?

Steve: All of these are Biblical principles that I can summarize:

Thank you, Steve!

General Principle to Follow

Since overall inflation is estimated to be between 8–10%, I suggest you reduce all spending by the same amount to ensure you are keeping up. You also need to increase your emergency savings, as you are able, to ensure you can navigate any disruptions to your income should inflation hurt your job or career.

Hopefully these ideas will set you on a course to develop your budget, stick with it, and navigate the rapidly changing effects of inflation on your finances. If you want help creating and staying on a budget, reach out to Steve today, or contact Crown to enroll in our Budget Coaching Program.

This article was originally published on The Christian Post on June 17, 2022.

Dear Chuck,

I began participating in my company’s 401K when starting my first job out of college last year. I know I should be giving and setting aside funds for emergencies, too. But where should I start?

Novice with Money

Dear Novice with Money,

It’s refreshing to hear from someone your age who’s already investing yet also desires to give and save! Most of our financial challenges can be resolved if we follow a simple, biblical practice: “Give First, Save Second.” It is easy to say but often a challenge to implement, so I have jotted down some tips for you below.

Givers

Since God is a giver, recognize and consider yourself a giver as well. This goes beyond simply practicing the act of giving to taking on the identity of a giver created in the image of God.

“For those whom he foreknew he also predestined to be conformed into the image of his son…” (Romans 8:29a ESV)

Savers

Saving does not represent a lack of faith, but it does reflect the heart of a faithful steward. Savers have resources to take care of their families and others, but saving to become self-reliant and take life easy is condemned in Scripture. We must learn to save in order to reduce stress, increase our capacity to give, and live without fear of economic challenges.

Think Beyond This Life

We should desire to steward wisely whatever God has entrusted to us because one day we will give an account.

“As for the rich in this present age, charge them not to be haughty, nor to set their hopes on the uncertainty of riches, but on God, who richly provides us with everything to enjoy. They are to do good, to be rich in good works, to be generous and ready to share, thus storing up treasure for themselves as a good foundation for the future, so that they may take hold of that which is truly life.” (1 Timothy 6:17–19 ESV)

With prices rising everywhere, it can be harder to budget for the future and can cause extra anxiety. For help with understanding inflation and to make a plan, Crown has a new Inflation Survival Guide that you can download and share with others.

This article was originally published on The Christian Post on June 10, 2022.

Dear Chuck,

My spouse believes we need to protect our home with a title lock. I disagree but agreed to check around. We have title insurance, so do we really need a title lock?

Title Lock or Title Insurance?

Dear Title Lock or Title Insurance,

This is a complicated but important question that impacts every homeowner. I will sort out the difference between a Title Lock and Title Insurance then give my advice.

Title Insurance

There are two types of title insurance: Lender’s and Owner’s.

Both forms of title insurance are worth the one-time cost which varies based on the price of the home. Bankrate.com offers several ways to save when purchasing title insurance.

Title Lock

There are TV ads and people claiming that Title Lock will protect against title fraud. This occurs when someone forges your name on a deed and files it with the county courthouse. Using the house as collateral, he/she is then able to borrow money against it. Although rare, it is a growing crime. Title Lock is not insurance; it is simply a monitoring service that periodically checks to see if your title has been transferred out of your name. Notification comes after it happens and does not solve the problem. See this brief explanation at Fox5Atlanta.com.

My Advice

Title insurance is what protects you. The title company must fix the problem and cover any costs involved. The elderly, or those who do not understand their rights, are frequently targeted. The crime is most successfully committed against those who fully own their home and are clear of any debt on it. Should a scammer illegally claim ownership to a home, he would have to prove the validity of the signature of the deed. Punishment for the crime of forgery in the first degree is imprisonment.

In most counties, you can access county property records online and do the checking yourself. So paying for Title Lock is an unnecessary expense. Companies that offer Title Lock services benefit from fears they create.

Some other ways to protect yourself from title fraud:

If you believe that you are a victim of identity fraud, immediately seek help. Experian offers tips.

My wife and I have purchased title insurance on every home we have ever owned and suggest that you do the same, but I find no reason to purchase the services of Title Lock.

The Crown Stewardship Podcast is a valuable resource to help guide you in the many facets of God’s financial principles. You can subscribe for alerts of new episodes. I hope you find it beneficial!

This article originally published on The Christian Post on June 3, 2022.

Dear Chuck,

I am stunned at the rising cost of our medical bills. It’s the first time in our lives that we haven’t been able to cover them within a month. We are now on a payment plan and are praying we don’t need to see a doctor again for some time! If you have any tips for us, please advise.

In a Financial Panic

Dear In a Financial Panic,

I am sorry for what you are going through, and I feel your pain! In the past twelve months, I have had to pay for two major medical expenses, one to repair an injury to my knee and the other for oral surgery. The dental implant and new crown will cost about $7,000 when it is all said and done. Our insurance covered only $1,000 of the dental expenses! While this is a widespread problem and a frightening experience, there is no need to panic.

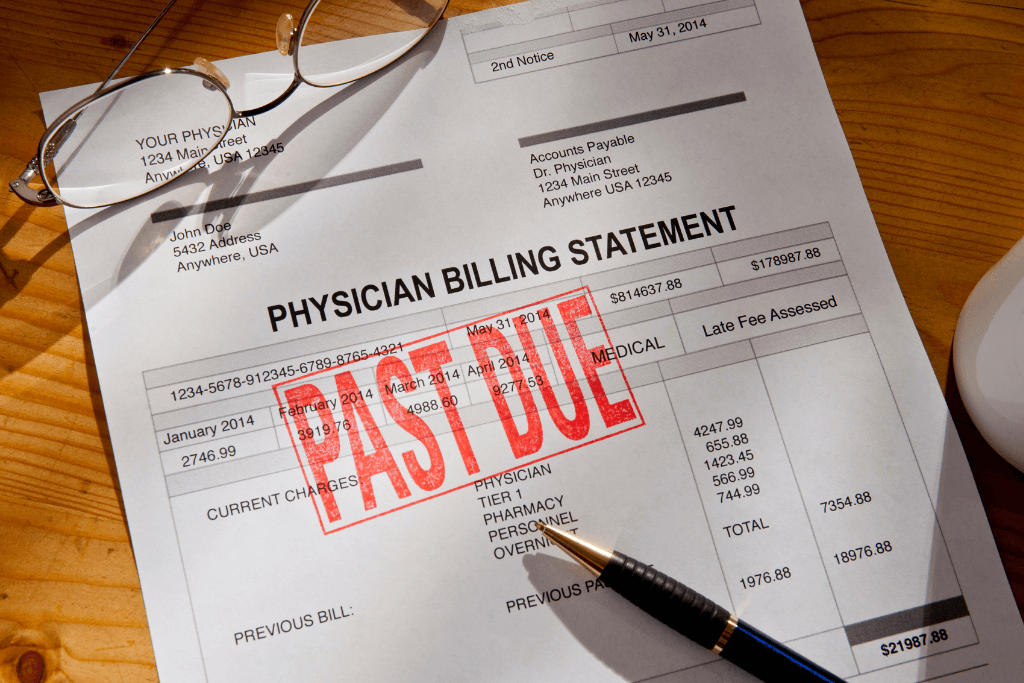

Medical Related Debt

Medical expenses are a leading cause of debt for Americans, and the strain is affecting many. With inflation hitting nearly every budget category, it is no surprise that medical debt is rising.

A Forbes article quotes Jonathan Walker, executive director of the Center for the New Middle Class: “The increase in the number of households that are feeling the pinch is concerning. . . . I was amazed that inflation in this category would impact consumers so quickly.” Covid added to the pain. In September, Credit Karma reported that its members took on an additional $3.6 billion in medical debt during the pandemic.

The Consumer Financial Protection Bureau (CFPB) found that 1 out of 5 U.S households have medical debt. When these show up on credit reports, it makes it more difficult to attain housing, get credit, or find employment. CFPB also reports that medical collections accounts appear on 43 million credit reports, accounting for $88 billion in medical debt. Prior research reveals that medical debt is not a predictive indicator of a person’s credit risk. Thus, on July 1, Equifax, Experian, and TransUnion will no longer include medical debt that was paid after being sent to collections. This will help millions. More information will be released as we approach that day.

The Kaiser Family Foundation did an analysis of US Census Bureau data and found that more than 90% of the nation has health insurance. However, medical debt is a major problem due to high deductibles and out-of-pocket expenses. 9% of adults owed more than $250 in health-related charges, which Kaiser describes as significant debt. 1% owed more than $10,000, accounting for the majority of all medical debt owed. It’s believed that more people struggle than what is documented because credit reporting companies can’t see all the medical debt. Plus, not all adults have credit reports.

How to Avoid or Reduce Medical Debt

Remain Hopeful

God can provide resources for medical bills from unexpected places. I’ve seen it happen to others and have experienced it myself. Do not lose heart. Ask the Lord to provide or stretch the resources you have. He can do anything! Remember, times like these give us greater compassion for those with medical conditions and debt that are worse than we can imagine.

Your pain will translate into a genuine concern for others with a similar problem. Someone you know may need emotional and prayer support. Even if you are unable to give them financial support, God can use you to share what you have and grant hope to others.

“Rejoice in the Lord always; again I will say, rejoice. Let your reasonableness be known to everyone. The Lord is at hand; do not be anxious about anything, but in everything by prayer and supplication with thanksgiving let your requests be made known to God. And the peace of God, which surpasses all understanding, will guard your hearts and your minds in Christ Jesus.” (Philippians 4:4-7 NIV)

While seeking the Lord’s guidance, if credit card debt is a source of your financial pain, Christian Credit Counselors is a trusted source of help. They can help your family get on the road to financial freedom.

This article was originally published on The Christian Post on May 27, 2022.

Dear Chuck,

I am a single mom with 3 children trying my best to manage my limited resources. It is becoming more and more challenging due to inflation, and at times, I get very overwhelmed. I want to be independent but have not been able to break free of government support programs. What should I do?

Overwhelmed Single Mom

Dear Overwhelmed Single Mom,

I am so sorry for the pain you are in right now. Everything is getting more expensive, and you are likely feeling it more than most others. My respect for single mothers who work hard to free themselves from government assistance and provide for their children is very high. Because of that, I write a quarterly article for The Life of a Single Mom—an online organization that connects single moms and provides helpful resources.

Crown is currently working with a group of young single mothers who meet weekly in a Bible study. Our purpose is to help them identify and act upon four things about themselves: their true identity, their God-given purpose, an inventory of all the tangible and intangible assets they have, and a plan to overcome their challenging economic circumstances.

It has been a rewarding experience for each of them and a great learning experience for us. Their honesty and transparency has expanded our understanding and empathy for these moms. We hope to develop a program that is transformative for those who live with overwhelming financial challenges.

Many of the young ladies share common problems: limited resources, limited time, and limited community that they can trust. Some have been rejected by their own families because they chose to have the child without marrying the father. While I cannot stop the damage being done by inflation, I can suggest you connect in a community of people who can help in all the areas where you are feeling the pain. This small step can be priceless.

Economic Value of Being in Community

A community can provide basic financial help, guidance, and a network of others with needed resources. Here are some practical helps that can come from being in a good Church, Bible study, or volunteer organization of Christians:

A community can also serve in areas like:

Plugging into the Right Community

Because there is true economic value living in community, I encourage you to take steps to improve this part of your life. It’s important to find a trusted group where you can be transparent and not worry about being judged. Online groups serve their purpose, but you need real people in your life. It must be a place where you can give and accept from others, knowing that you are all serving Christ. If you are with people you trust, you can forget your past and look forward with hope. This can be a small group, a Bible study, a Women’s Ministry, a charitable organization where you serve, or a local Church.

Serving one another in community moves us out of isolation. It builds confidence and courage and motivates us to work as unto the Lord. We learn how to have fun, be creative, accept correction, and be accountable. Financial healing and strength can be experienced when people help guide us. They help us learn to live with greater margin as we practice Biblical financial stewardship. This results in less fear, stress, doubt, burnout, and debt.

Do not let pride prevent you from moving forward and discovering what God has for you. Trust the Lord. Or, as one person told me, “Collapse yourself on the Lord,” and abide among His people. The Body of Christ is a place to serve and a place to be served—a place to experience love, acceptance, encouragement, and hope. This is how you will grow in courage and faith.

At a very minimum, I suggest you seek out several wise mentors who can give you financial advice when needed. A friend calls this group of advisors her Ironing Board because they help her iron out her problems. She goes to her four volunteers for advice as needed. None of them has anything to gain by helping her—just a shared joy in watching the progress she makes.

“Let us hold fast the confession of our hope without wavering, for he who promised is faithful. And let us consider how to stir up one another to love and good works, not neglecting to meet together, as is the habit of some, but encouraging one another, and all the more as you see the Day drawing near.” (Hebrews 10:23-25 ESV)

A community of like-minded individuals can walk you through financial challenges and hold up your arms when you grow weary. Your needs may grant someone else the opportunity to fulfill God’s purpose in his/her life. Taking small steps will have a big impact towards your goal of financial independence! Thank you for your desire to overcome these challenges. Keep us posted on your progress.

In these inflationary times, I recommend you check out Squeeze—a trusted Crown partner. The company shops household bills to bring you the lowest rates and best deals. Savings are quick and can last a lifetime. Sign up for free, and squeeze your first bill in under five minutes.

This article was originally published on The Christian Post on May 20, 2022.