Dear Chuck,

I’m 64 and like my job as a plant supervisor. I plan to continue working until I am 70. Is it better to begin drawing full Social Security at age 66 or wait until 70 and get the higher amount? I am getting conflicting advice.

Not So Secure

Dear Not So,

You ask a loaded question because none of us know how long we’ll live! So, setting aside the unknown factor of our actual lifespan vs. our expected life span, I will provide some input to your question.

Although Social Security administrators have incentivized us to wait until 70 by providing us a larger monthly income, it is not necessarily the best choice as I will attempt to show. No doubt, it is a complicated equation with a number of variables including your health, financial condition, lifestyle and retirement plans. I will cover the basics here.

The Social Security Act was passed by Congress as part of the New Deal in 1935. It was our government’s attempt to help the elderly, unemployed, widows, orphans, and impoverished impacted by the Great Depression. Today, Americans associate it with retirement income. In fact, a survey from TransAmerica reveals that most seniors expect Social Security to be their primary income.

Retirement is a major concern among many because they are not saving or have not saved enough. In a recent report, Google revealed the 10 most asked questions about retirement:

Social Security benefits are based on the top 35 years of earning history and determined by the age one begins collecting. It is possible to begin claiming benefits at 62, but to get 100% of the benefits, one must wait until full retirement age (FRA). For those born between 1943-1954 that age is 66; those born between 1955-1959 – age 66 plus several months; and for those born after 1960 – age 67.

The average retiree draws $1,461 a month or $17,532 in a year, enough to replace about 40% of the average American’s pre-retirement income. This makes saving, investing, and other sources of income imperative to reduce personal and family stress when work is no longer possible.

My father, like many he knows, could not imagine living into his 80s, but he has. Others, younger than him, fear running out of resources as they will likely live longer than ever expected.

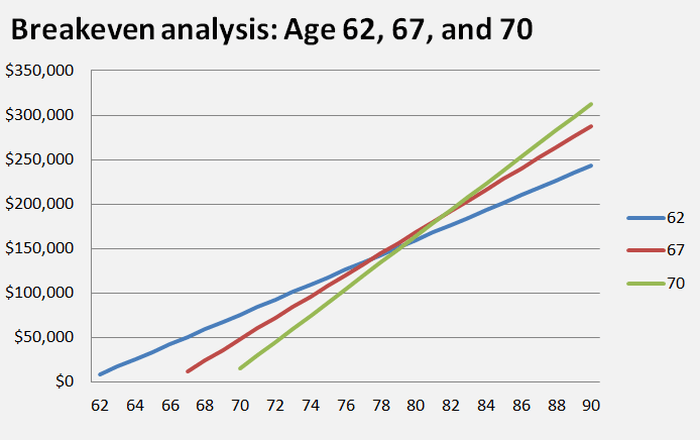

It’s important to answer the questions. As shown below, someone at the full retirement age of 67 will collect more in benefits if they begin drawing at 62 instead of 70 until they reach their late 70s. If one begins at 67 they earn more than starting at 70 until the breakeven point of age 81.

As you can tell, breakeven occurs at a similar age range regardless of the choice you make, but the overall income received will largely depend on how long you live.

Data source: https://www.fool.com/retirement/2018/06/23/is-62-the-best-age-to-start-drawing-social-securit.aspx

Data source: https://www.fool.com/retirement/2018/06/23/is-62-the-best-age-to-start-drawing-social-securit.aspx

According to InvestorJunkie.com:

A couple of websites for planning purposes include: Social Security Administration Information and Estimator and Bankrate’s Social Security Benefit Calculator

According to ssa.gov, you can work while receiving Social Security benefits, but there are limits.

However, ssa.gov states: If your earnings will be over the limit for the year but you will be retired for part of the year, we have a special rule that applies to earning for one year. The special rule lets us pay a full Social Security check for any whole month we consider you retired, regardless of your yearly earnings.

It’s been suggested, that if married, and both spouses work, the higher earner should delay withdrawing until full benefits kick in so the survivor can receive the highest benefit for the rest of his/her life.

A friend of mine ran the numbers. He says collecting the full benefits at 66 or 67, though less, outweighs the benefit of waiting until the age of 70 for the larger monthly payment. He claims that the government benefits when people wait until 70 to begin withdrawing.

I used to think I would wait until 70 to draw Social Security benefits. But, I could begin drawing once I reach full retirement age, invest it and continue working!

Remember that we have no guarantee how long we will live.

Come now, you who say, “Today or tomorrow we will go into such and such a town and spend a year there and trade and make a profit”— yet you do not know what tomorrow will bring. What is your life? For you are a mist that appears for a little time and then vanishes. (James 4: 13-14 ESV)

Obviously, there are also great concerns regarding the solvency of the SS Administration and their ability to fund the enormous obligations of the program. I have not addressed those concerns but don’t think for most that should be a significant factor in when you decided to take your benefits.

I think it is a good plan to wait until you reach full retirement age to begin drawing your social security benefits and continue to work. This will enable you to invest up to 2 or 3 years of this income and accelerate the growth of your funds before you have only the social security as your primary income.

Originally published on the Christian Post, May 24, 2019

Subscribe for Weekly Updates

"*" indicates required fields

Search

Christian Credit Counselors

Is credit card debt causing you stress and strain? Christian Credit Counselors would like to help!

Notifications