Dear Chuck,

My wife and I are considering buying a house now although it’s a year earlier than we planned. We don’t know if the low rates will be available next year. Should we go for it?

Buy or Hold?

Dear Buy or Hold,

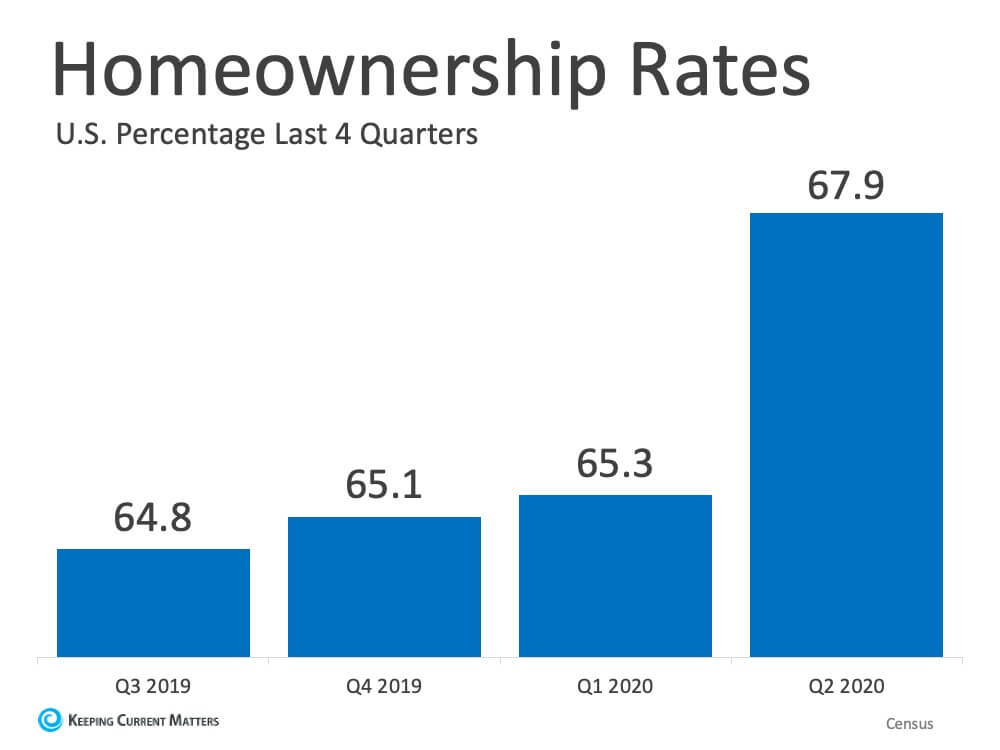

You and your wife are not the only ones with this mindset. Homeownership is on the rise in different parts of the United States. People have been stuck at home with time to research available inventory in different parts of the country. The historic low mortgage rates and pandemic fears along with the flexibility of remote work are propelling many to buy. Some are seeking to leave areas where crime and disruptive protesting have impacted their livelihoods.

It is a good time to buy a home, but only if you are ready. Let’s look at the trends first then some pros and cons of buying now.

(Image source: https://www.keepingcurrentmatters.com/2020/07/29/homeownership-rate-continues-to-rise-in-2020/)

You can read Zillow’s Forecast here. I have pulled some of the highlights which point out that rates are low, but so is inventory:

Low mortgage rates are poised to stay for a while, so buyer demand should stick around even as seasonal headwinds start to form. Although, there are some storm clouds gathering. Broader uncertainty due to the surge in coronavirus cases and the prospect of disappearing fiscal support pose looming limitations as well. Historically low levels of for-sale inventory also has the potential to thwart the strong gains the housing market has recently enjoyed, and while for-sale inventory rose slightly in June, inventory remains significantly below last year’s levels. The coming months will be a true test of the housing market’s enduring strength and resilience.

There are benefits to homeownership that include safety, security, and accessibility to desired education and lifestyle opportunities. Habitat for Humanity acknowledges the crucial role of homeownership in society:

Habitat for Humanity knows that safe, decent and affordable shelter plays an absolutely critical role in helping families to create a new cycle, one filled with possibilities and progress. Affordable homeownership frees families and fosters the skills and confidence they need to invest in themselves and their communities. The outcomes can be long-lasting and life-changing.

Studies conducted by academics and experts draw a straight line between housing quality and the well-being of children. Surveys of Habitat homeowners show improved grades, better financial health, parents who are more sure that they can meet their family’s needs. Wherever we work, we witness tangible evidence that strong and stable homes help build strong and stable communities.

The biggest financial decision most of us ever make is buying a house. Too often in America, we find couples who are “house poor.” This means that they were convinced they should stretch to buy a home in their preferred neighborhood, their preferred school district, or with their preferred amenities, only to get several months into it and find they stretched too far.

If your total housing expense–which includes your rent or mortgage, insurance, taxes, maintenance, and utilities–is 40% or more of your total income, it will likely cause financial stress. Plus, it restricts the ability to give, save, and invest.

Keeping your total housing expense at 30% or below will relieve a great deal of stress. Have a look at our free mortgage amortization calculator. Be sure to include these items in your budget:

But godliness with contentment is great gain, for we brought nothing into the world, and we cannot take anything out of the world. But if we have food and clothing, with these we will be content. (1 Timothy 6:6-8 ESV)

It is always good to be patient. I am curious as to why you were planning to buy a year from now. If you were waiting to save more for a down payment, or to be in a better position with moving expenses, by all means, wait. Those who are content and patient make far better decisions than those who are hasty and impatient.

I hope this helps you to make a better decision. My guess is that mortgage rates will be low for quite some time, so be patient and make a wise decision that will bring you and your family years of joy.

This article was originally published on The Christian Post, August 14, 2020.

Subscribe for Weekly Updates

"*" indicates required fields

Search

Christian Credit Counselors

Is credit card debt causing you stress and strain? Christian Credit Counselors would like to help!

Notifications