Dear Chuck,

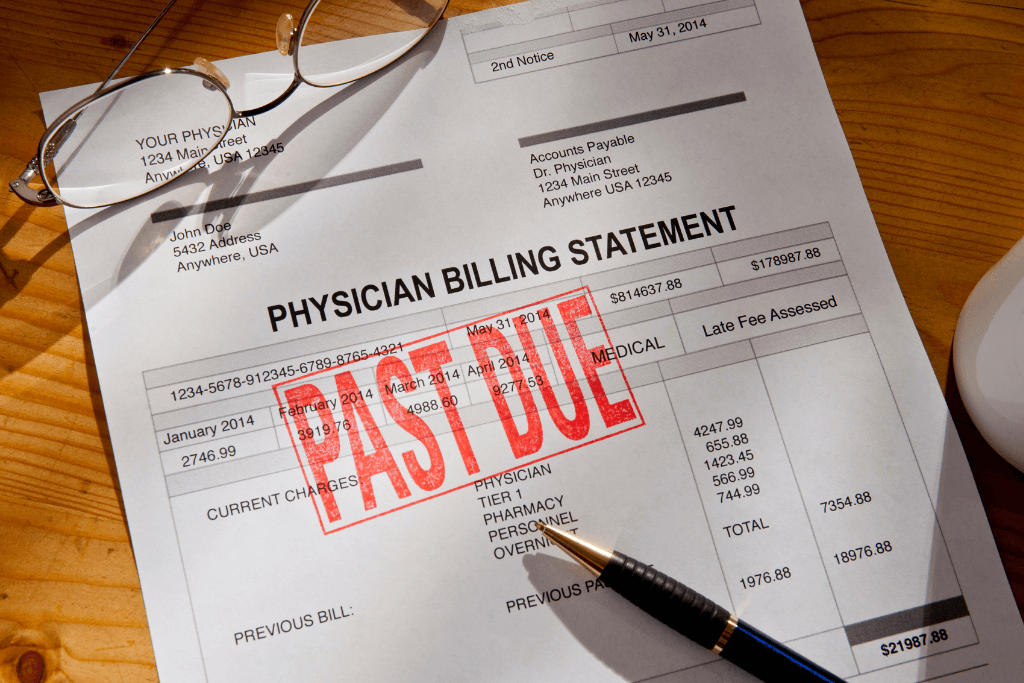

I am stunned at the rising cost of our medical bills. It’s the first time in our lives that we haven’t been able to cover them within a month. We are now on a payment plan and are praying we don’t need to see a doctor again for some time! If you have any tips for us, please advise.

In a Financial Panic

Dear In a Financial Panic,

I am sorry for what you are going through, and I feel your pain! In the past twelve months, I have had to pay for two major medical expenses, one to repair an injury to my knee and the other for oral surgery. The dental implant and new crown will cost about $7,000 when it is all said and done. Our insurance covered only $1,000 of the dental expenses! While this is a widespread problem and a frightening experience, there is no need to panic.

Medical Related Debt

Medical expenses are a leading cause of debt for Americans, and the strain is affecting many. With inflation hitting nearly every budget category, it is no surprise that medical debt is rising.

A Forbes article quotes Jonathan Walker, executive director of the Center for the New Middle Class: “The increase in the number of households that are feeling the pinch is concerning. . . . I was amazed that inflation in this category would impact consumers so quickly.” Covid added to the pain. In September, Credit Karma reported that its members took on an additional $3.6 billion in medical debt during the pandemic.

The Consumer Financial Protection Bureau (CFPB) found that 1 out of 5 U.S households have medical debt. When these show up on credit reports, it makes it more difficult to attain housing, get credit, or find employment. CFPB also reports that medical collections accounts appear on 43 million credit reports, accounting for $88 billion in medical debt. Prior research reveals that medical debt is not a predictive indicator of a person’s credit risk. Thus, on July 1, Equifax, Experian, and TransUnion will no longer include medical debt that was paid after being sent to collections. This will help millions. More information will be released as we approach that day.

The Kaiser Family Foundation did an analysis of US Census Bureau data and found that more than 90% of the nation has health insurance. However, medical debt is a major problem due to high deductibles and out-of-pocket expenses. 9% of adults owed more than $250 in health-related charges, which Kaiser describes as significant debt. 1% owed more than $10,000, accounting for the majority of all medical debt owed. It’s believed that more people struggle than what is documented because credit reporting companies can’t see all the medical debt. Plus, not all adults have credit reports.

How to Avoid or Reduce Medical Debt

Remain Hopeful

God can provide resources for medical bills from unexpected places. I’ve seen it happen to others and have experienced it myself. Do not lose heart. Ask the Lord to provide or stretch the resources you have. He can do anything! Remember, times like these give us greater compassion for those with medical conditions and debt that are worse than we can imagine.

Your pain will translate into a genuine concern for others with a similar problem. Someone you know may need emotional and prayer support. Even if you are unable to give them financial support, God can use you to share what you have and grant hope to others.

“Rejoice in the Lord always; again I will say, rejoice. Let your reasonableness be known to everyone. The Lord is at hand; do not be anxious about anything, but in everything by prayer and supplication with thanksgiving let your requests be made known to God. And the peace of God, which surpasses all understanding, will guard your hearts and your minds in Christ Jesus.” (Philippians 4:4-7 NIV)

While seeking the Lord’s guidance, if credit card debt is a source of your financial pain, Christian Credit Counselors is a trusted source of help. They can help your family get on the road to financial freedom.

This article was originally published on The Christian Post on May 27, 2022.

Subscribe for Weekly Updates

"*" indicates required fields

Search

Christian Credit Counselors

Is credit card debt causing you stress and strain? Christian Credit Counselors would like to help!